The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Amazon (AMZN) Continues the Bearish Elliott Wave Sequence Lower

Read MoreAmazon (AMZN) shows an impulsive structure from 12.1.2022 high favoring more downside. This article and video look at the Elliott Wave path.

-

Elliott Wave View: Apple (AAPL) Expect Weakness Continues After A Corrective Bounce

Read MoreShort term Elliott Wave View in Apple Inc., (AAPL) suggests that cycle from 12.05.2022 high was ended at 140 low as wave 1 as 5 waves impulse Elliott Wave structure. While above there, it starts bouncing in proposed 7 swing correction, which expect to fail below 150.90 high of wave (2) to resume lower. It ended […]

-

Starbucks ($SBUX) Should Pullback At Any Moment

Read MoreStarbucks Corporation (SBUX) is an American multinational chain of coffeehouses and roastery reserves. It is the world’s largest coffeehouse chain. As of November 2021, the company had 33,833 stores in 80 countries, 15,444 of which were located in the United States. Out of Starbucks’ U.S.-based stores, over 8,900 are company-operated, while the remainder are licensed. Starbucks ($SBUX) Elliott Wave Analysis – […]

-

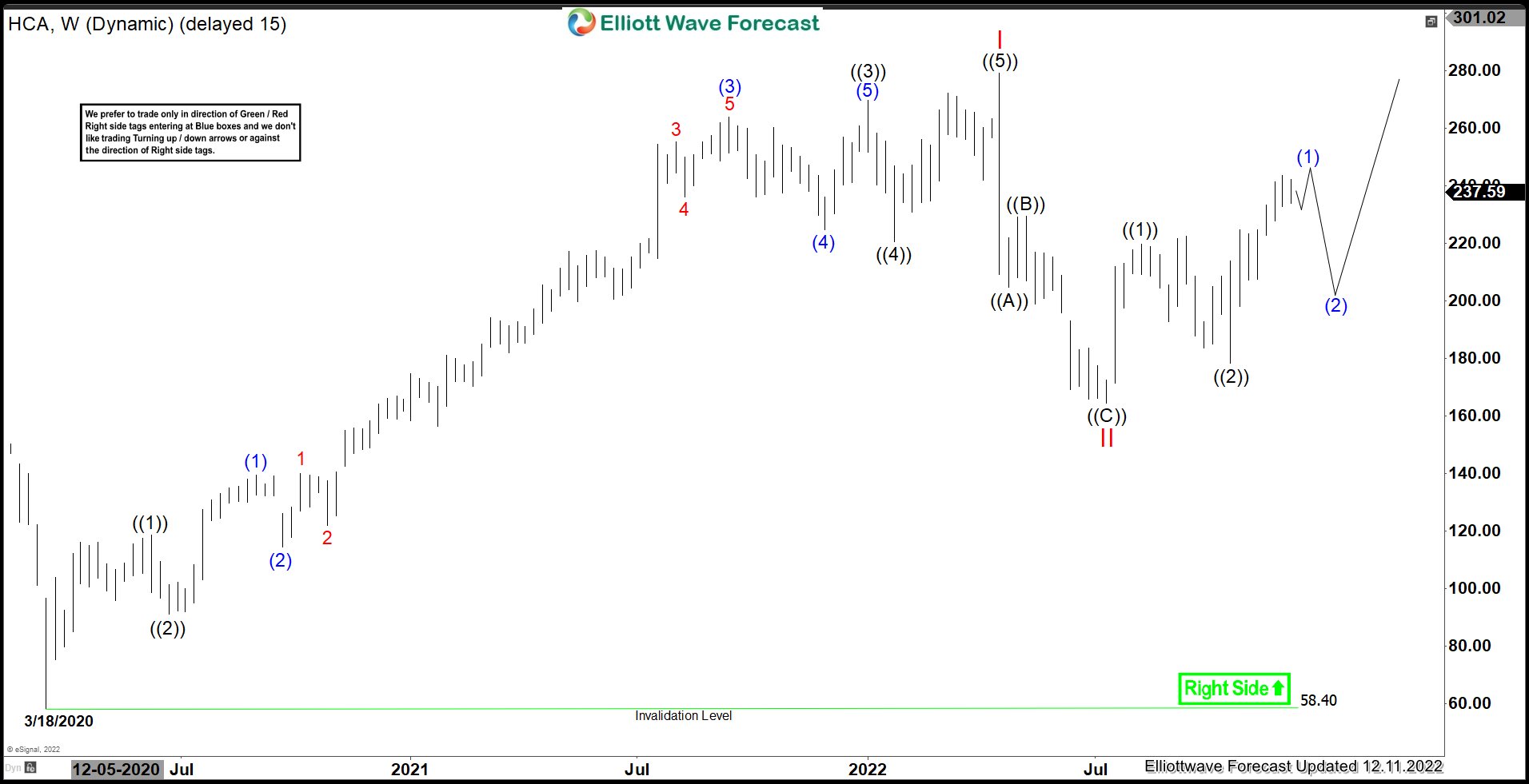

HCA : Should It Be Ready For Next Rally ?

