The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

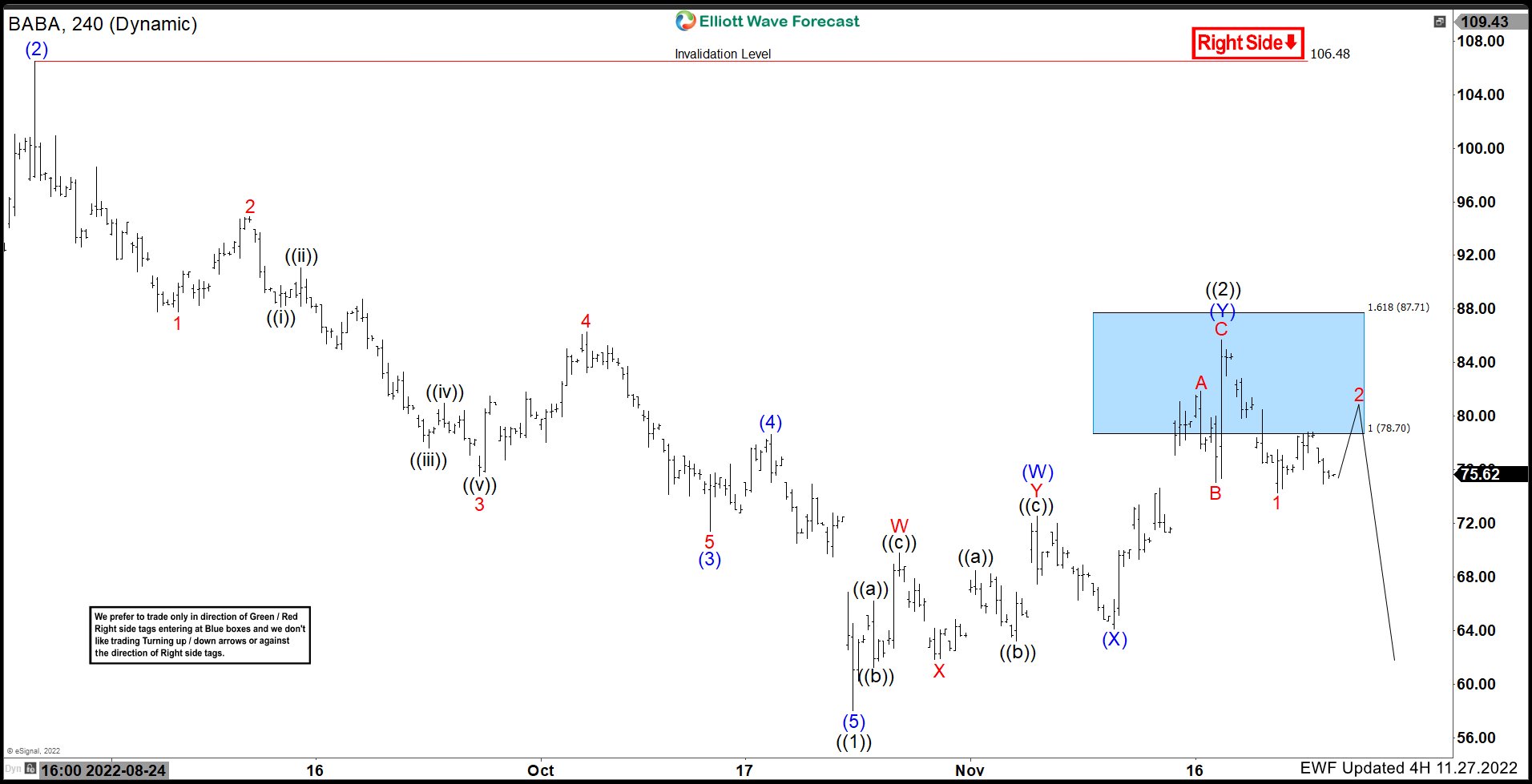

Alibaba ($BABA) Provides Another Opportunity from Blue Box area.

