The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

TSM (Taiwan Semiconductor) Should Remain Supported In Pullback To Resume Rally

Read MoreTaiwan Semiconductor Manufacturing Company Limited., (TSM) manufactures, packages, tests & sells integrated circuits & other semiconductor devices internationally. The company was headquartered in Taiwan, comes under Technology – Semiconductors sector & trades as “TSM” at NYSE. TSM favors upside in ((3)) of I of (III) within the sequence started from September-2023 low. It expects short […]

-

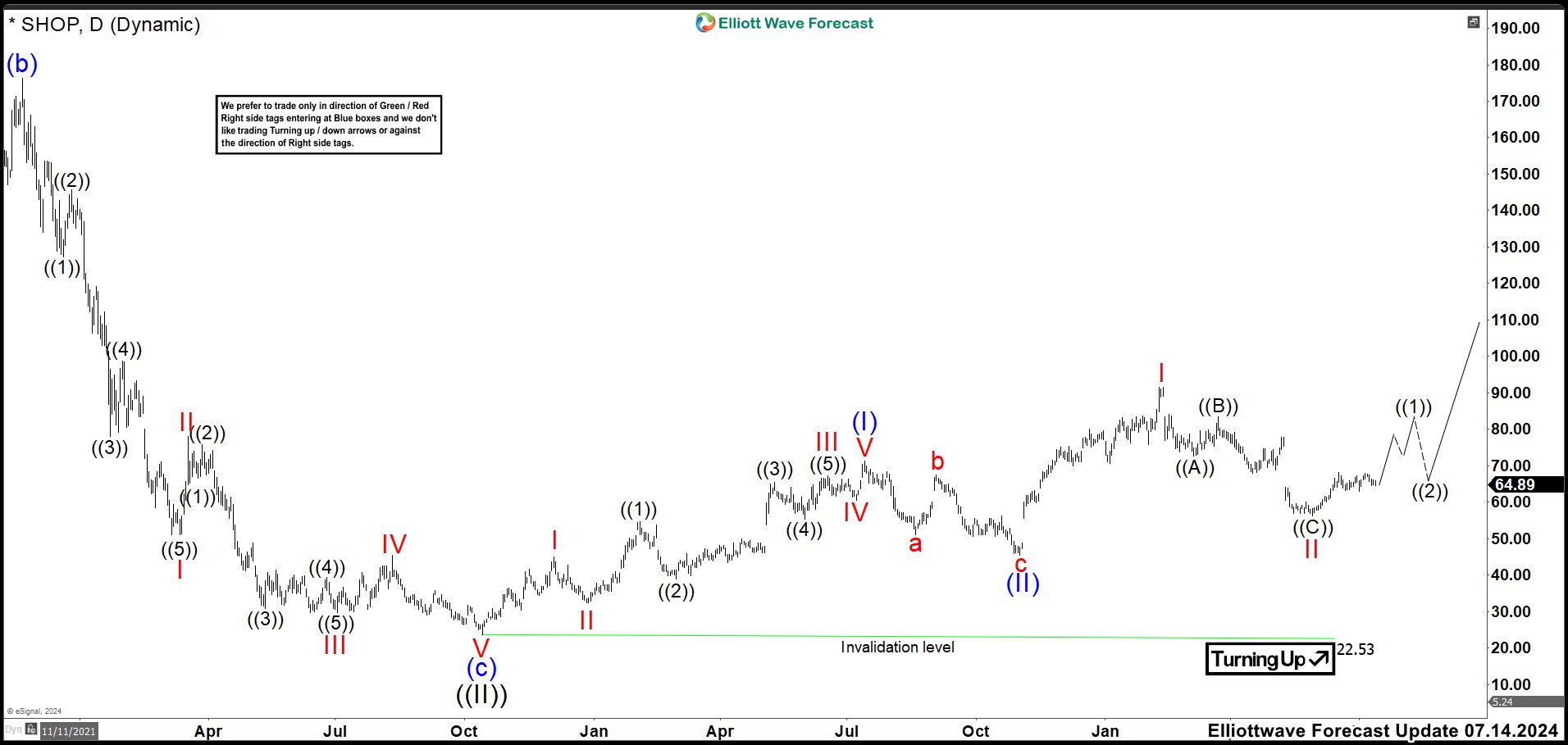

Shopify (SHOP) is Nesting looking for a Rally

Read MoreShopify Inc. is a Canadian multinational e-commerce company in Ottawa, Ontario. Shopify (SHOP) is the name of its proprietary e-commerce platform for online stores and retail point-of-sale systems. The Shopify platform offers online retailers a suite of services including payments, marketing, shipping and customer engagement tools. SHOP Daily Chart July 2023 Shopify ended a Grand Supercycle in July 2021 and we labeled it as wave ((I)). Since then, […]