Read MoreHCA Healthcare, Inc., (HCA) provides health care services company in the United States. The company operates general & acute care hospitals that offers medical & surgical services, including inpatient care, intensive care, cardiac care, diagnostic & emergency services & outpatient services. It is based in Nashville, Tennessee, comes under Healthcare (XLV) sector & trades as […]

-

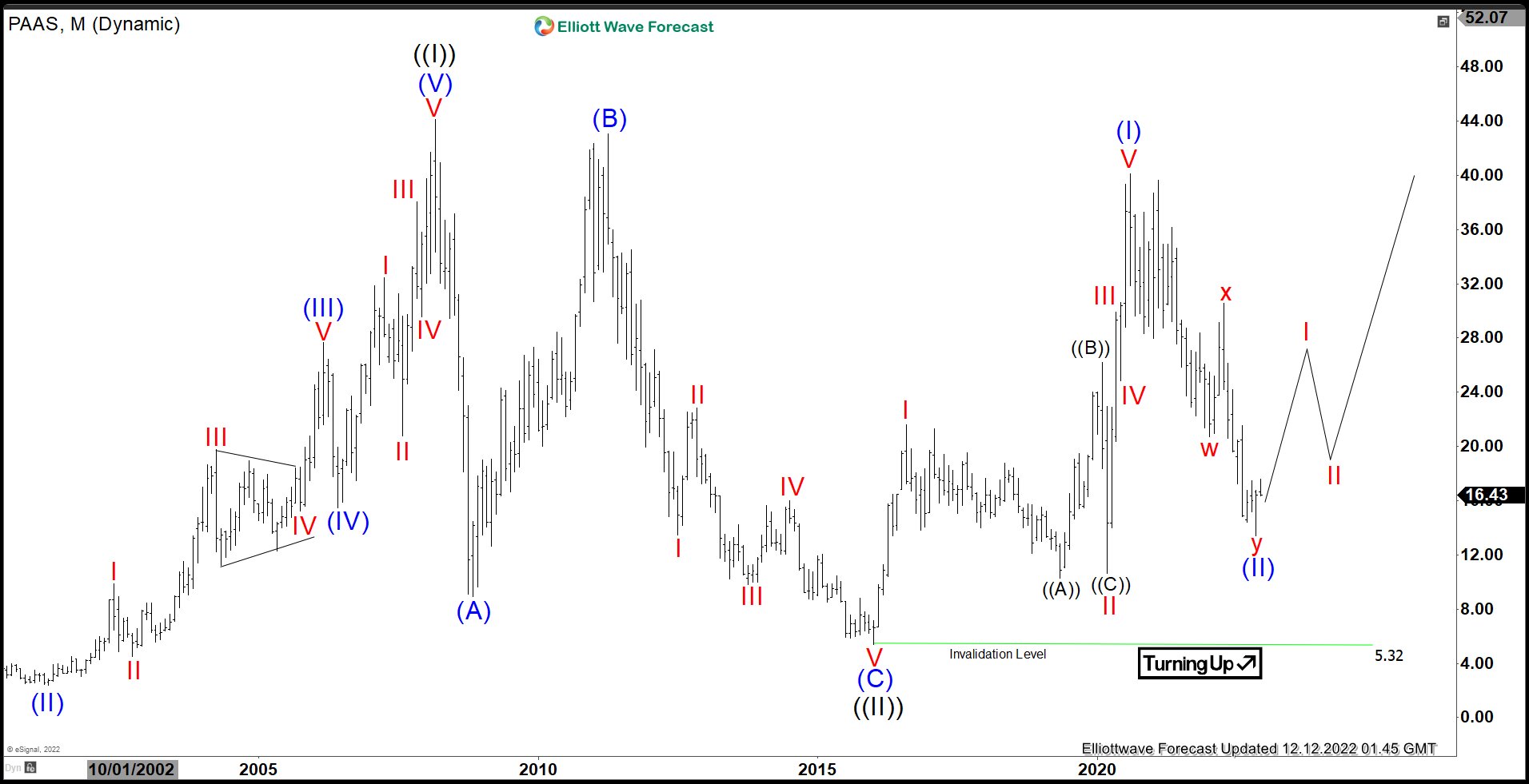

Pan American Silver (PAAS) Bottom Can be In Place

Read MoreSilver (XAGUSD) has ended correction to the cycle from 2020 low and turning higher. This would suggest that silver miners most likely have formed the bottom as well. Below is the chart of Pan American Silver (ticker: PAAS), one of the leading precious metal miners. The company is engaged in the production and sale of […]

