The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

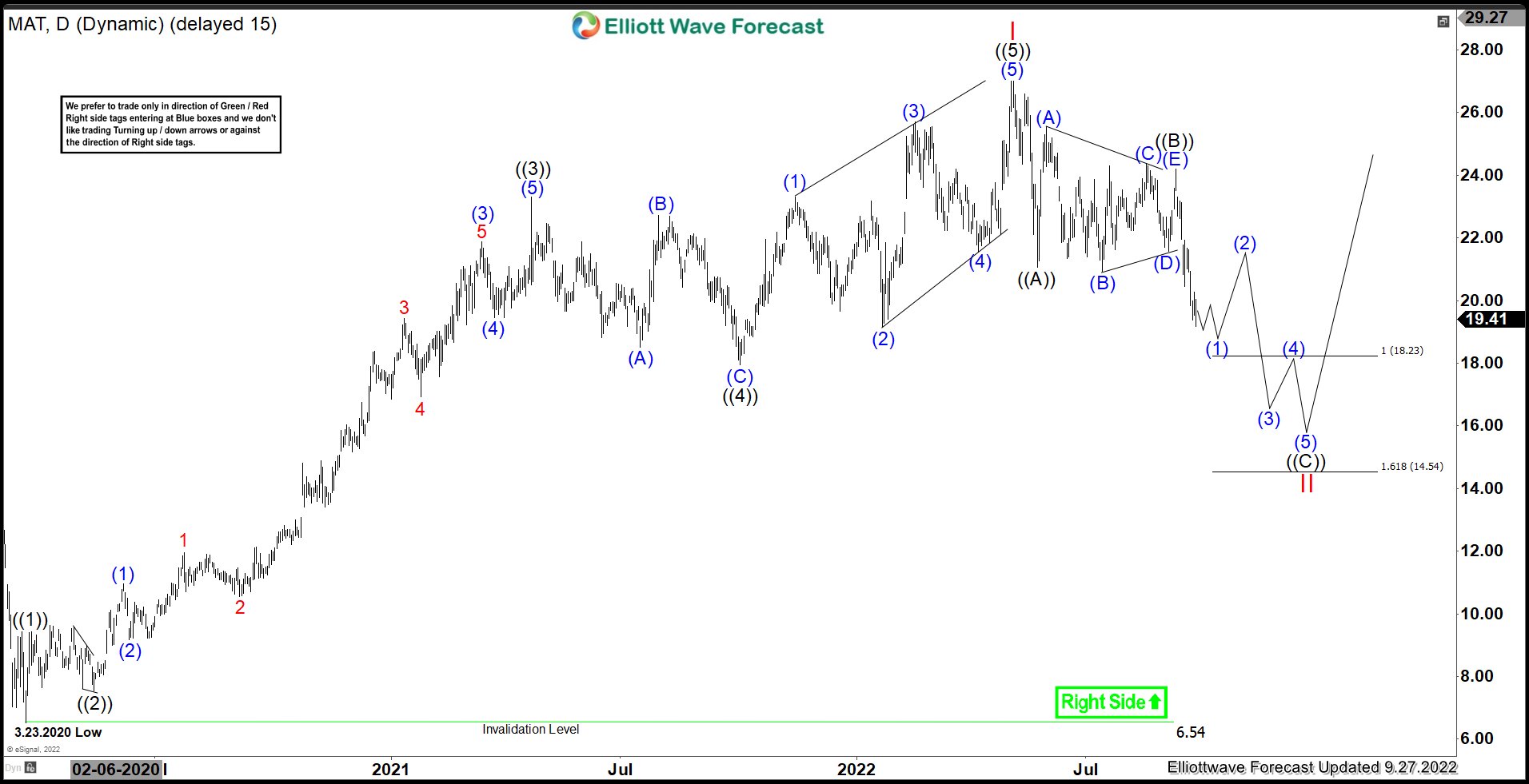

MAT : Expect Short Term Downside To Continue Before Rally Resumes

Read MoreMattel, Inc. (MAT), a children’s entertainment company, designs & produces toys & consumer products worldwide The company operates through North America, International & American Girl segments. It is based in El Segundo, CA, comes under Consumer Cyclical sector & trades as “MAT” ticket at Nasdaq. MAT made a low of $6.53 during March-2020 sell off […]

