The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Updated Novavax Inc. ($NVAX) 4H Elliottwave Forecast

Read MoreGood day Traders and Investors. In today’s article, we are going to follow up on Novavax Inc. ($NVAX) forecast posted back in April 2022 and take a look at the latest 4H count. You can find the article here: https://elliottwave-forecast.com/stock-market/novavax-enters-buying-area/ Novavax, Inc. is an US American biotechnology company. Founded in 1987 and headquartered in Gaithersburg, Maryland, […]

-

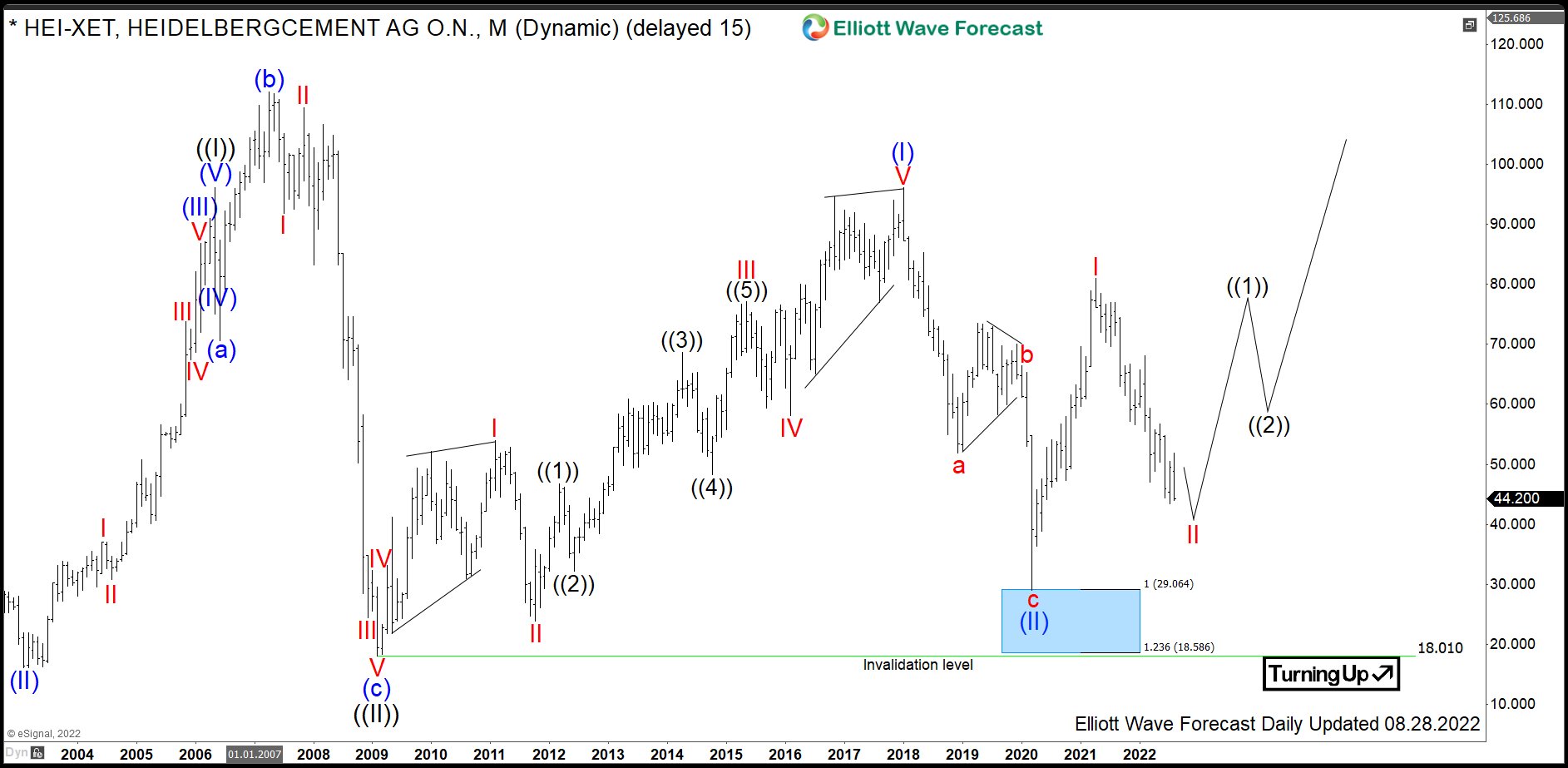

$HEI : German Materials Giant HeidelbergCement Entering Buying Area

Read MoreHeidelbergCement is a German multinational building materials company. Today, it is the largest producer of construction aggregates in the world. It is number 2 in production of cement and number 3 worldwide in ready mixed concrete. Founded in 1874 and headquartered in Heidelberg, Germany, HeidelbergCement is a part of DAX40 index. One can trade it […]

