The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

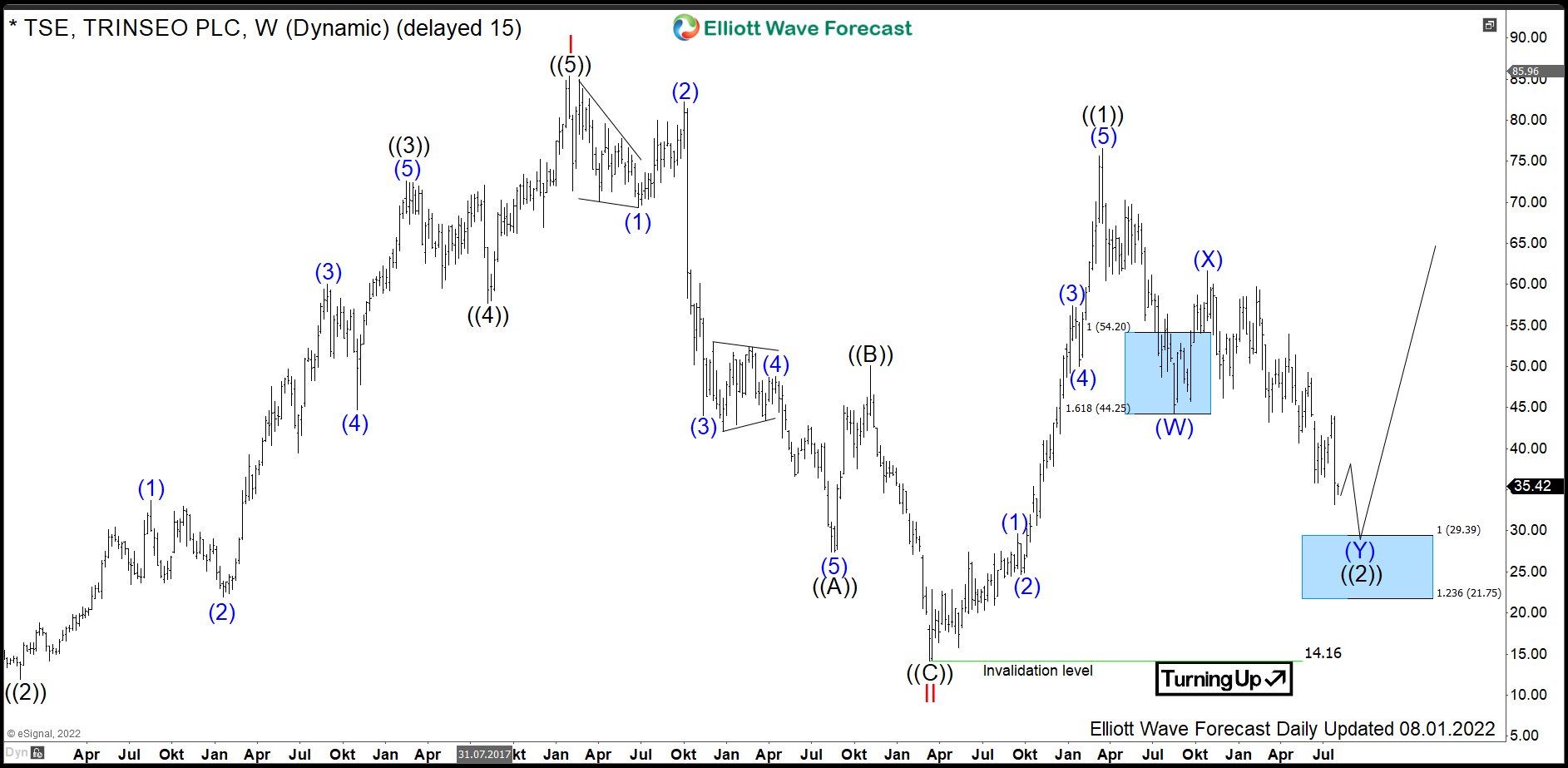

$TSE: Materials Manufacturer Trinseo Provides an Opportunity in 7 Swings

Read MoreTrinseo (formerly Styron) is a global materials company based in Berwyn, Pennsylvania, USA. The stock being a component of the Russel2000 index can be traded under ticker $TSE at NYSE. Trinseo offers a broad line of plastics, latex and synthetic rubber. The primary markets are automotive, appliances, electronics, packaging, tire industries, among others. In long […]

-

Has Draft Kings ($DKNG) Bottomed and Ready to Rally? (Update)

Read MoreGood day Traders and Investors. In today’s article, we are going to follow up on Draft Kings ($DKNG) forecast posted back in January 2022 and take a look at the latest Daily count. You can find the article here: https://elliottwave-forecast.com/stock-market/draft-kings-dkng-poised-bounce/ Company profile: ““DraftKings is an American daily fantasy sports contest and sports betting provider. The company allows users to enter daily […]