-

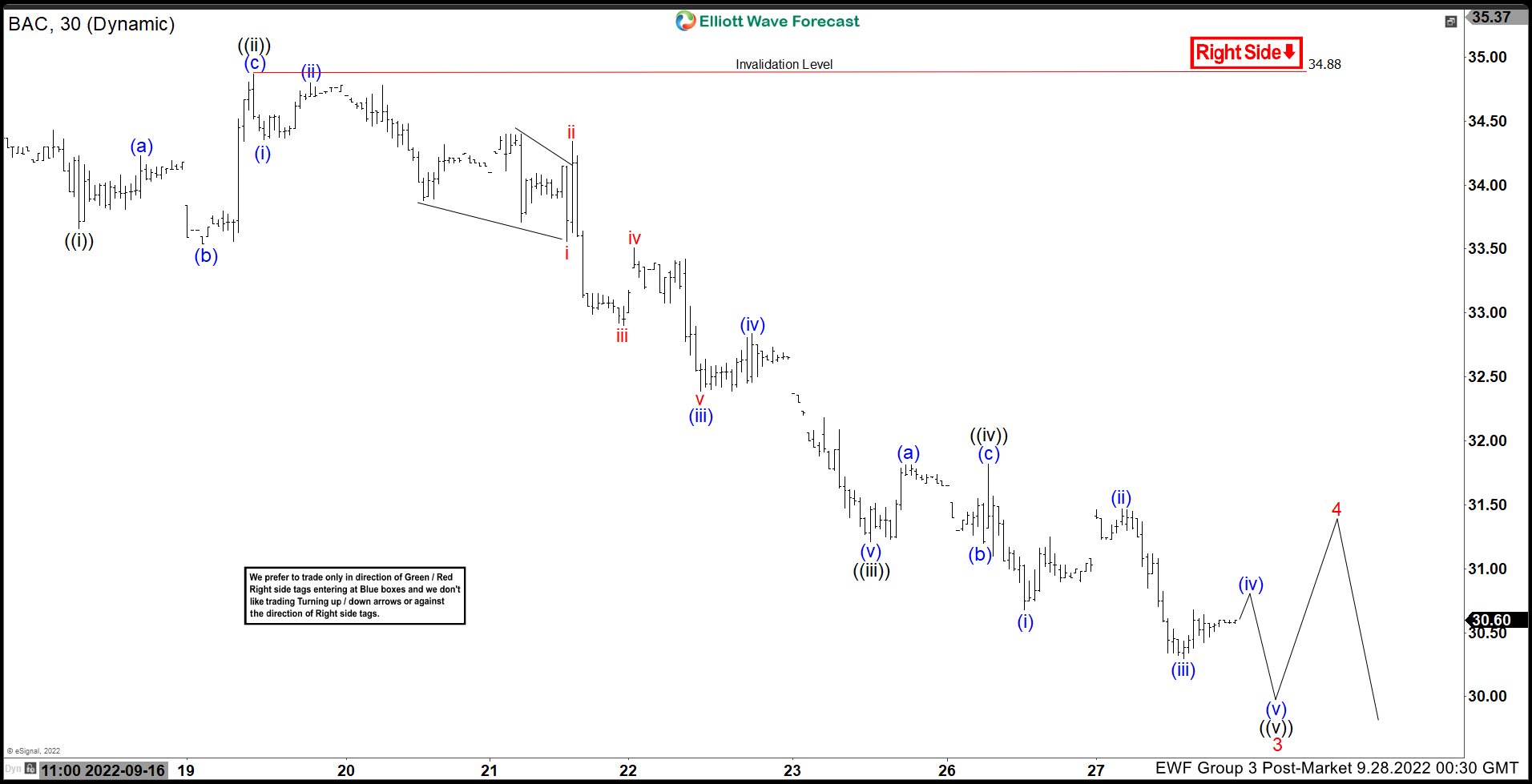

Elliott Wave View: Bank of America (BAC) Rally Should Fail for More Downside

Read MoreBank of America (BAC) shows an impulsive structure from 9.12.2022 high. Rally should fail in 3, 7, 11 swing for more downside.

