The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

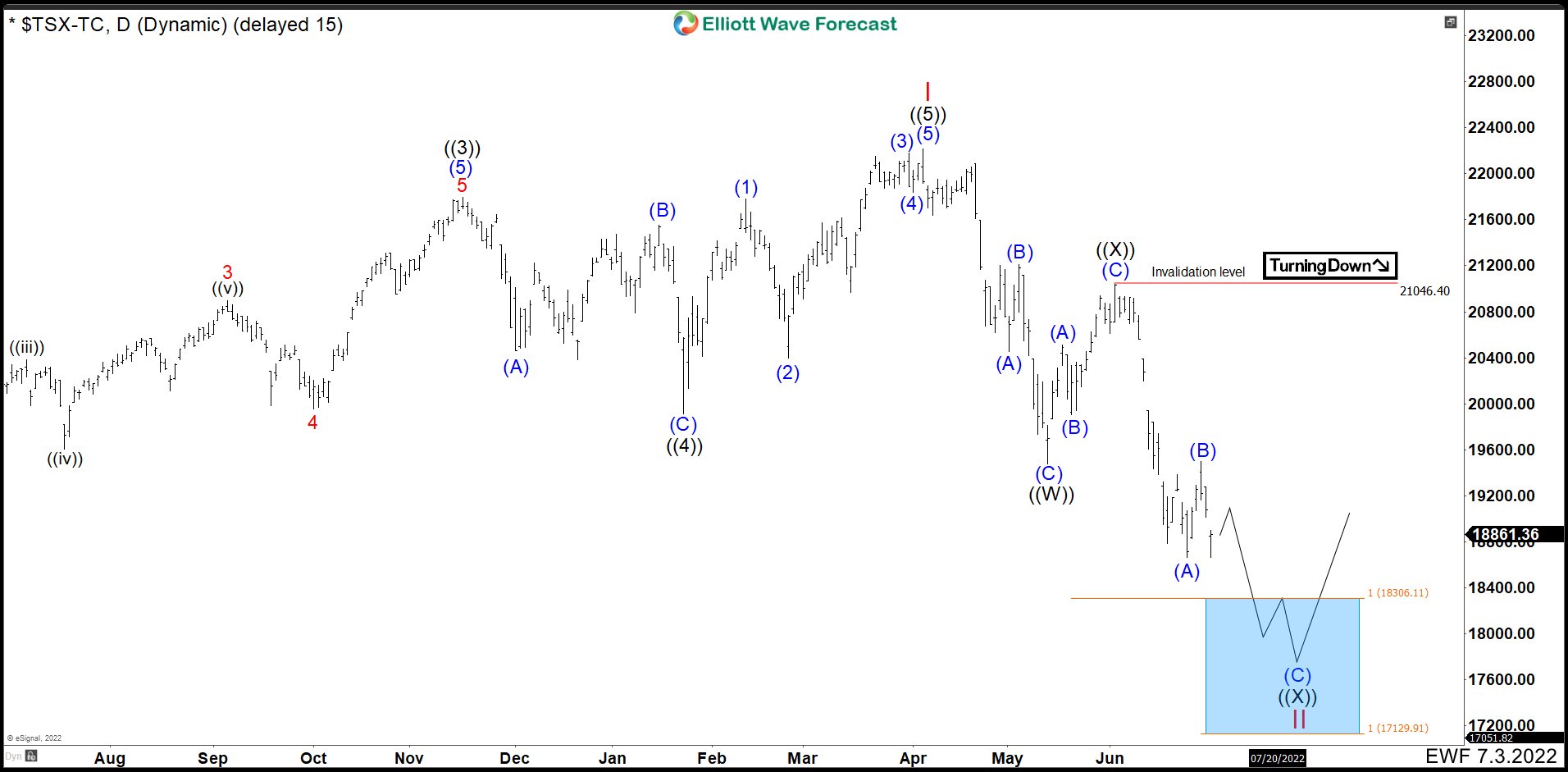

Canada Index (TSX) Needs One Wave Down To End A Double Correction

Read MoreThe S&P/TSX is a major stock market index which tracks the performance of largest companies by market capitalization on the Toronto Stock Exchange in Canada. It is a free float market capitalization weighted index. The index covers approximately 95 percent of the Canadian equities market. The S&P/Toronto Stock Exchange Composite Index has a base value […]

-

Elliott Wave View: Further Downside in AMD Expected

Read MoreAMD shows incomplete bearish sequence and looking for further downside. This article and video look at the Elliott Wave path.

