The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Costco Wholesale (COST) Continues Upside In Bullish Sequence

Read MoreCostco Wholesale Corporation., (COST) engages in the operation of membership warehouse in the United States, Puerto Rico, Canada, United Kingdom, Mexico, Japan, Korea, Australia, Spain, France, Iceland, China & Taiwan together with its subsidiaries. It offers branded & private-label products in the range of merchandise categories. It also operates e-commerce websites in the US, Canada, […]

-

Ford $F Entered in a Double Three Structure to the Downside

Read MoreFord Motor Company is an American multinational automobile manufacturer headquartered in Dearborn, Michigan, United States. It was founded by Henry Ford and incorporated on June 16, 1903. The company sells automobiles and commercial vehicles under the Ford brand, and luxury cars under its Lincoln luxury brand. FORD (F) Daily Chart August 2023 In January 2022 Ford made a high at 25.87 and we called wave I and the […]

-

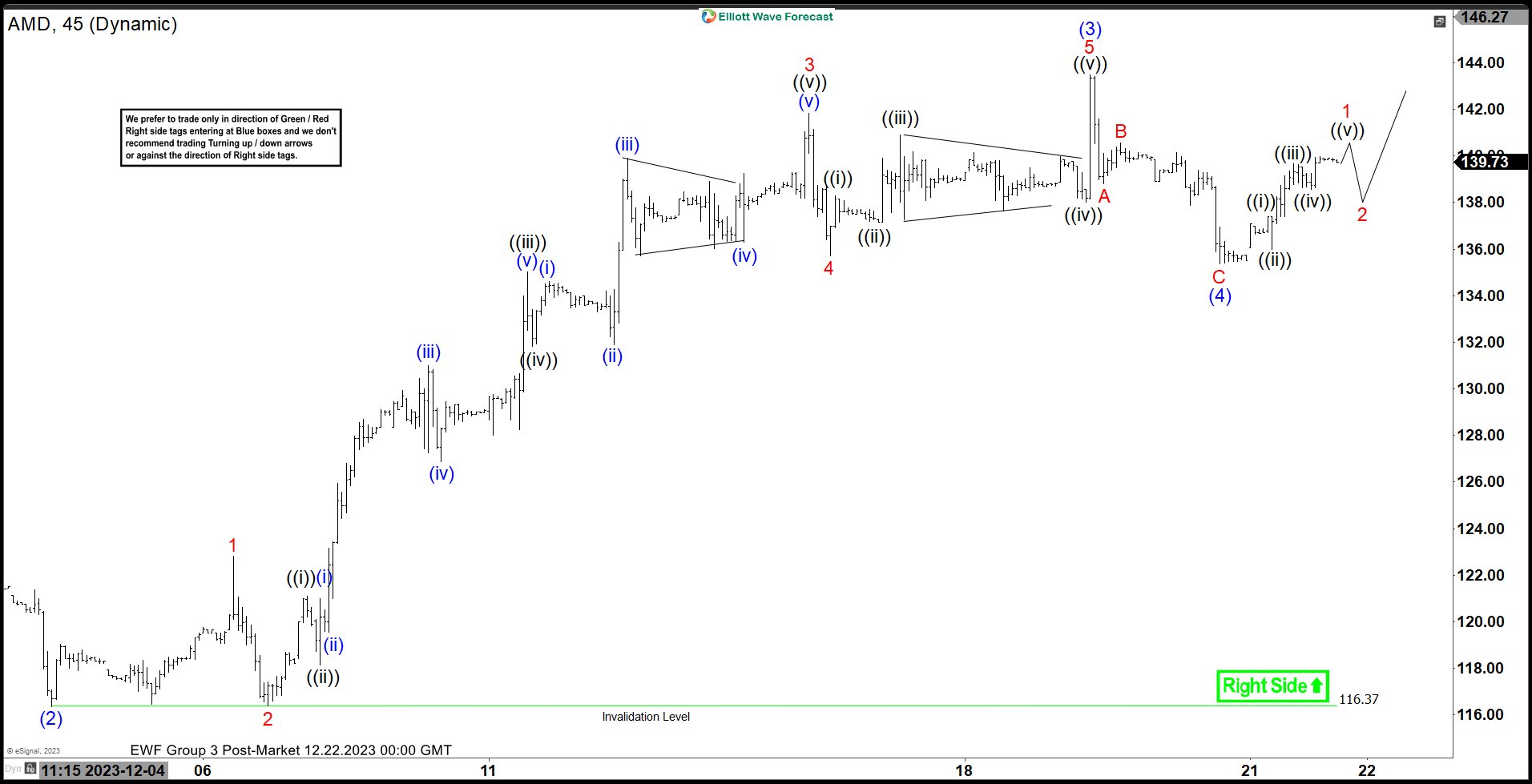

AMD Looking for One More Leg Higher to Complete an Impulse Structure

Read MoreShort Term Elliott Wave View in AMD shows a bullish sequence from 10.26.2023 low favoring further upside. Up from 10.26.2023 low, wave (1) ended at 125.72 and dips in wave (2) ended at 116.37. The impulse is in progress as the 45 minutes chart below shows. Internal subdivision of wave (3) was unfolding as a […]