Read MoreGood day Traders and Investors. In today’s article, we will look at the past performance of 4 Hour Elliottwave chart of Alibaba ($BABA). The decline from 08.26.2022 high has unfolded as 5 swings and made a lower low on 10.24.2022 which created a bearish sequence in the 4H timeframe. Therefore, we knew that the structure […]

-

10 Best Food Stocks to Buy Now

Read MoreFood stocks are one of the most popular investments for investors during economic downturns because they are the most essential consumer staple. No matter how much people are struggling financially, they must spend money on food. Therefore, the food industry was relatively stable during the pandemic, while other industries struggled. One of the prominent trends […]

-

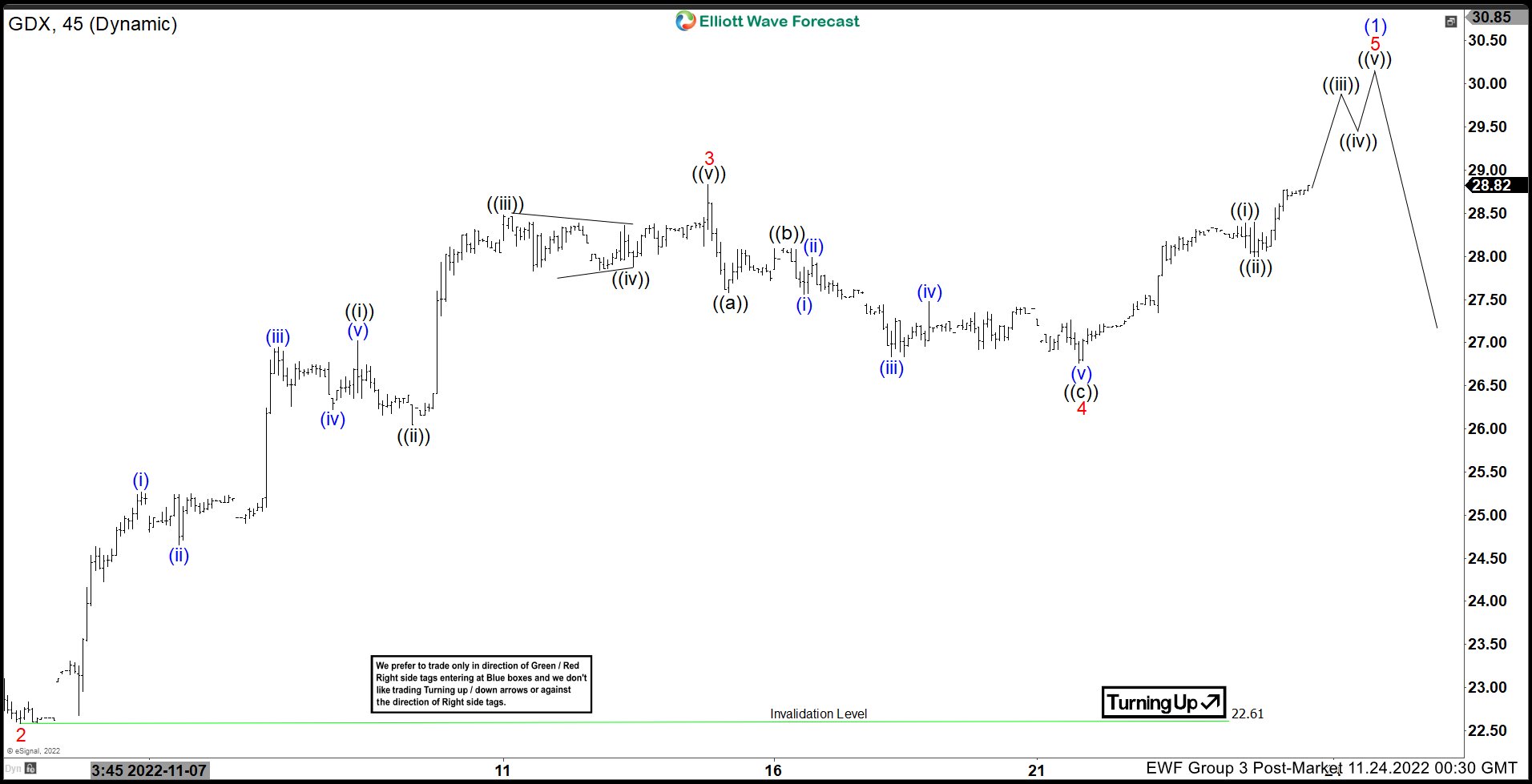

Elliott Wave View: Gold Miners (GDX) Starts a New Bullish Cycle

Read MoreGDX starts a new bullish cycle from 10.13.2022 low and the ETF should continue to stay supported. This article and video look at the Elliott Wave path.