-

Enphase Energy (ENPH) in wave (IV) Pullback

Read MoreEnphase Energy (NASDAQ: ENPH) is a technology company with headquarter in Fremont, California. Enphase designs and manufactures software-driven home energy solutions for the solar industry. It designs, develops, manufactures, and sells home energy solution that connect solar generation, energy storage, and management on one intelligent platform. The stock has resumed to all-time high and continues […]

-

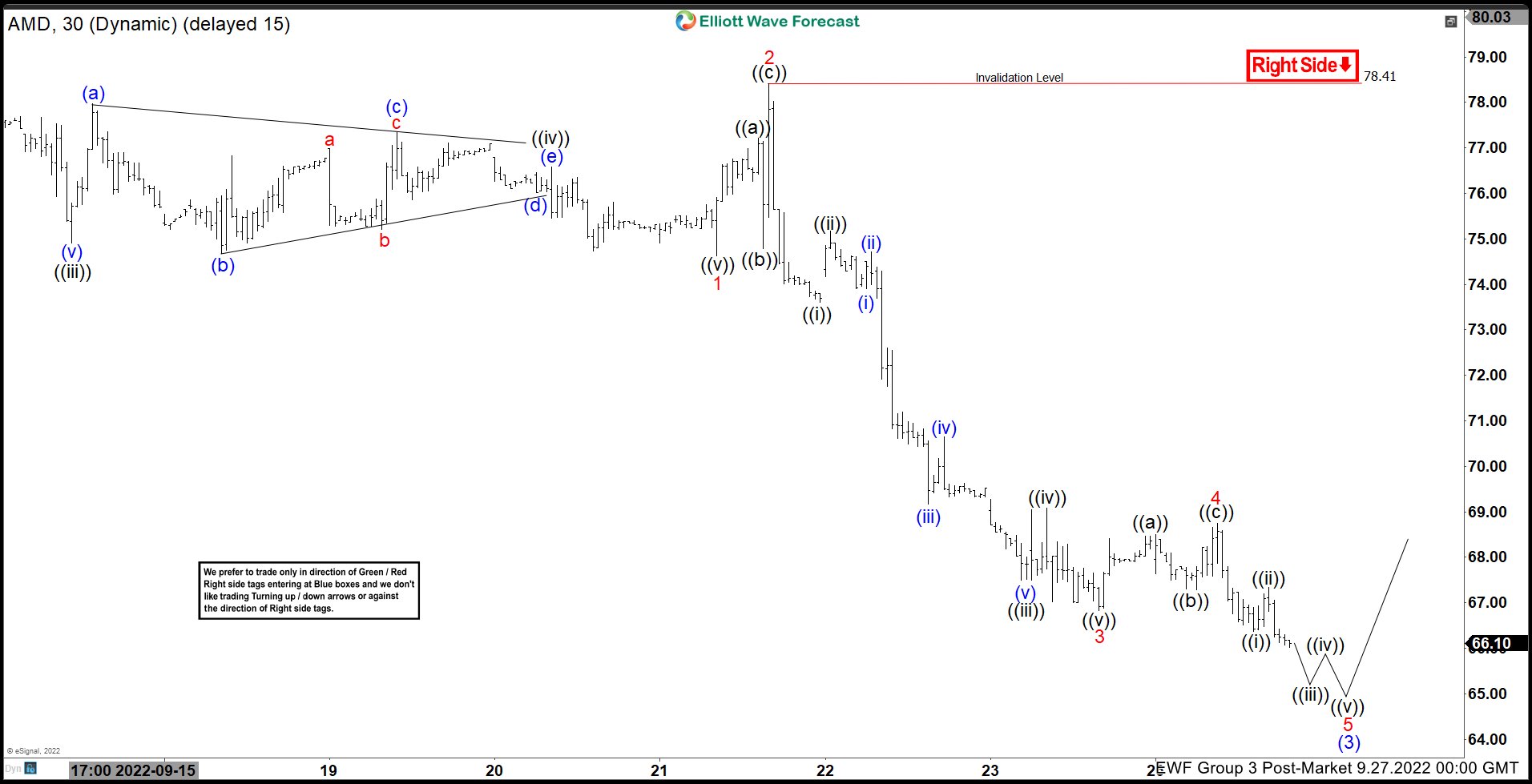

Elliott Wave View: Advanced Micro Devices (AMD) Looking to Extend Lower

Read MoreAdvanced Micro Devices (AMD) shows bearish sequence from 8.5.2022 high calling for more downside. This article & video look at the Elliott Wave path.