-

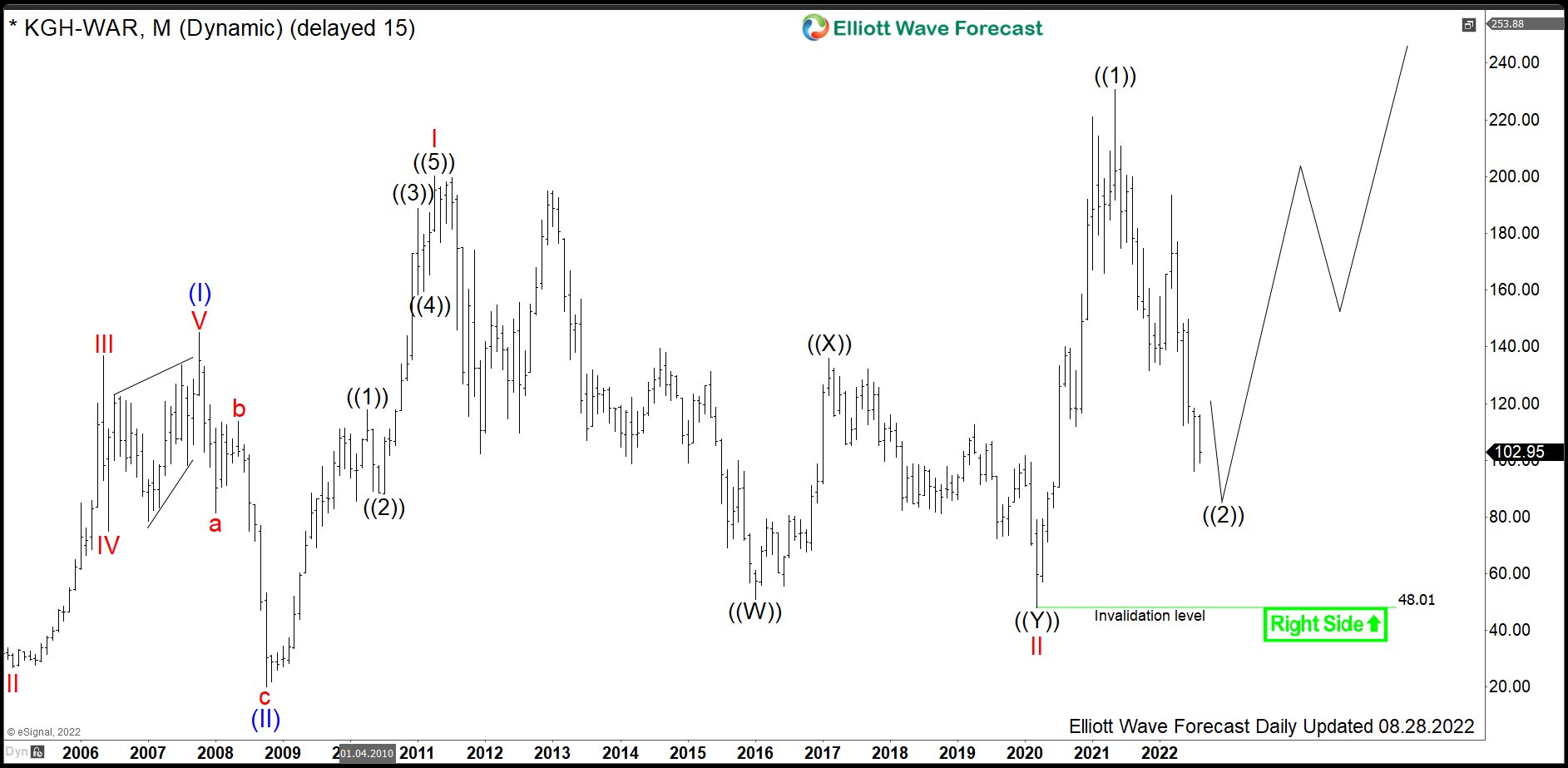

$KGH: Metals Producer KGHM Trading Close to Buying Area

Read MoreKGHM Polska Miedź S.A. is a multinational corporation which has its headquarters in Lubin, Poland. Traded under tickers $KGH at WSE and $KGHPF in US in form of ADRs, it is a component of the WIG30 index. KGHM has been a major copper and silver producer for more than 50 years. As a matter of fact, it […]

