The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Nio Inc. ($NIO) has reached Inflection Area. What’s next?

Read MoreGood day Traders and Investors. In today’s article, we are going to follow up on Nio Inc. ($NIO) forecast posted back in Feb 2022 and take a look at the latest count. You can find the article here. Nio (NYSE: NIO) is a Chinese multinational automobile manufacturer with headquarters in Shanghai. It specializes in designing […]

-

HDFC BANK Bounce From The Blue Box. Will The Rally Continue?

Read MoreHDFC Bank Limited is an Indian banking and financial services company headquartered in Mumbai. It is India’s largest private sector bank by assets and world’s 10th largest bank by market capitalization as of April 2021, the third largest company by market capitalization of $122.50 billion on the Indian stock exchanges. It is also the fifteenth […]

-

Top Nasdaq Stocks to Buy in 2024

Read MoreNASDAQ 100 is one of the most prominent large-cap growth indices in the world. It is composed of the 100 largest and most actively traded companies in the United States of America. The companies of this sector belong to the non-financial sector and are segmented under the technology, retail, industrial, biotechnology, health care, telecom, transportation, […]

-

Elliott Wave View: Amazon (AMZN) Rallying in a Double Zigzag

Read MoreAmazon (AMZN) is looking to do a double correction from 9.1.2022 low & should see more upside. This article & video look at the Elliott Wave path.

-

Cameco (CCJ) Looking to Extend Higher

Read MoreThe fundamental of Uranium continues to get better. Various countries like Japan and South Korea have now turned to nuclear power as a solution to the energy crisis. The U.S. and Europe recently proposed to put a cap on Oil supplied by Russia. Russia in turns turned off the gas pipe in Nordstream 1. The […]

-

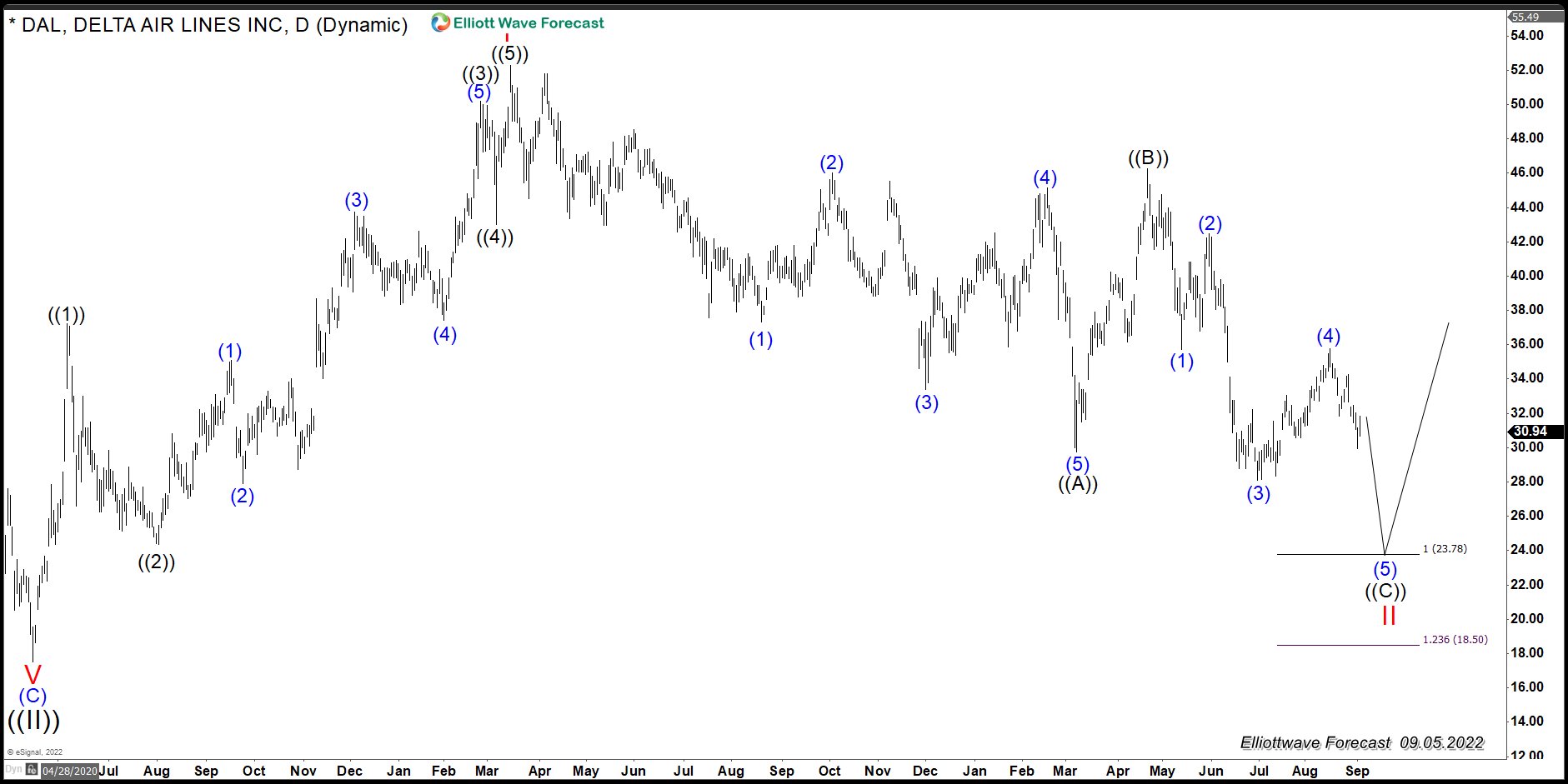

$DAL (Delta Air Lines INC): Another Buying opportunity In the Horizon

Read MoreDelta Airlines (DAL) shows an impulse from all-time low and 2020 low & should give a buying opportunity soon. This article looks at the Elliott Wave chart.