-

The Best Wheat Stocks to Buy in 2024

Read MoreWheat is not only a food staple but is also used in the production of biofuels and other derivatives for various industries. Therefore, the value of wheat is high and it also explains the high profits of the industry. The wheat Market is projected to register a CAGR of 4.5% over the forecast period (2022-2027), […]

-

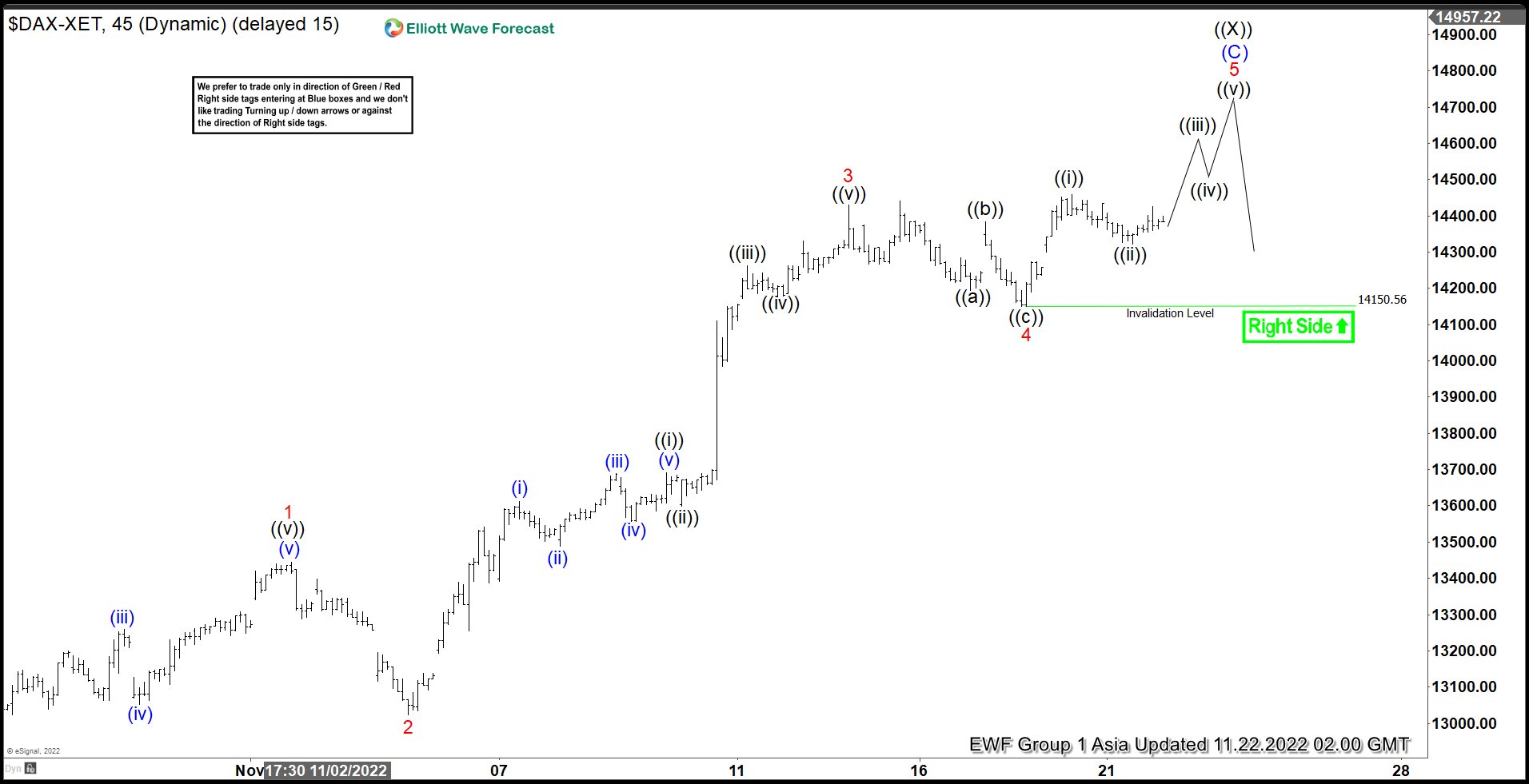

Elliott Wave View: DAX Ending 5 Waves Rally

Read MoreDAX cycle from 9.28.2022 low is in progress as 5 waves and about to end soon. This article and video look at the Elliott wave path.