-

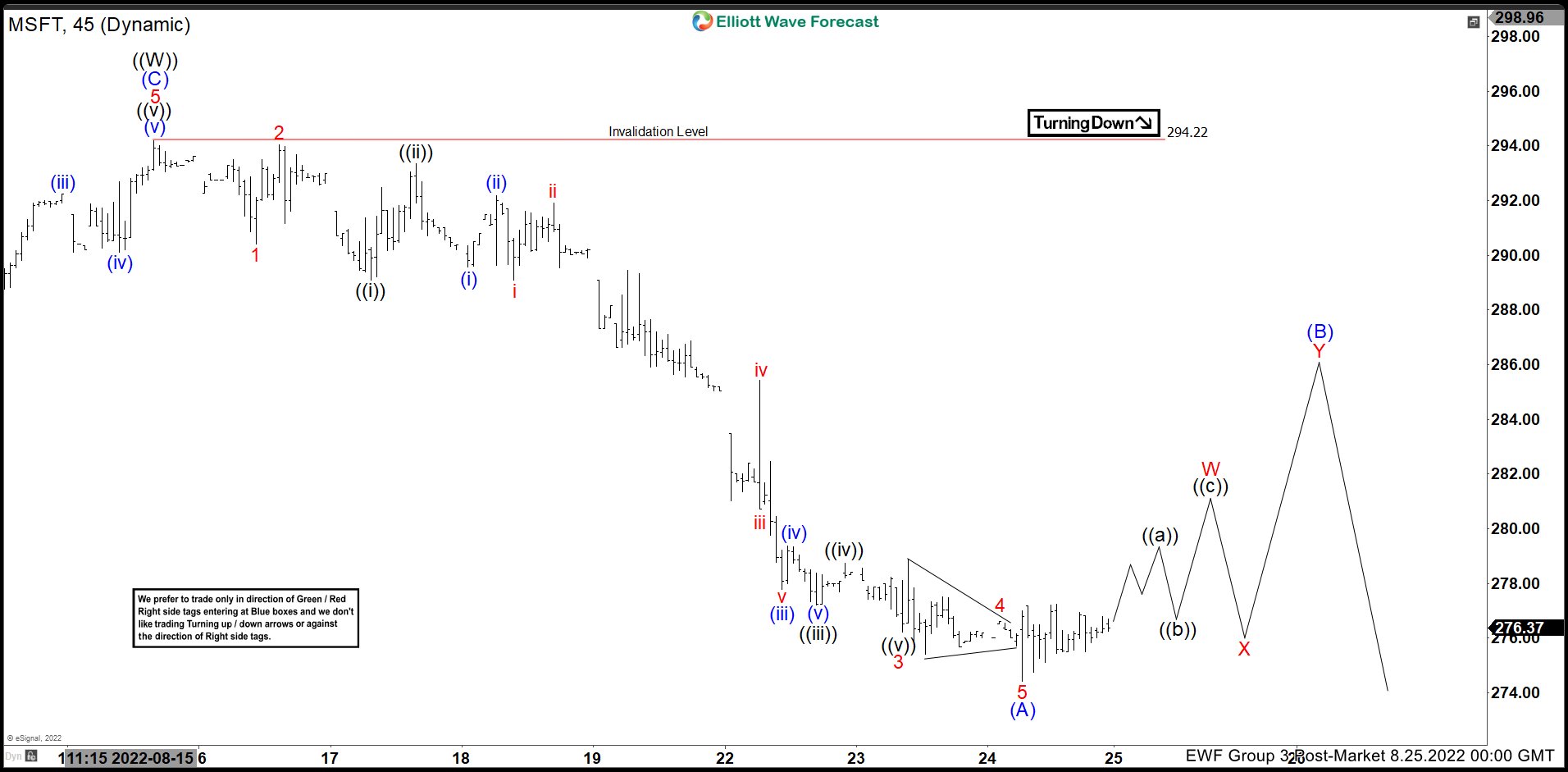

Elliott Wave View: Microsoft (MSFT) Shows 5 Waves Down

Read MoreMicrosoft (MSFT) has completed a cycle lower from Aug 15th peak and we are expecting to see a 3, 7 or 11 swings pullback higher before turning lower again