-

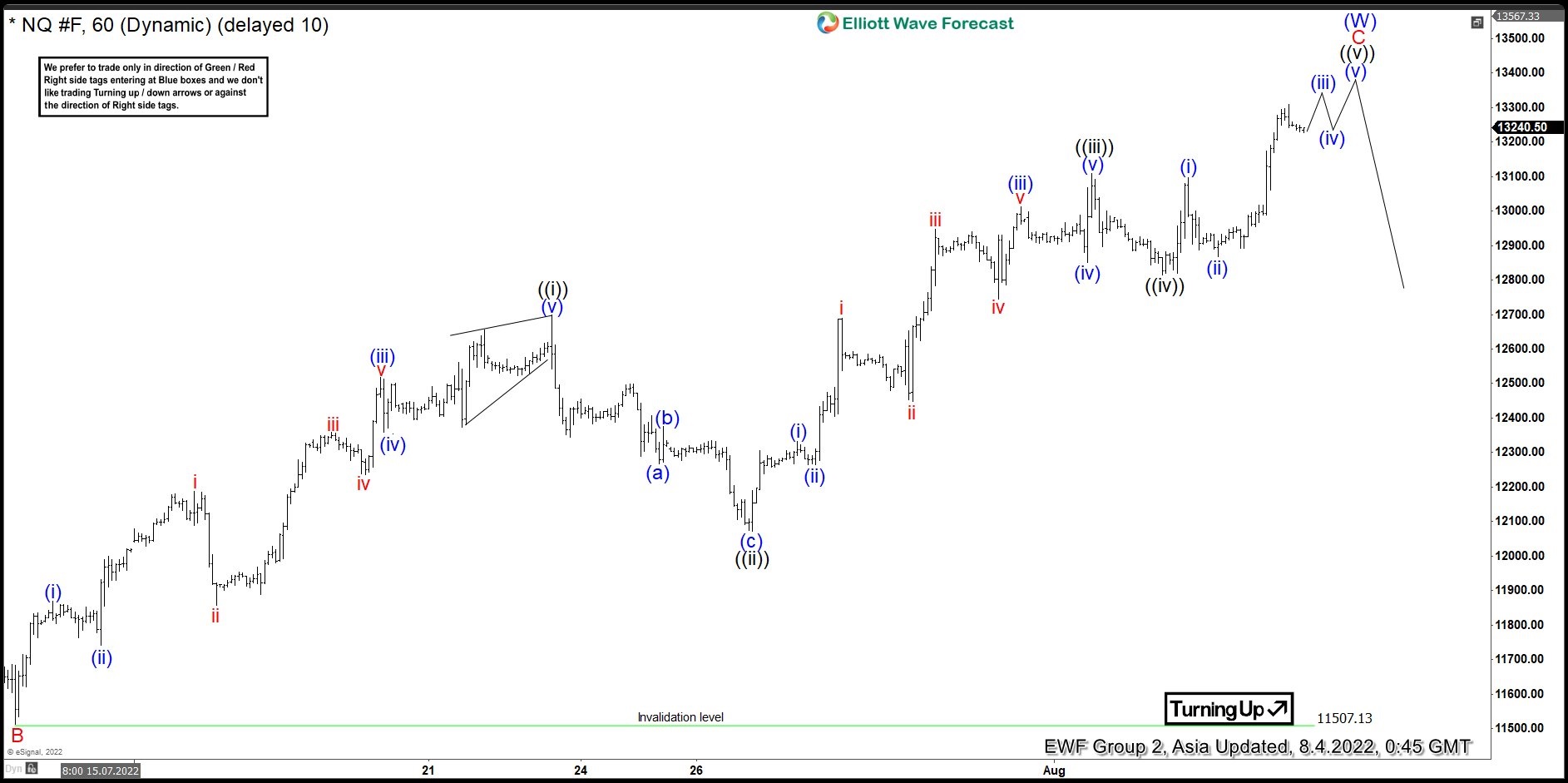

Elliott Wave View: Nasdaq (NQ) May See 3 Waves Pullback Soon

Read MoreNasdaq cycle from 6.17.2022 low remains in progress but expected to end soon. This article and video look at the Elliott Wave path.

-

Pan American Silver (PAAS) Still May See Further Downside

Read MoreCommodities have been pulling back after the first half year rally due to inflation and war in Ukraine. The Fed has hiked rates a few times to tame the inflation, and all types of commodities have taken a step back in the past month or two, including silver. Below is a technical update for Pan […]

-

10 Best Gas Stocks to Buy Now

Read MoreAs the demand for cleaner energy sources rises, alternate energy sources are on the rise. Despite being a non-renewable energy source, natural gas is a cleaner, cheaper, and less carbon-intensive alternative to coal. The International Energy Agency sees natural gas demand rising 31% by 2040. Oil stocks are one of the riskier yet most profit-generating sectors. […]

-

Starbucks ($SBUX) Ended A Double Correction And It Should Continue Higher

Read MoreStarbucks Corporation (SBUX) is an American multinational chain of coffeehouses and roastery reserves. It is the world’s largest coffeehouse chain. As of November 2021, the company had 33,833 stores in 80 countries, 15,444 of which were located in the United States. Out of Starbucks’ U.S.-based stores, over 8,900 are company-operated, while the remainder are licensed. Starbucks ($SBUX) Elliott Wave Analysis – […]