-

Elliott Wave View: SPY Starts A New Leg Lower

Read MoreShort term Elliott Wave view in SPY suggests the decline from 3/30/2022 high is unfolding as a 5 waves. Down from wave ((B)), wave (1) ended at 385.15, and rally in wave (2) ended at 417.44. The ETF then extends lower in wave (3) towards 362.17. Rally in wave (4) completed at 393.16 with subdivision […]

-

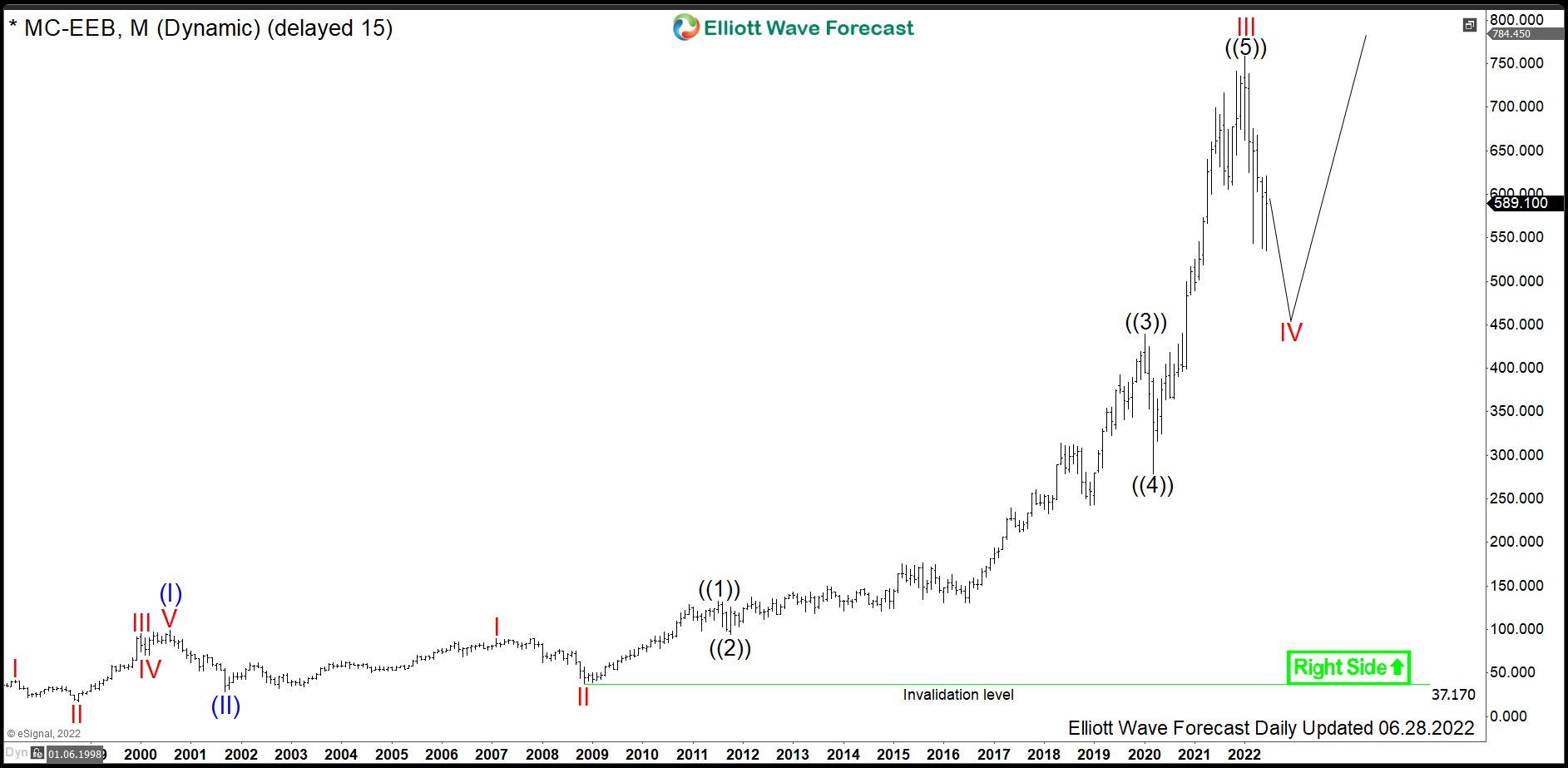

$MC : Luxury Producer LVMH Provides an Opportunity to Join the Rally

Read MoreMoët Hennessy Louis Vuitton, commonly known as LVMH, is a French multinational luxury goods company. Headquartered in Paris, LMVH was formed 1987 through a merger of the fashion house Louis Vuitton (founded in 1854) with Moët Hennessy (established in 1971). The company controls and manages 75 prestigious brands under the umbrellas of 6 branches: Perfumes […]