-

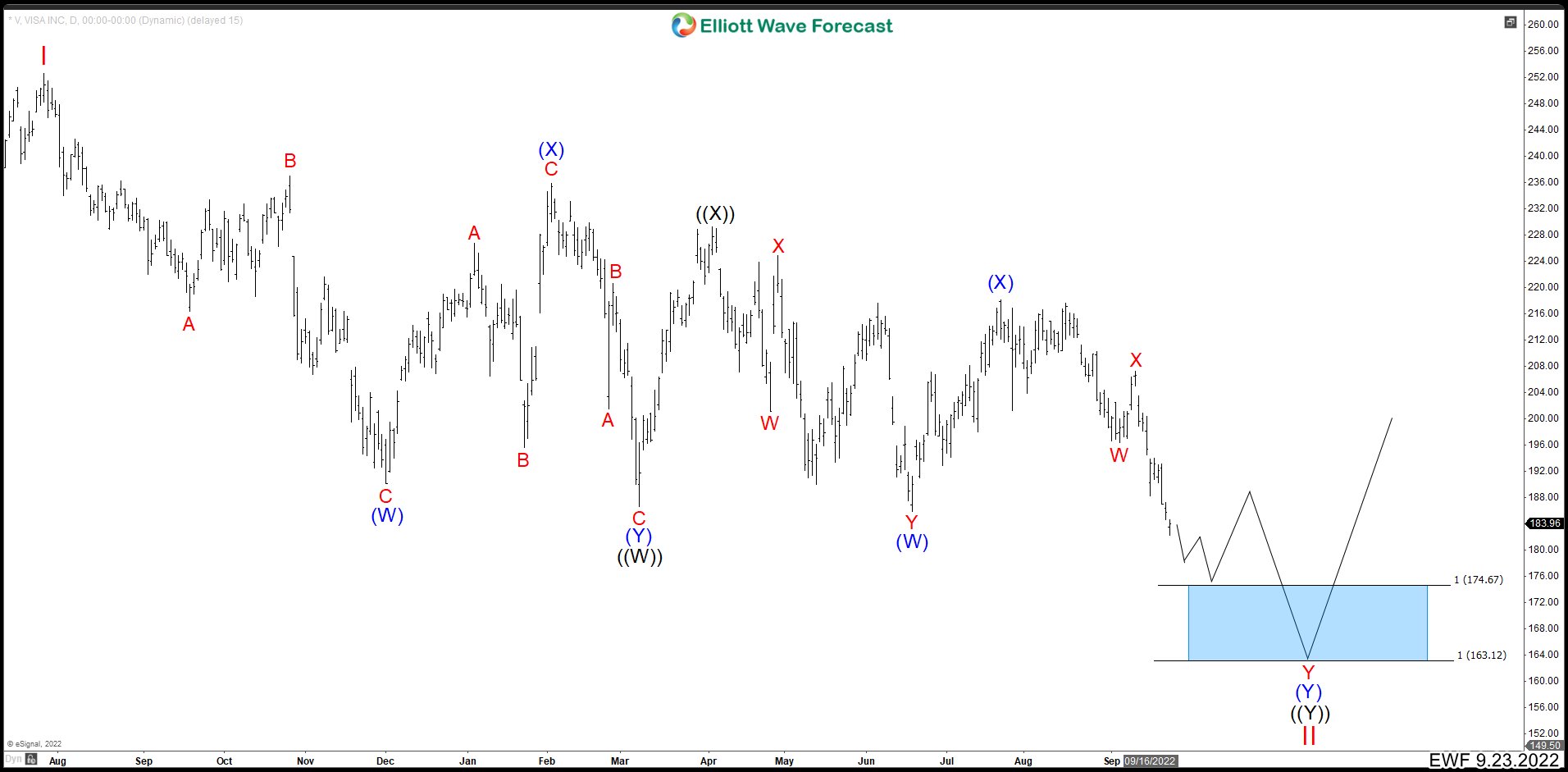

Visa (V) Shows An Incomplete Double Correction Structure

Read MoreVisa Inc. (V) is an American multinational financial services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. Visa is one of the world’s most valuable companies. VISA (V) Daily Chart From September 2022 Visa (V) ended an important market cycle in July 2021 that started in aVrch 2020. The rally reached […]

