The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

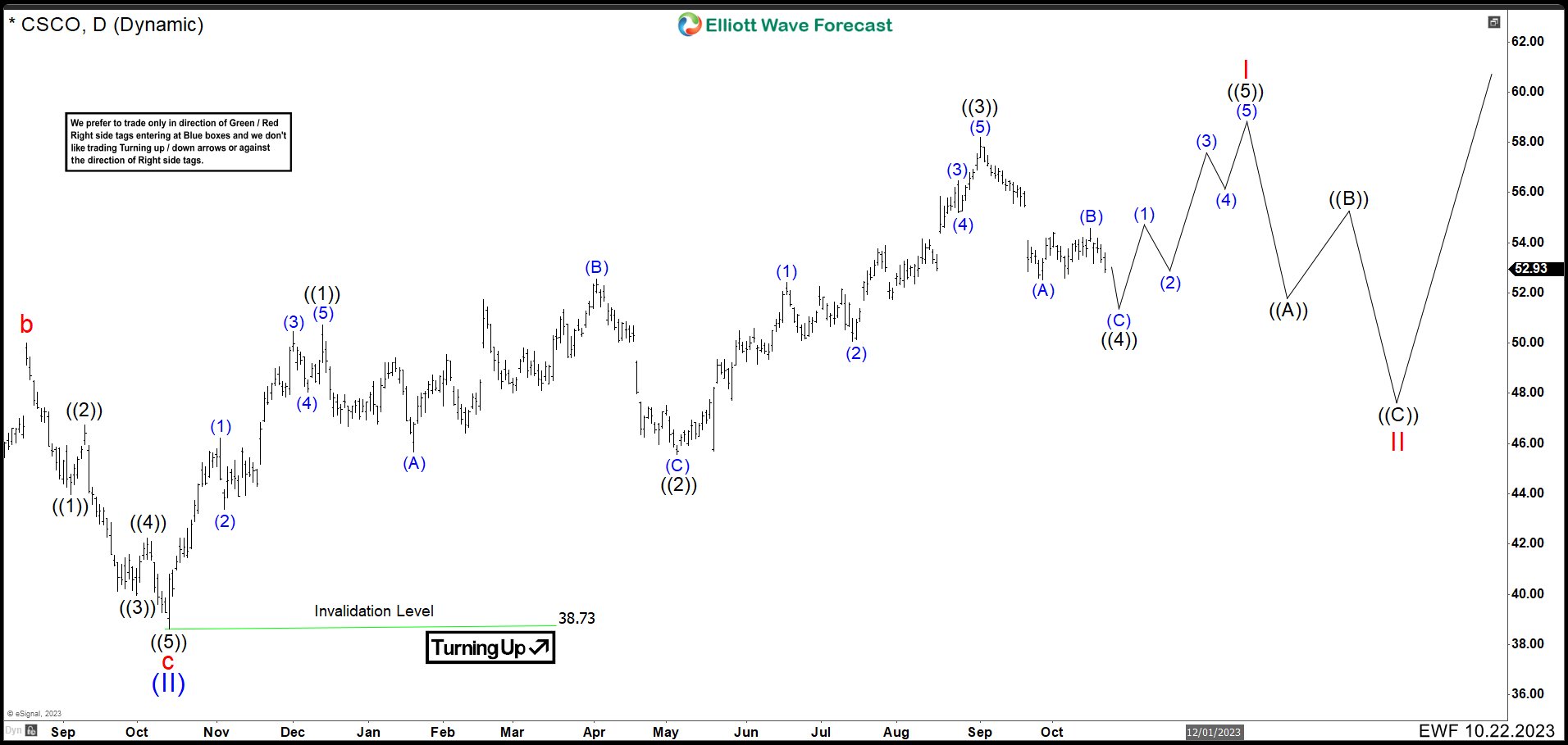

Cisco (CSCO) Should Make One More High Before a Big Correction

Read MoreCisco Systems, Inc., commonly known as Cisco (CSCO), is an American-based multinational digital communications technology conglomerate corporation headquartered in San Jose, California. Cisco develops, manufactures, and sells networking hardware, software, telecommunications equipment and other high-technology services and products. At the end of 2021, Cisco finished an impulsive structure at 64.33 which we called wave (I). Then, CSCO dropped nearly a year to complete a zig zag corrective […]

