The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

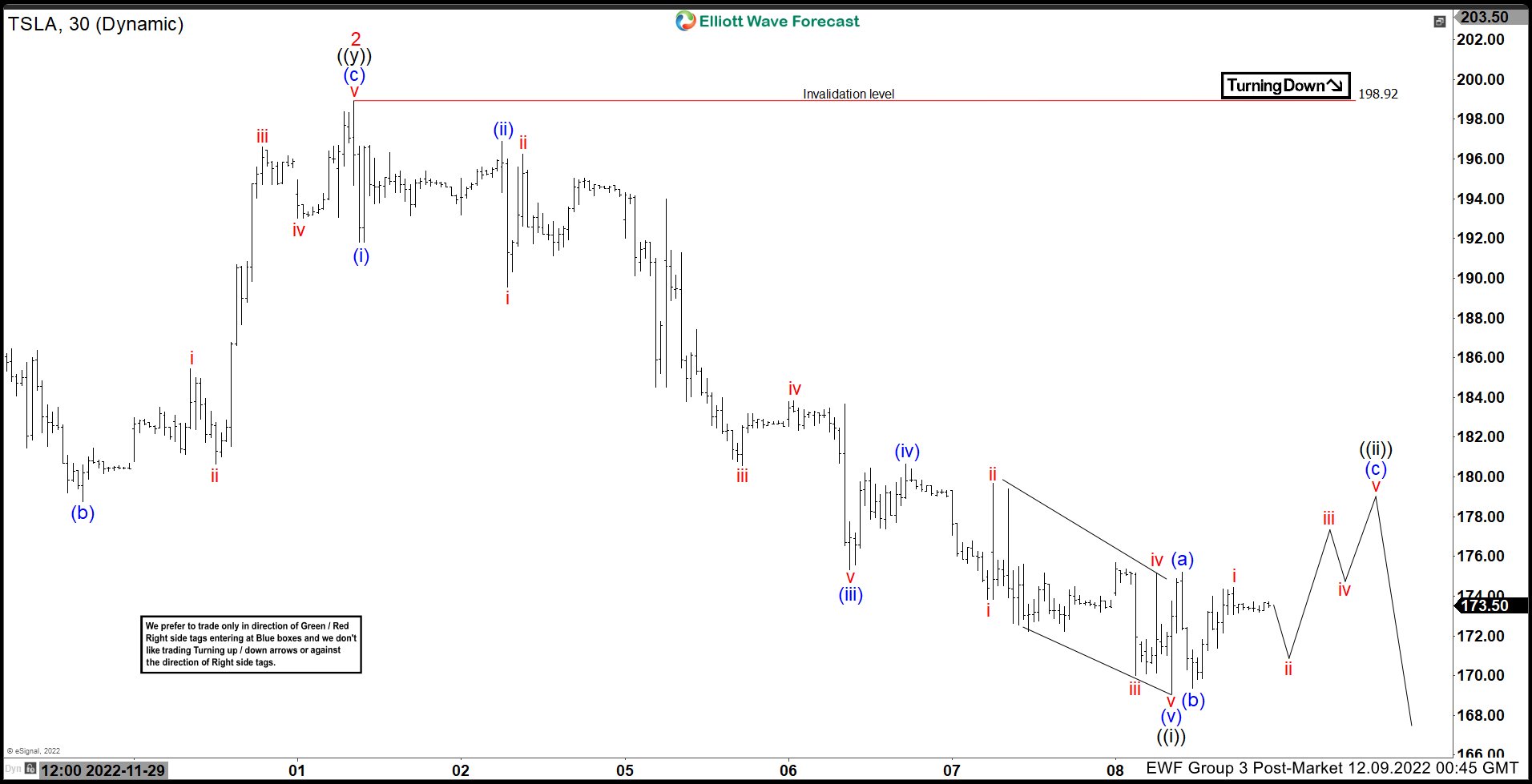

Elliott Wave View: Tesla (TSLA) Downside Looks Incomplete

Read MoreTesla (TSLA) cycle from 11.1.2022 remains in progress as an impulse. This article and video look at the Elliott Wave path.

