The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Amazon $AMZN Incomplete Sequences Calling The Decline

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of Amazon $AMZN. As our members know, Amazon stock has been showing incomplete bearish sequences in the cycle from the August 16th peak. We recommended members to avoid buying the stock and keep favoring the short side due to […]

-

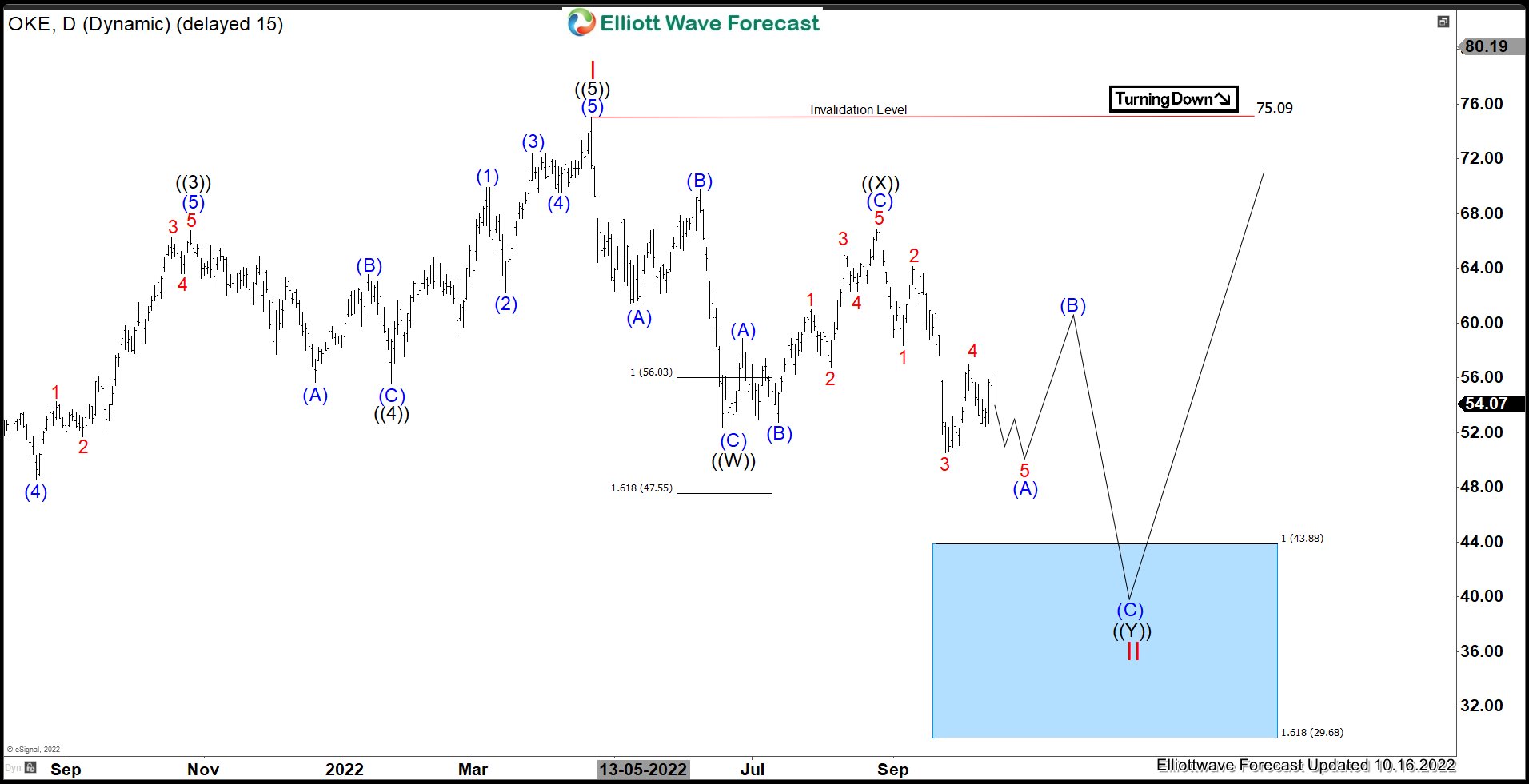

OKE : Expect Double Correction before Upside Resumes

Read MoreONEOK, Inc., (OKE) together with its subsidiaries, engages in gathering, processing, storage & transportation of natural gas in the United States. It operates through Natural gas gathering & processing, Natural gas liquids & Natural gas pipelines segments. The company is headquartered in Tulsa, Oklahoma, comes under Energy sector and trades as “OKE” ticket at NYSE. […]

-

COIN And Cryptos Should Continue Lower as Market Pressure

Read MoreCoinbase Global, Inc., branded Coinbase (COIN), is an American company that operates a cryptocurrency exchange platform. Coinbase is a distributed company; all employees operate via remote work and the company lacks a physical headquarters. It is the largest cryptocurrency exchange in the United States by trading volume. The company was founded in 2012 by Brian Armstrong and Fred Ehrsam. COIN Daily Chart May 2022 In […]