-

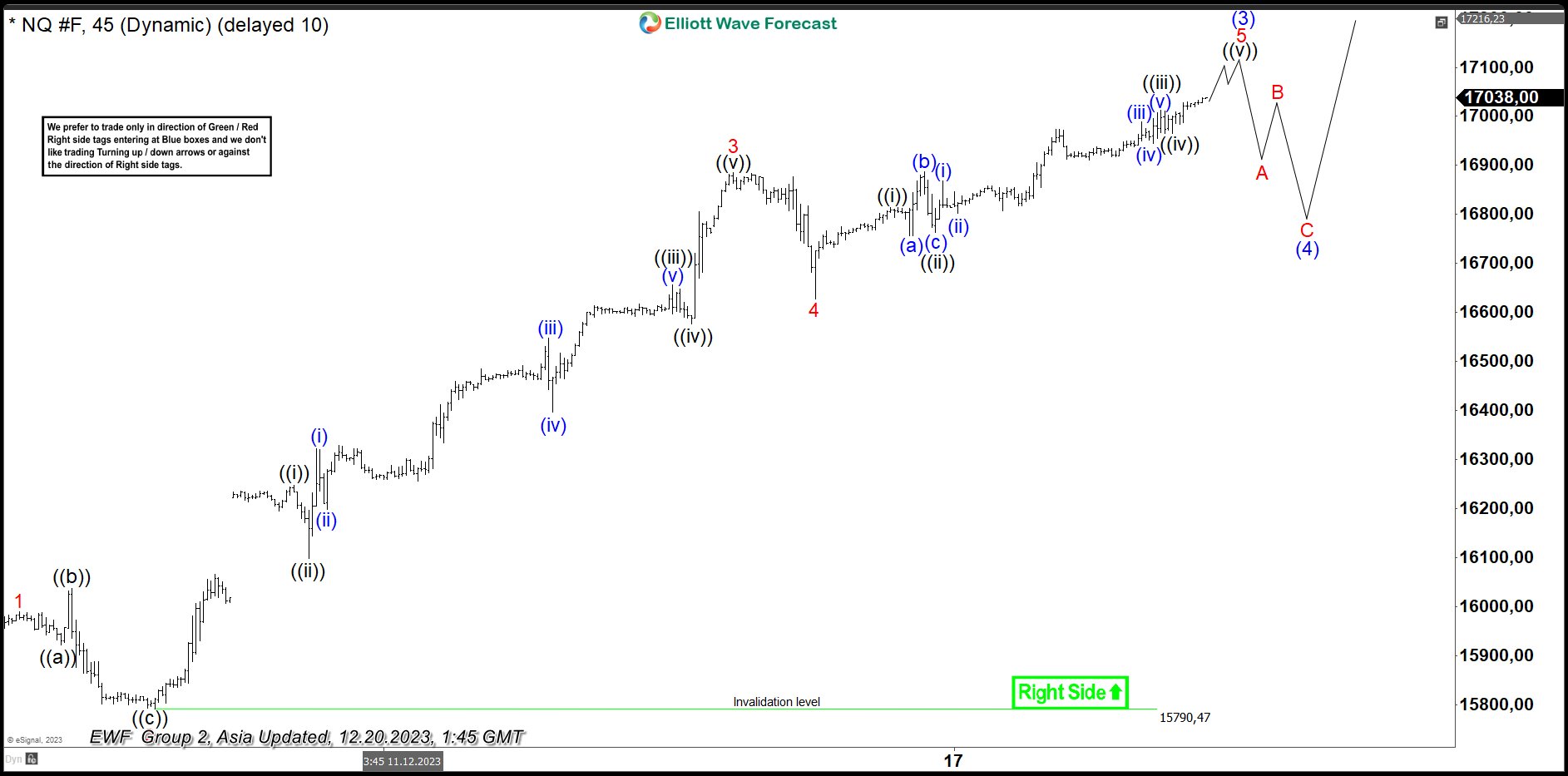

Nasdaq (NQ) Short Term Should Remain Supported

Read MoreNasdaq (NQ) shows bullish sequence from 10.26.2023 low favoring more upside. This article and video look at the Elliott Wave path.