-

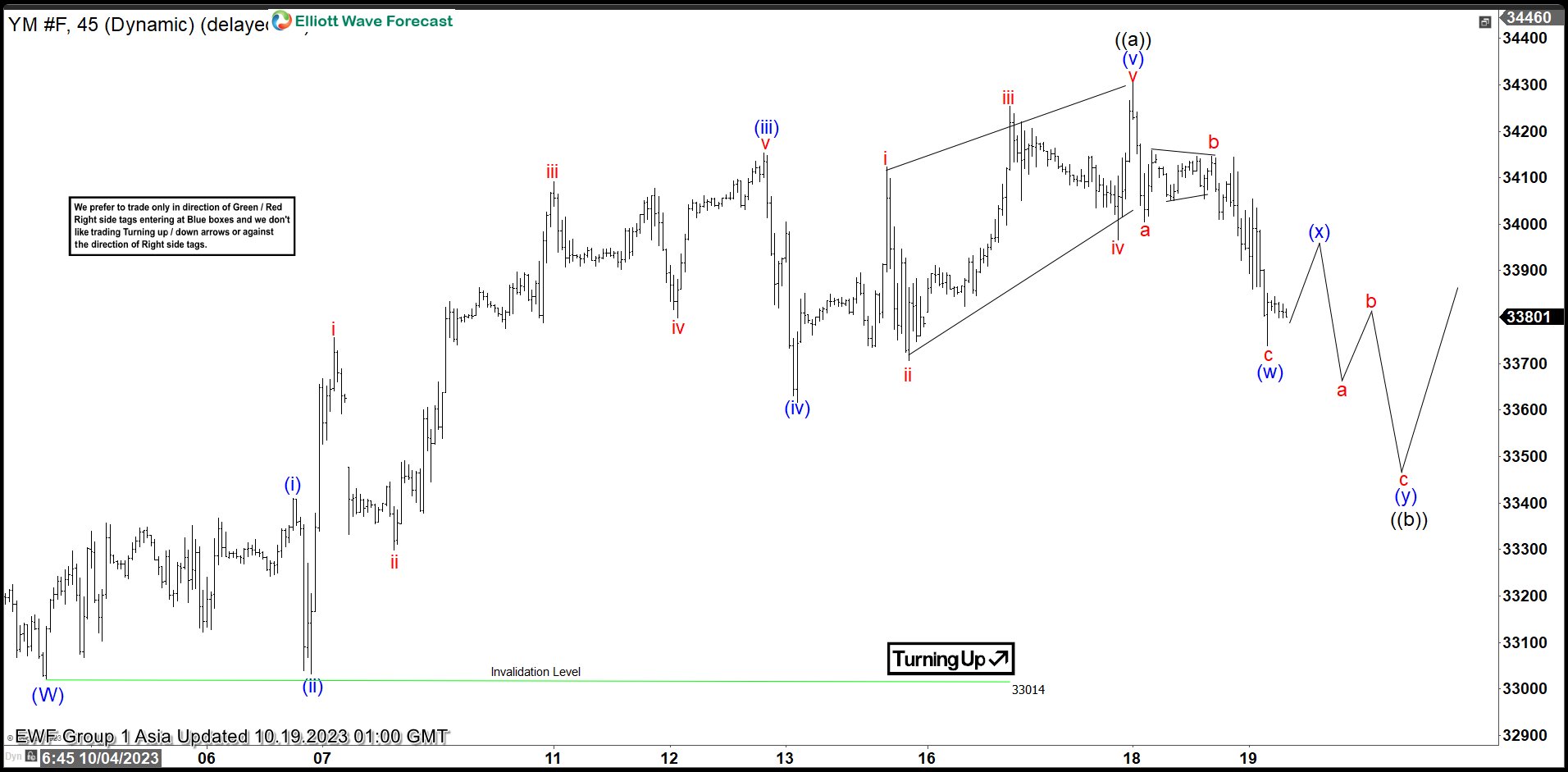

Dow Futures (YM) Pullback May Find Support

Read MoreDow Futures (YM) is looking to correct rally from Oct 4. This article and video look at the Elliott Wave path of the Index.