-

XLK Perfectly Reacting Lower From The Blue Box Area

Read MoreIn this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of XLK. The decline from the 16 August 2022 high unfolded as an impulse sequence and showed a lower low sequence within the bigger cycle from December 2021 peak. Therefore, we knew that the structure in XLK is incomplete to […]

-

Uranium ETF (URA) Still Has Not Confirmed Bottom

Read MoreThe long term fundamental background in the next few years for Uranium remains very good. With the world in energy crisis and in need of a green energy, Uranium offers an alternative source. One way to capitalize on this opportunity is with the Uranium Miners ETF (URA). The ETF invests on the Uranium itself as well […]

-

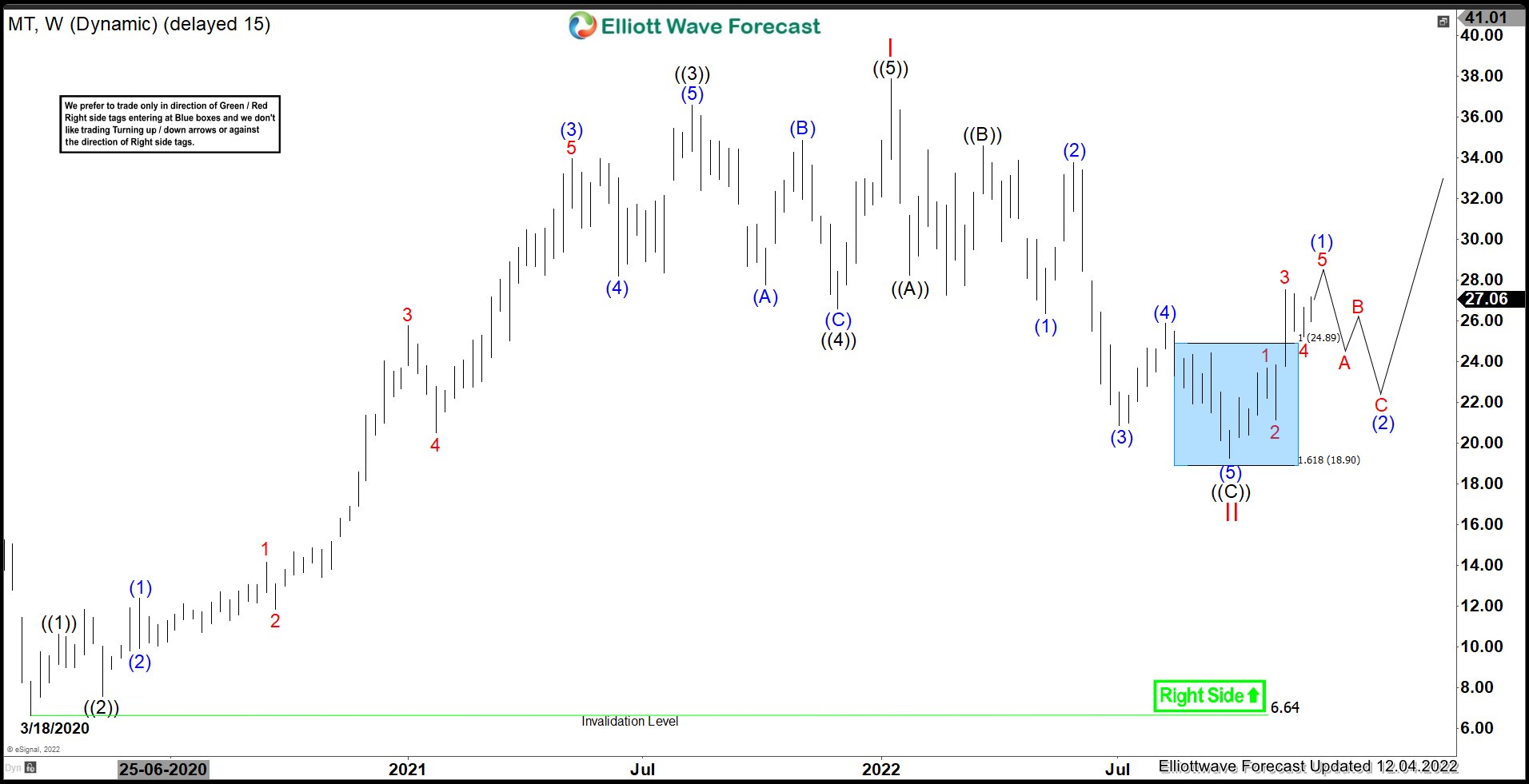

MT : Should It Be Ready For Next Rally ?

Read MoreArcelorMittal S.A., (MT) together with its subsidiaries, operates as integrated steel & mining companies in Europe, North & South America, Asia & Africa. Its principal steel products include semi-finished flat products, including slabs, finished flat products comprising plates, coils & sheets, bars, wire-rods, structural sections, rails, pipes & tubes. It is based in Luxembourg, comes […]

-

VanEck Gold Miners ETF ($GDX) Perfect Reaction from Blue Box Area.