-

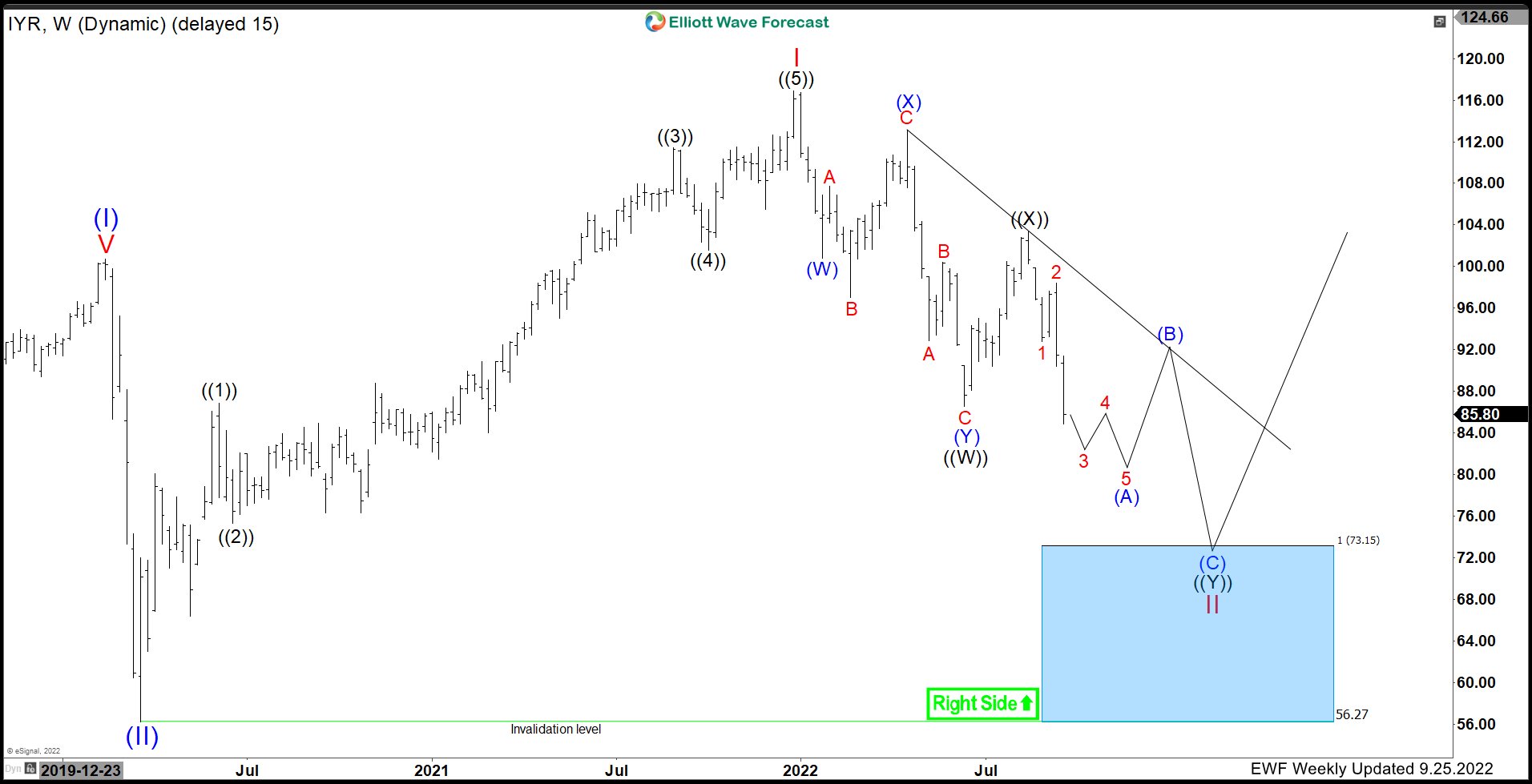

$IYR: Real Estate looking for More Downside. What’s Next?

Read MoreHello Everyone! In this technical blog, we are going to take a look at the Elliott Wave path in The Real Estate ETF (IYR). The iShares U.S. Real Estate ETF seeks to track the investment results of the $DJUSRE index. The index is composed of U.S. equities in the real estate sector. It provides exposure […]