-

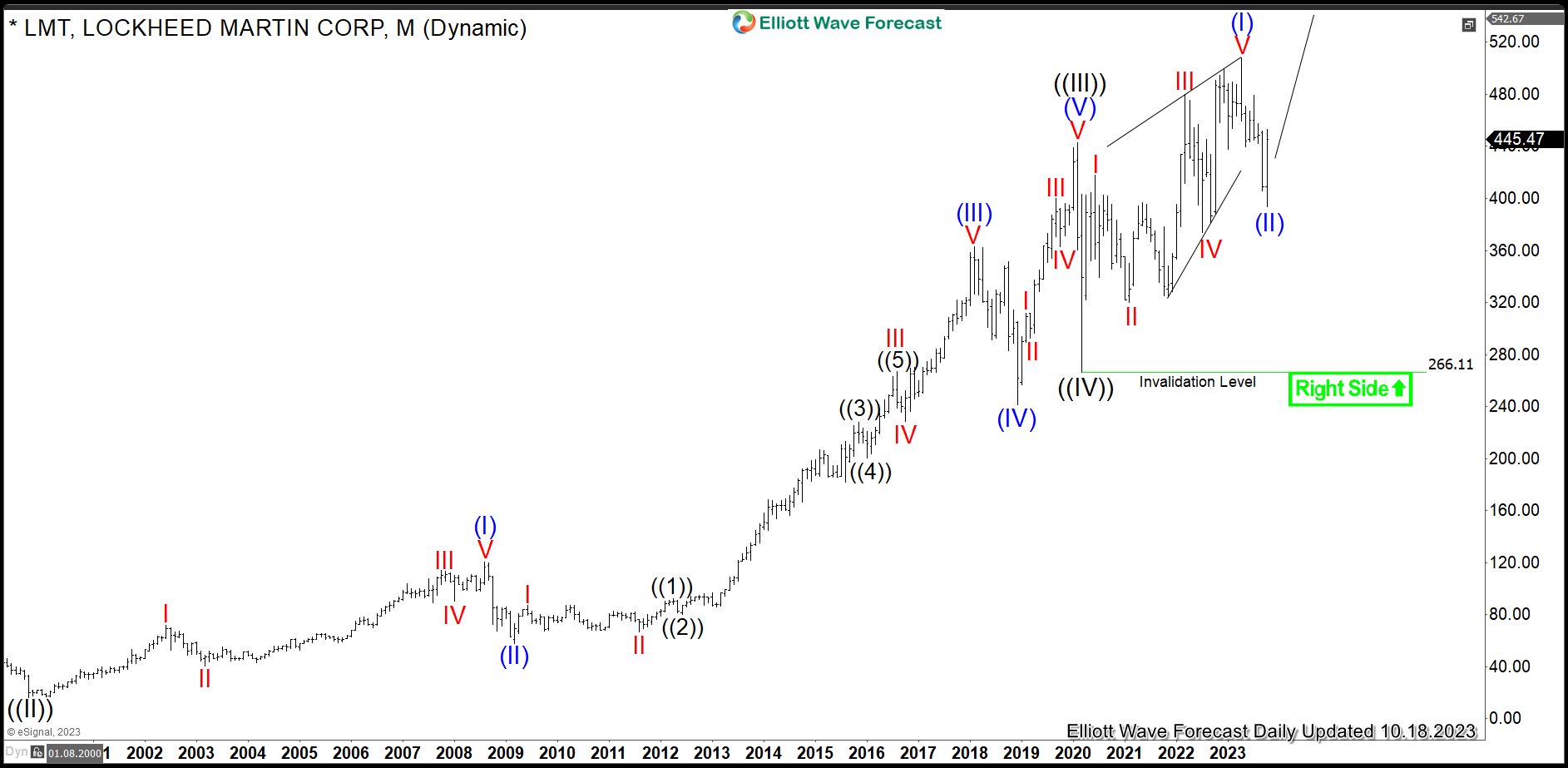

$LMT : Pullbacks in Lockheed Martin Remain Supported

Read MoreLockheed Martin is one of the the largest defense, arms and aerospace companies based in the United States and the world. It employs approximately 110’000 people worldwide. The company operates mainly on four business segments, i.e., Aeronautics, Missiles & Fire control, Rotary & Mission system and Space systems. It’s the world’s largest defense contractor based […]

-

ES_F (E-mini S&P) Reaction from Equal Legs Area

Read MoreIn this article, we’re going to take a quick look at the Elliott Wave charts of ES_F (E-mini S&P 500) published in the members area of the website. As our members know, E-mini S&P500 is trading within the cycle from the October 13, 2022 low (3502). The rally so far is in 3 waves but has scope […]