-

Eli Lilly & Company (LLY) Favors Pullback Before Rally Resumes

Read MoreEli Lilly & Company (LLY) discovers, develops & markets human pharmaceuticals worldwide. It is having around 550 B market cap as on December, 18th. It is based in Indianapolis, Indiana, US, comes under Healthcare sector & trades as “LLY” ticket at NYSE. LLY reacted higher as expected from the previous article, in ((3)) towards $584.39 […]

-

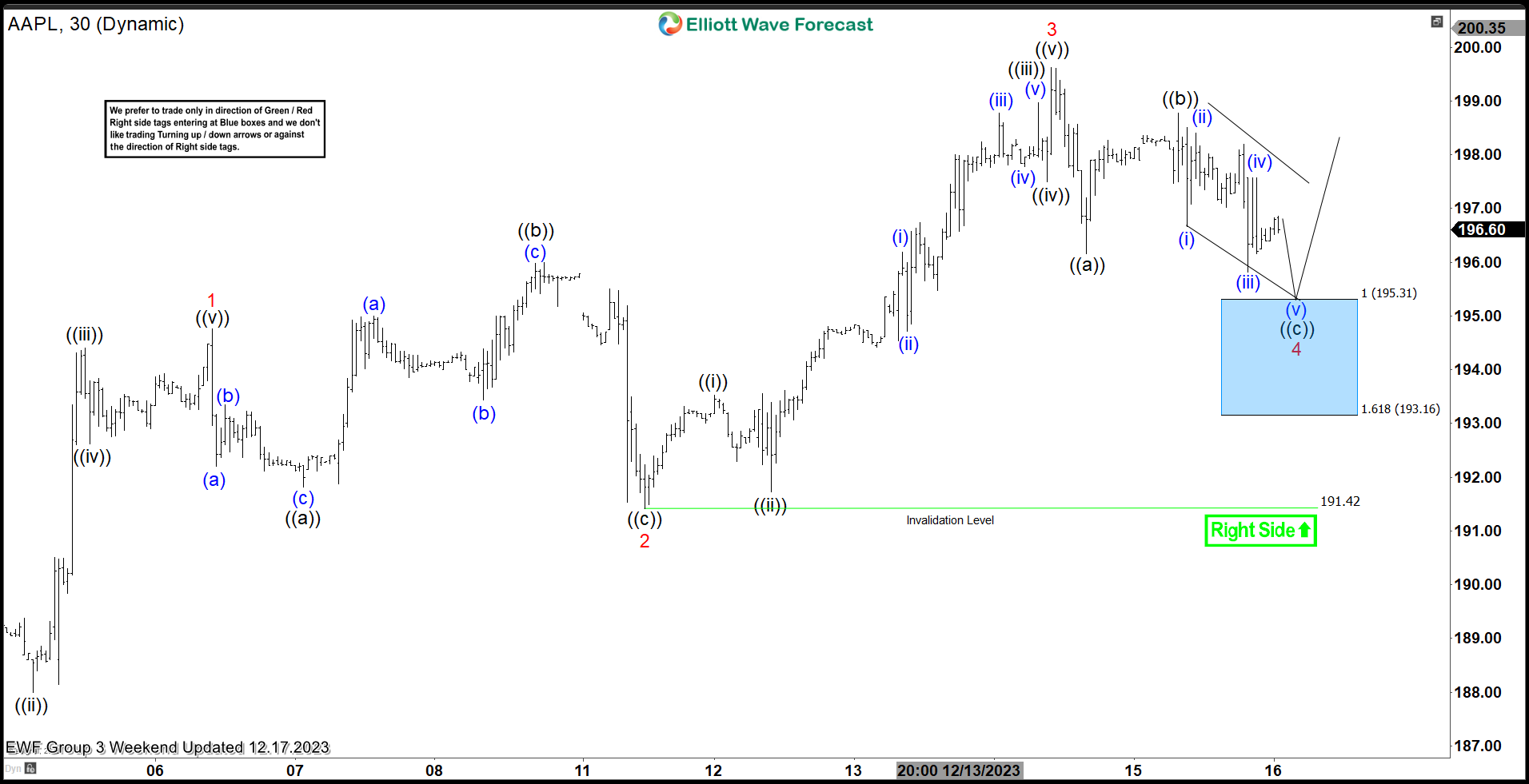

AAPL Keeping The Momentum & Reacting Higher From Blue Box Area

Read MoreIn this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of AAPL. We presented to members at the elliottwave-forecast. In which, the rally from 04 December 2023 low is unfolding as an ending diagonal structure. Showing a higher high sequence favored more upside extension to take place. Therefore, we […]