The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

VanEck Gold Miners ETF ( $GDX ) Perfect Reaction From The Blue Box Area.

Read MoreHello everyone! In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of VanEck Gold Miners ETF ( $GDX ) . The rally from 2.28.2024 low at $25.64 unfolded as a 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. […]

-

Will NVO (Novo Nordisk) Provide Any Buying Opportunity?

Read MoreNovo Nordisk A/S (NVO), a healthcare company engages in the research, development, manufacture & marketing of the pharmaceutical products worldwide. It operates in two segments, Diabetes & Obesity care & Rare Disease. It is based in Denmark, comes under Healthcare – Biotechnology sector & trades as “NVO” ticker at NYSE. NVO is trading at all […]

-

Elliott Wave Intraday Looking for S&P 500 ETF (SPY) to End Wave 5

Read MoreS&P 500 ETF (SPY) extends higher in wave ((v)). This article and video look at the short term Elliott Wave path for the ETF.

-

SPX in all-time bullish sequence – when is next pullback?

Read MoreHello traders. In this post, we will examine the SPX all-time bullish trend and predict the next significant pullback. The index is close to breaking into a new all-time high, with several such moments already in 2024. In a strong trend like this, the key question is: when is the next correction? This post will […]

-

Silver Miners ETF (SIL) Correction In Progress

Read MoreSIL (Silver Miners ETF) is a financial product designed to mirror the performance of silver mining companies. It offers investors a straightforward way to gain exposure to the silver market without directly purchasing physical silver or individual mining stocks. SIL diversifies risk by spreading investments across multiple companies within the sector, potentially providing a hedge […]

-

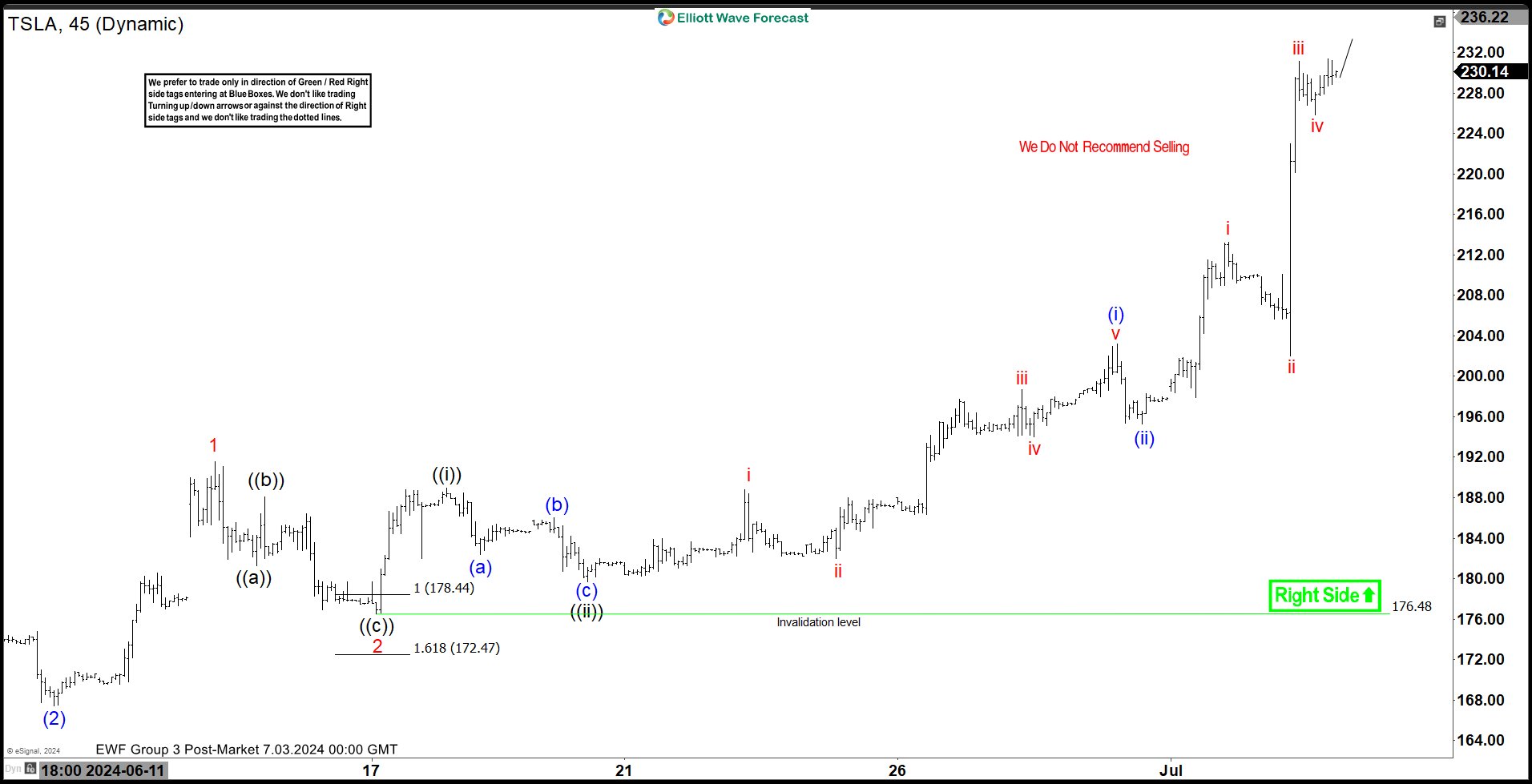

Elliott Wave Looking for New Impulsive Rally in Tesla (TSLA)

Read MoreTesla (TSLA) is rallying as an impulse from 6.12.2024 low. This article and video look at the Elliott Wave path for the stock.