-

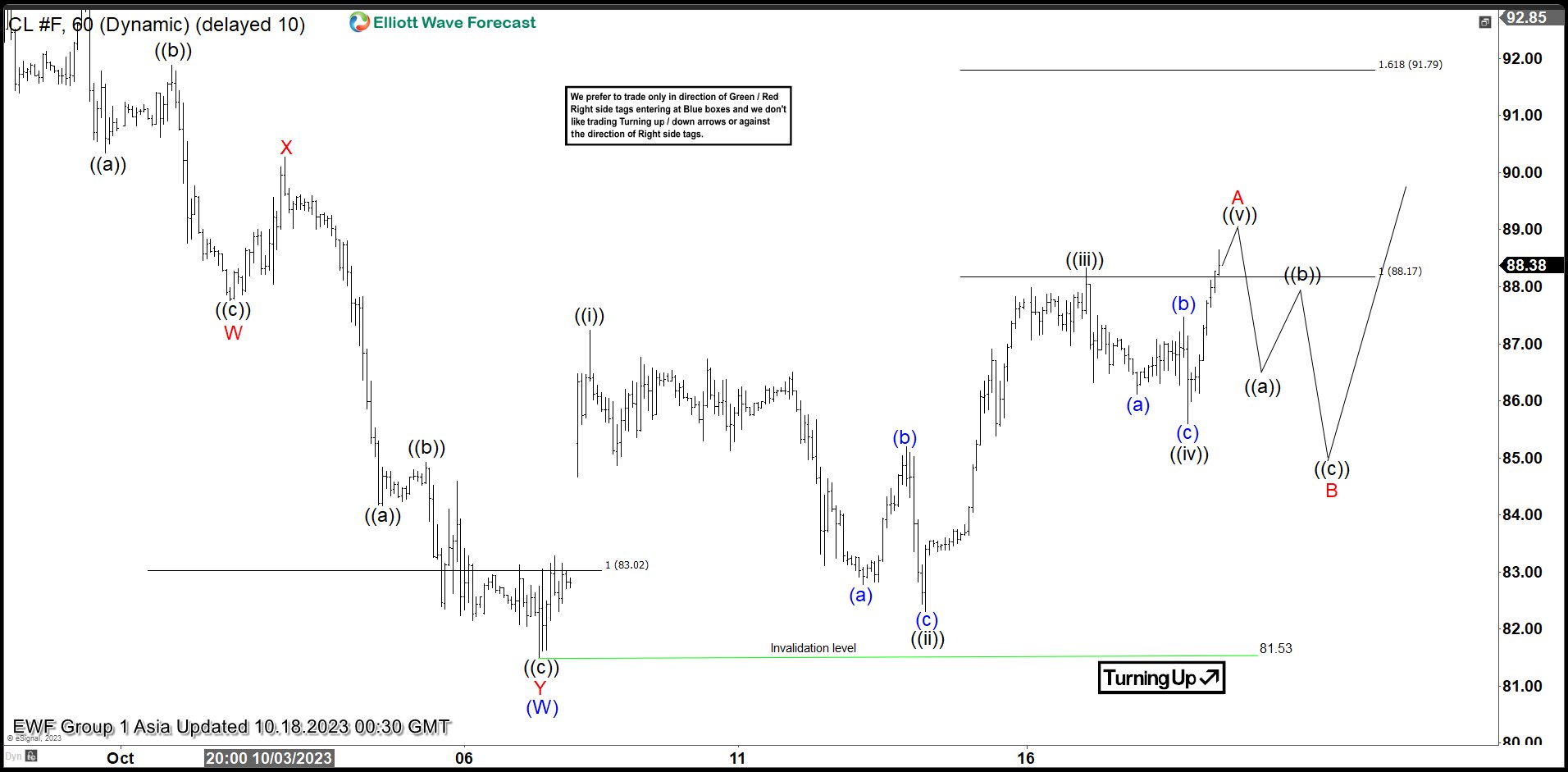

Light Crude Oil (CL) Shows 5 Swing Sequence Favoring More Upside

Read MoreLight Crude Oil (CL) shows 5 swing sequence from 10.6.2023 low favoring more upside. This article and video look at the Elliott Wave chart.

-

NASDAQ Futures Reacting From Equal Legs Area

Read MoreIn this blog, we take a look at the past performance of Nasdaq futures charts. The index provided a buying opportunity at the equal legs area.