-

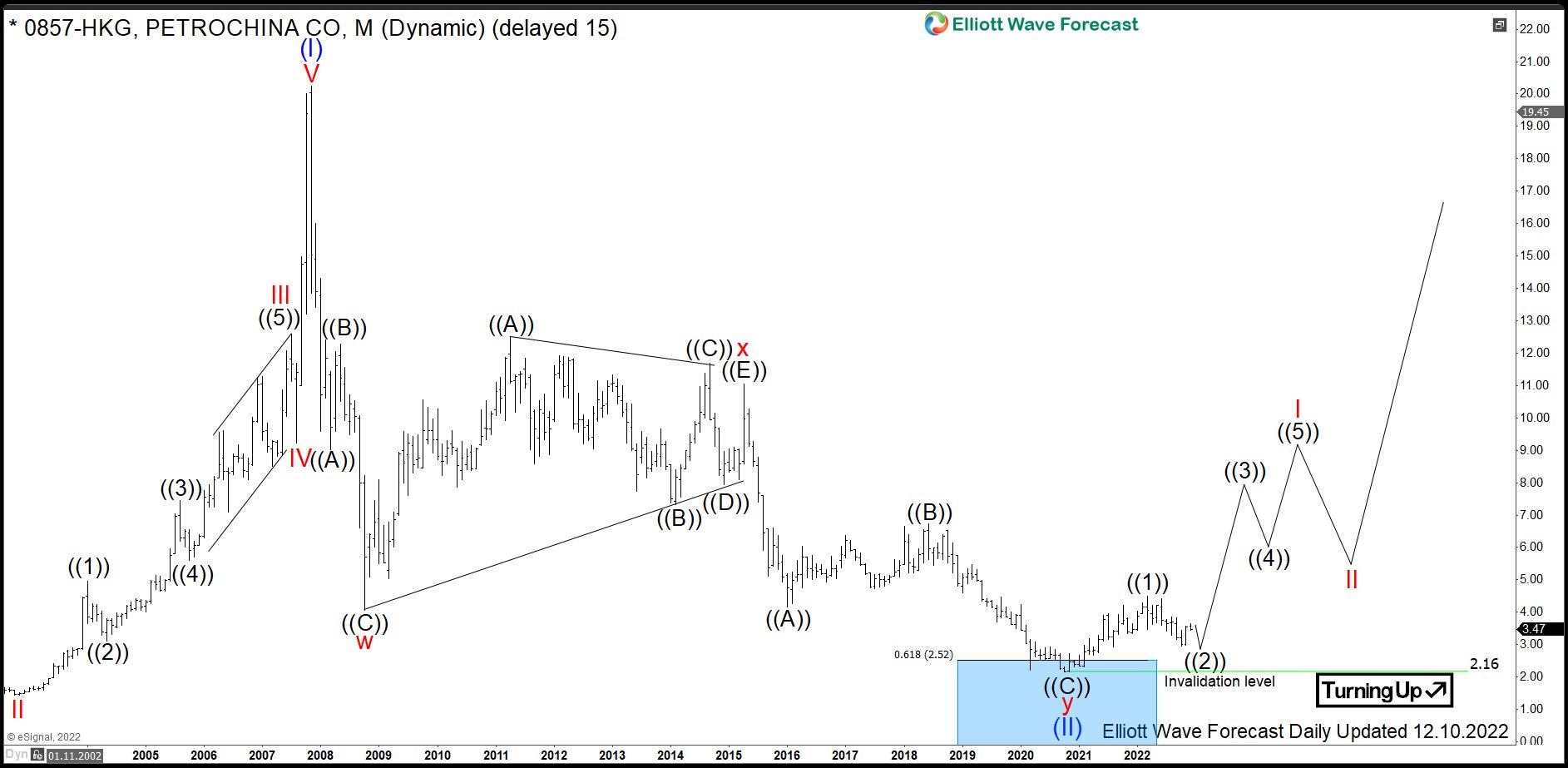

#0857: Can Oil Giant PetroChina Accelerate Higher?

Read MorePetroChina Company Limited is a Chinese oil and gas company and is the listed arm of the state-owned China National Petroleum Corporation (CNPC). Behind only Saudi Aramco and before another Chinese company Sinopec, it is the second largest worldwide in terms of revenue. Founded 1999, it is headquartered in Dongcheng District, Beijing, China. International investors […]