-

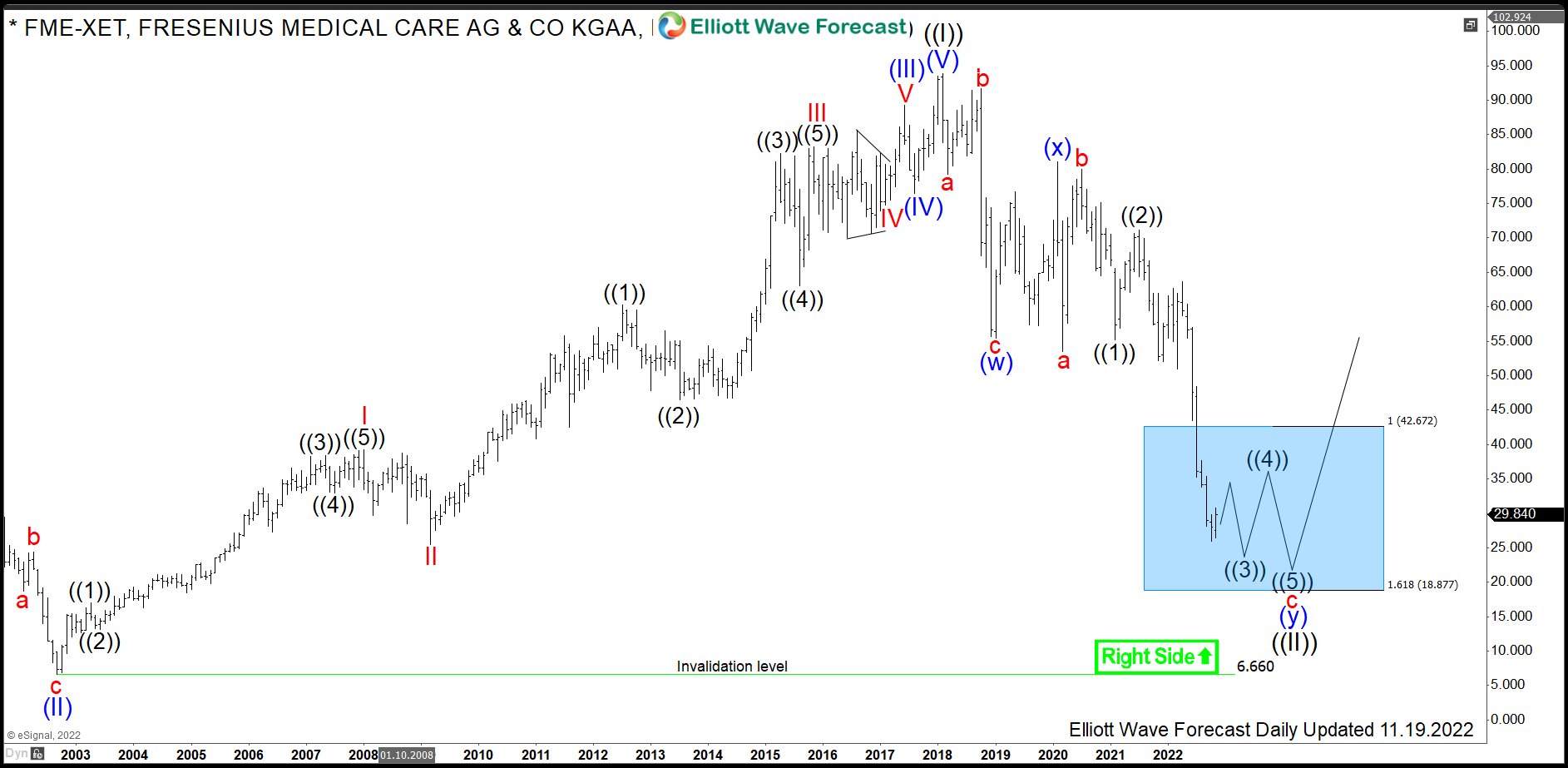

$FME : Fresenius Medical Care Enters Monthly Buying Area

Read MoreFresenius Medical Care is a German American healthcare company. It is one of the four devisions of Fresenius SE & Co. KGaA. The company provides kidney dialysis services and treats end-stage renal disease. Today, it has 38% share of the dialysis market in the US. Fresenius Medical Care operates 42 production sites, mainly in the […]