-

Best Agriculture Stocks to Buy in 2024

Read MoreThe agriculture industry is one of the largest influencers of the global economy, employing more than one billion people globally. Some of the leading agriculture companies generate up to $ 50-$ 115 billion in annual revenue. Within the agriculture sector, many new subcategories are emerging which are expected to see rapid growth in the coming […]

-

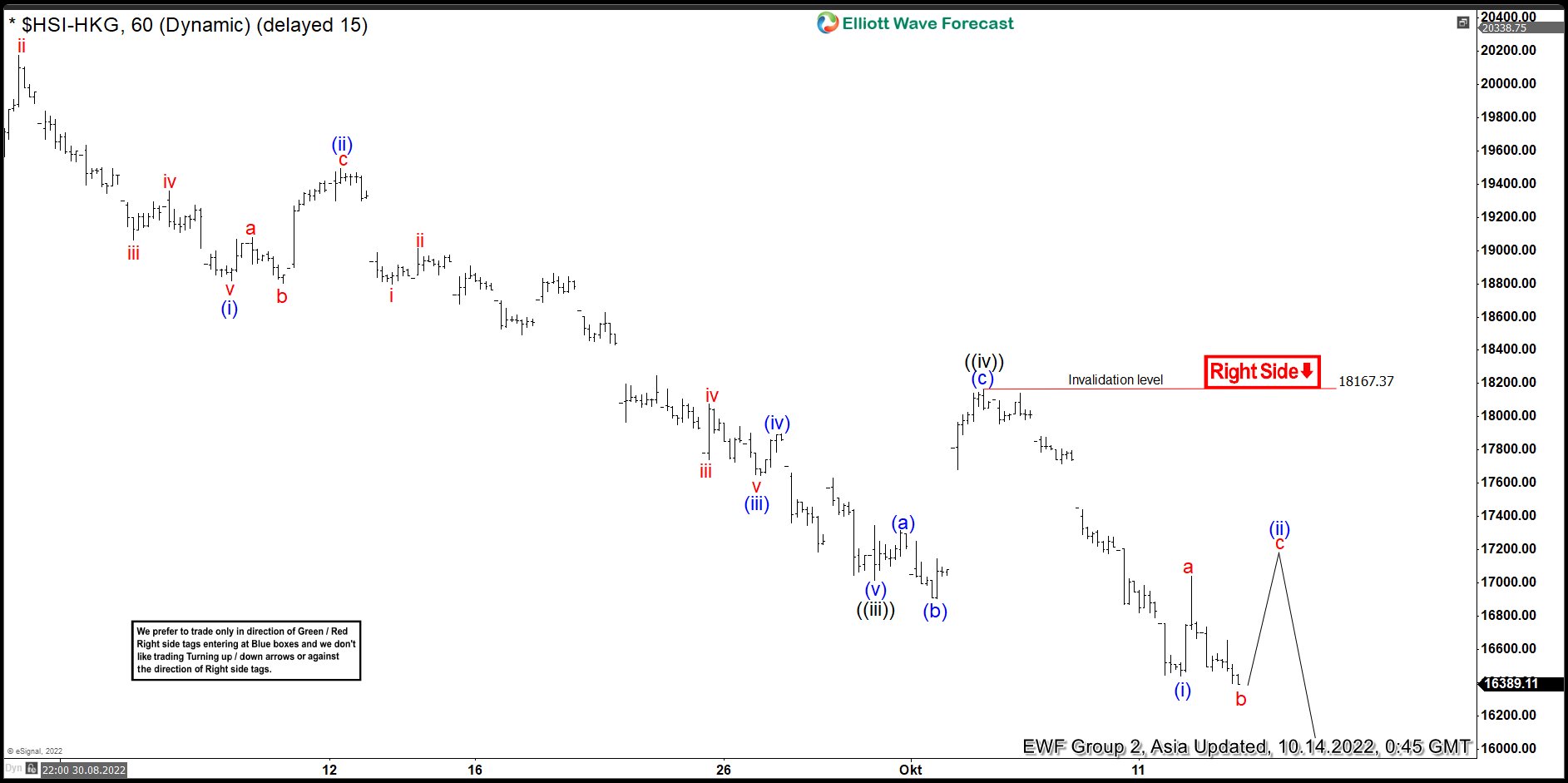

Elliott Wave View: Hangseng Index Sequence Remains Bearish

Read Morehangseng Index shows a 5 waves impulse structure down from 6.28.2022 high & can see further downside. This article and video look at the Elliott Wave path.

-

Value Stocks vs Growth Stocks – Which has More Profit Potential

Read MoreValue Stocks Value stocks are stocks that are currently trading at a price lower than their actual intrinsic value. This means those stocks are undervalued. By identifying and purchasing stocks priced by the market below their intrinsic value, investors aim for higher profits. When the stock prices eventually reach the price levels as per their […]