-

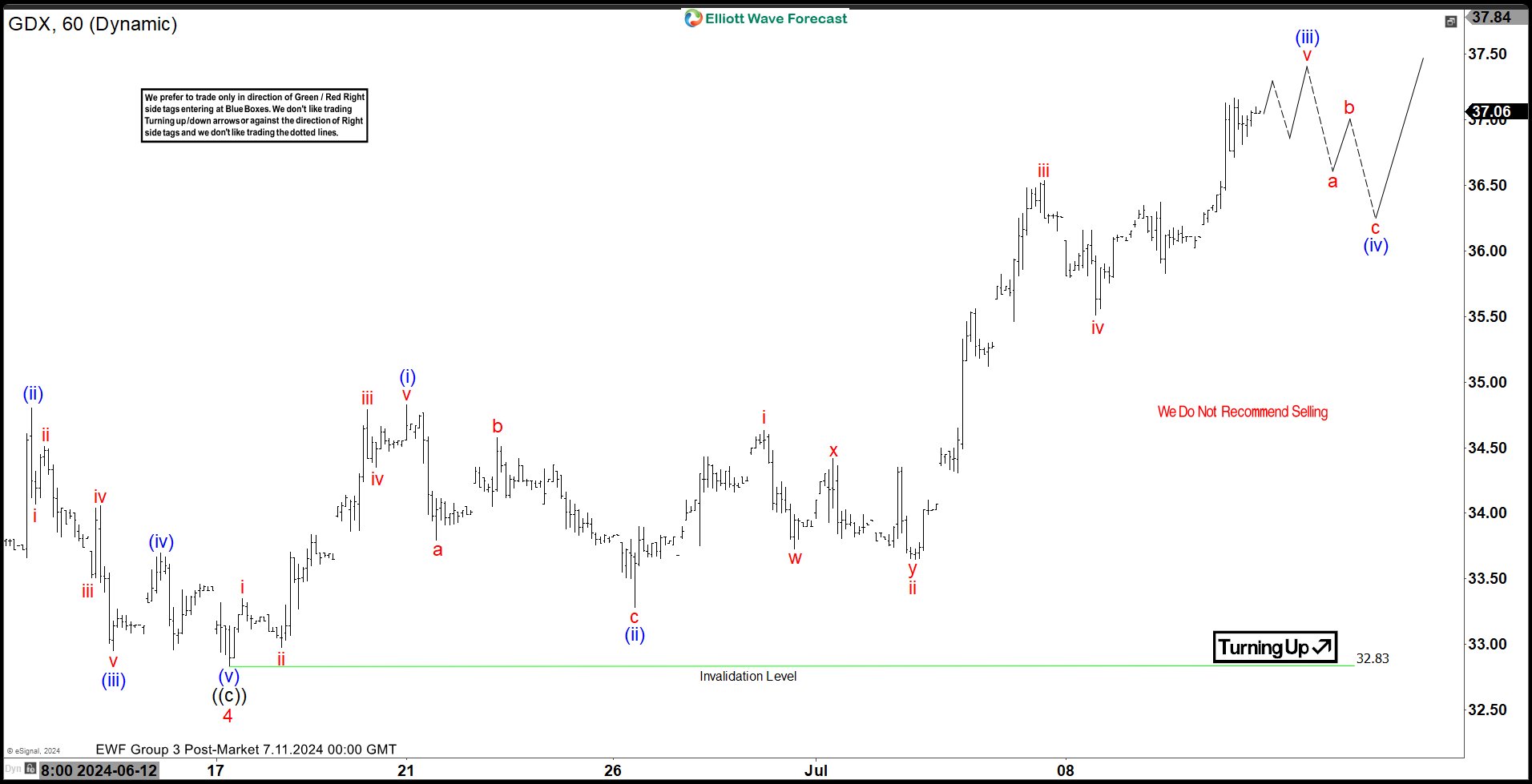

Elliott Wave Expects Gold Miners ETF (GDX) to Continue Rally

Read MoreGold Miners ETF (GDX) is rallying as an impulse and should extend higher. This article and video look at the Elliott Wave path.