-

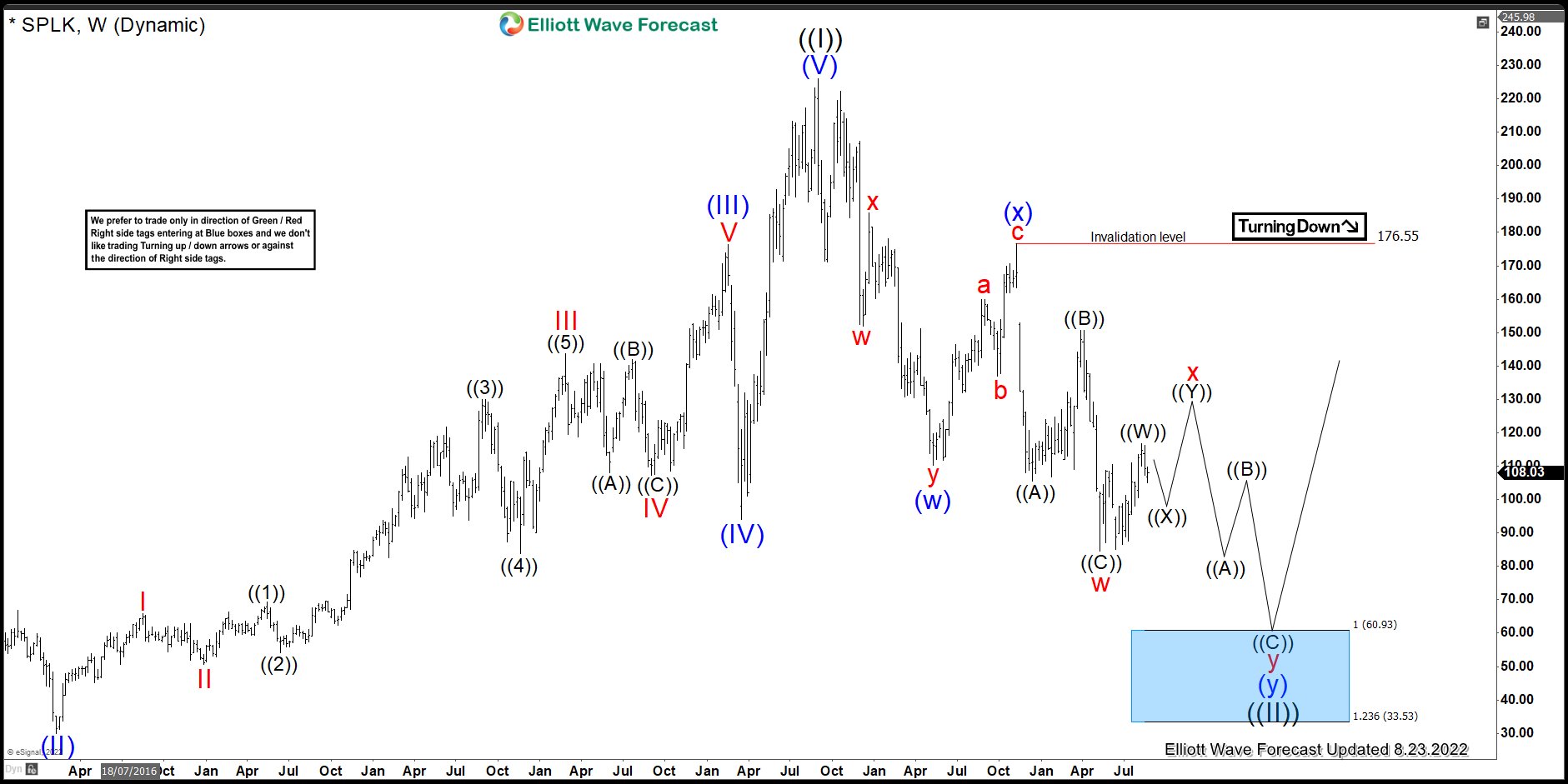

Splunk Incorporation ( SPLK) Elliott Wave Forecast Analysis

Read MoreSplunk Inc ticker symbol: SPLK engages in the development and marketing of cloud software solutions. Its products include Splunk cloud, Splunk light, and Splunk enterprise. It also offers solutions for Information Technology operations, security, internet-of-things, application analytics, business analytics, and industries. The company was founded by Erik M. Swan, Michael J. Baum, and Robin K. […]

-

Best Fuel Cell Stocks to Buy Now

Read MoreWhat are Fuel Cell Stocks? A fuel cell is a cell that generates electric power using the constant flow of fuel (usually hydrogen) with the addition of air (oxygen). The process is clean, quiet, and highly efficient, and the technology has many applications, notably in alternative fuel vehicles. Benefits of Fuel Cell Technology High Efficiency […]