-

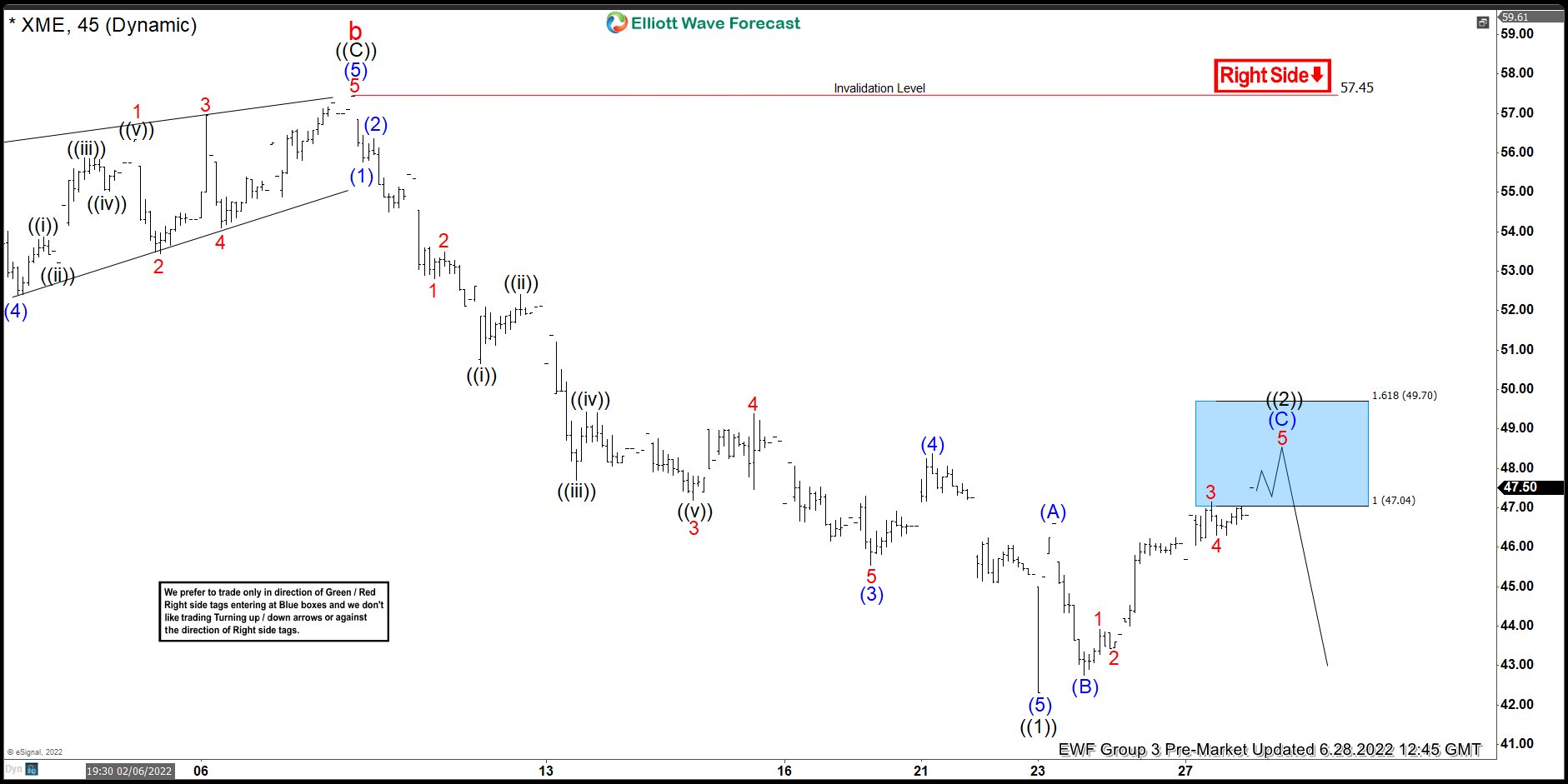

XME Reacting Strongly From The Blue Box Area

Read MoreIn this blog, we take a look at the past performance of XME charts. In which, the stock provided a selling opportunity in the blue box area.

-

Best Defense Stocks to Invest in Now

Read MoreThe current situation between Russia and Ukraine has hugely affected the financial markets. The movement of many shares especially companies involved in the defense sector is proof. The US has spent a total of $ 54 billion, as an aid towards Ukraine. The US is expected to increase its defense budget in the coming years. […]