-

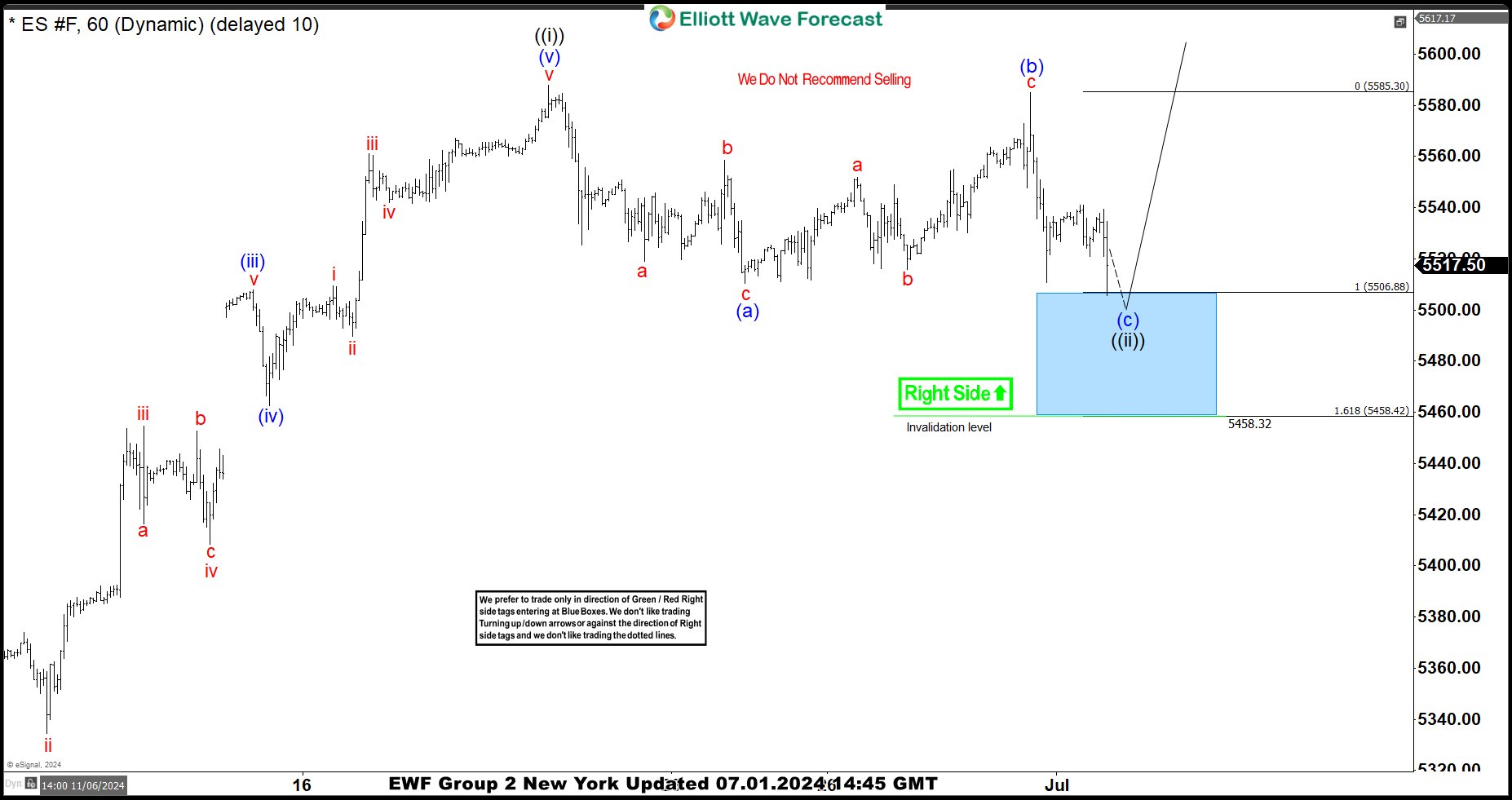

S&P 500 E Mini (ES_F) Perfect Reaction Higher From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of E mini ES_F charts. The index is showing a perfect reaction higher from the blue box area.