Read MoreGood day Traders and Investors. In today’s article, we will look at the past performance of the Weekly Elliottwave chart of Gold Miners ETF ($GDX). The decline from 08.03.2020 high marked the end of the cycle from Jan 2016 lows. The ETF traded lower in 3 swings and bounced at red w on 09.27.2021. The […]

-

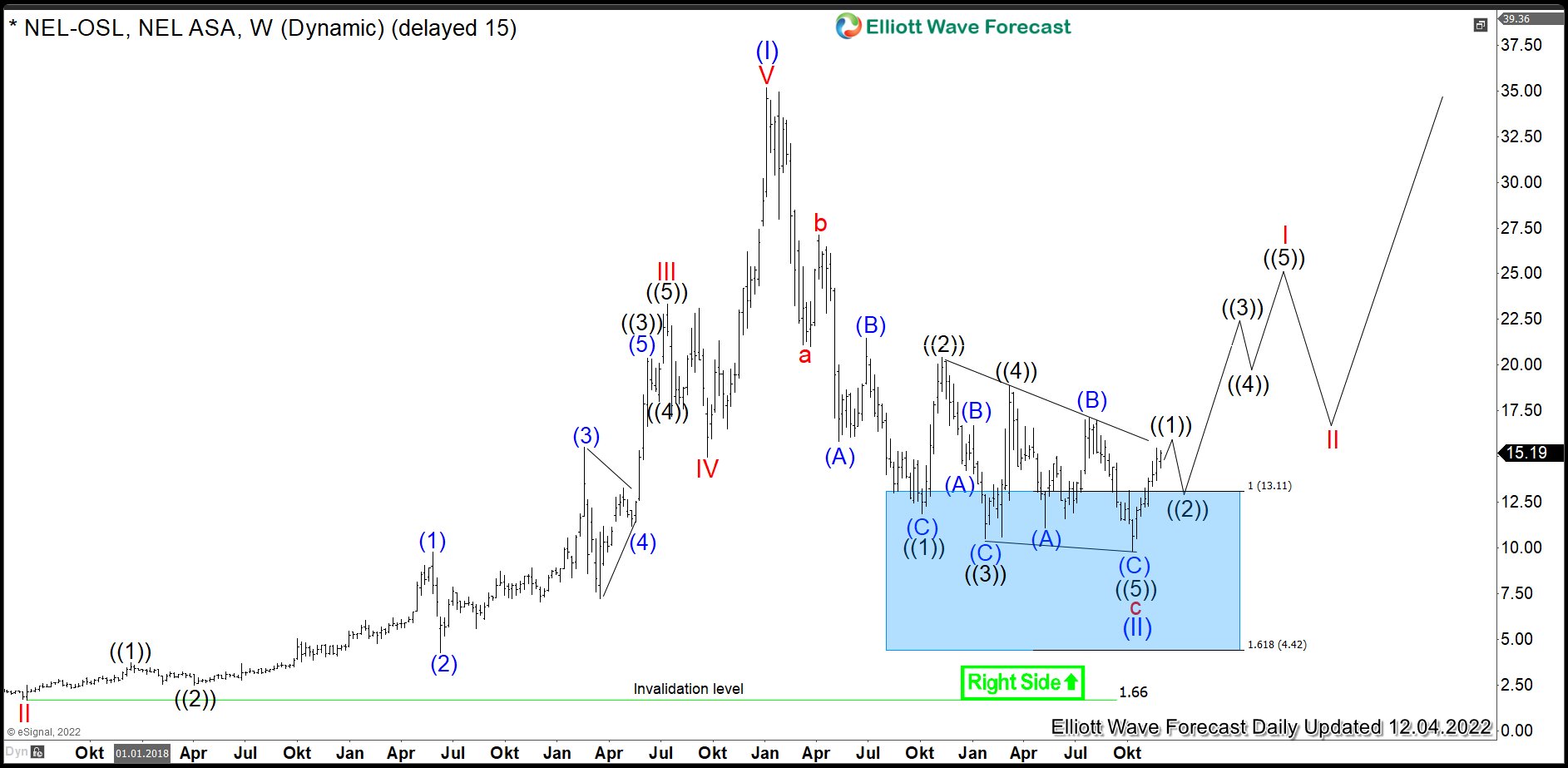

$NEL : Is Hydrogen Stock Nel ASA Bullish amid Energy Crisis?

Read MoreNel ASA is a Norwegian heavy electrical equipment company. It provides solutions for production, storage and distribution of hydrogen from renewable energy sources. Founded in 1927 and headquartered in Oslo, Norway, it can be traded under the ticker $NEL at Oslo Stock Exchange. Nel is a part of OBX25 index. In the initial article from May […]