-

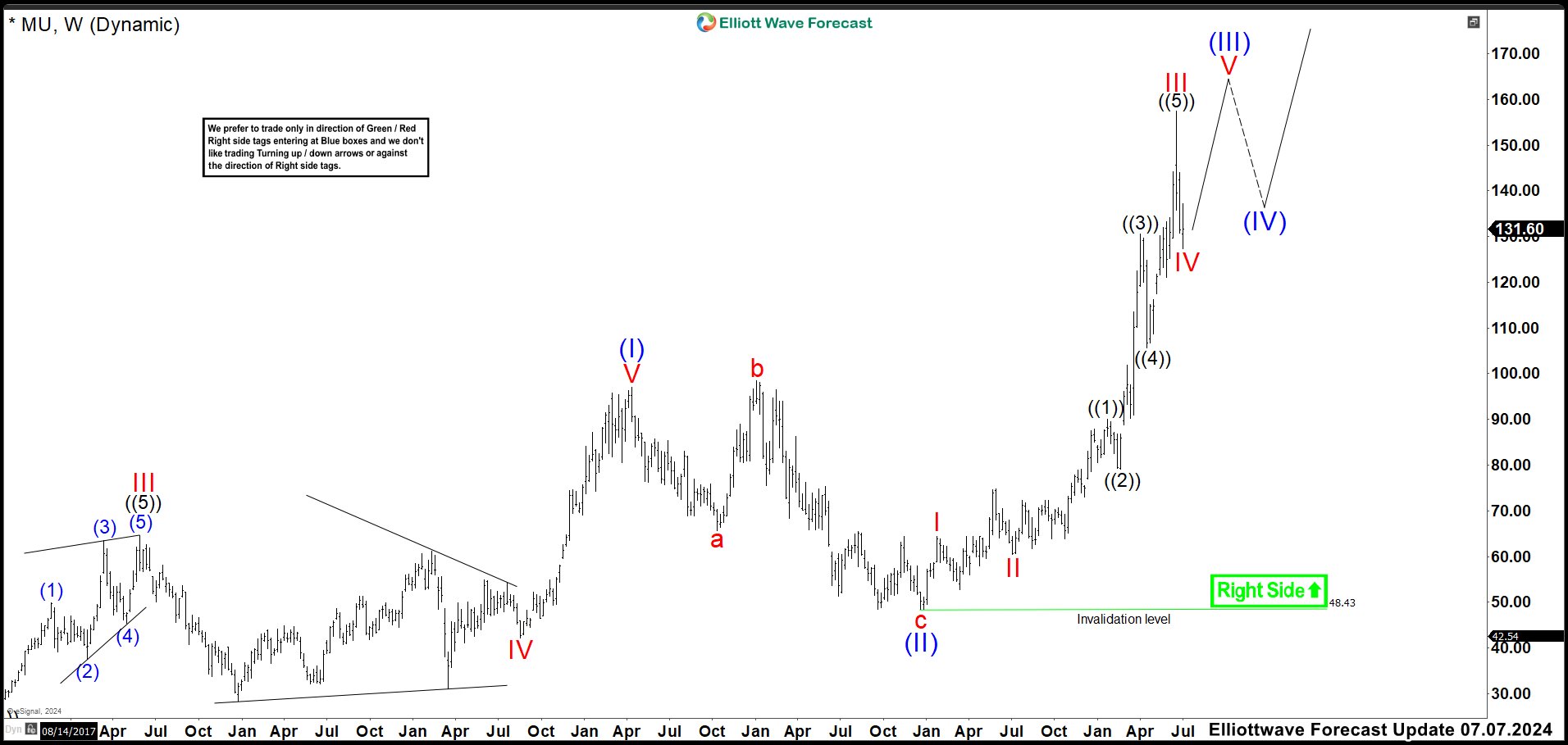

Micron Technology Inc (MU) Rallied as Expected Making More than 200%

Read MoreMicron Technology, Inc. (MU) designs, develops, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. Micron Technology, Inc. was founded in 1978 and is headquartered in Boise, Idaho. MU Weekly Chart March 2023 The last time […]

-

S&P 500 (SPX) Bullish Elliott Wave Sequence Remains in Play

Read MoreSPX impulsive rally remains in progress and Index should see further upside. This article and video look at the Elliott Wave path.