The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

ONEOK (OKE) Should Continue Rally in Bullish sequence

Read MoreONEOK Inc. (OKE), engages in gathering, processing, fractionation, storage, transportation & marketing of natural gas & natural gas liquids in the United States. It operates through Natural gas gathering & processing, Natural gas liquids & Natural gas pipelines segments & Refined products & Crude. The company is based in Tulsa, Oklahoma, comes under Energy sector […]

-

Elliott Wave Intraday Analysis: FTSE should Continue Higher

Read MoreShort Term Elliott Wave in FTSE suggests that the index has completed a bearish sequence from 5.15.2024 high. The decline made a zig zag Elliott Wave structure. Down from 5.15.2024 high, wave A ended at 8106.79 low. Rally in wave B ended at 8405.24 high with internal subdivision as an expanded flat structure. Up from […]

-

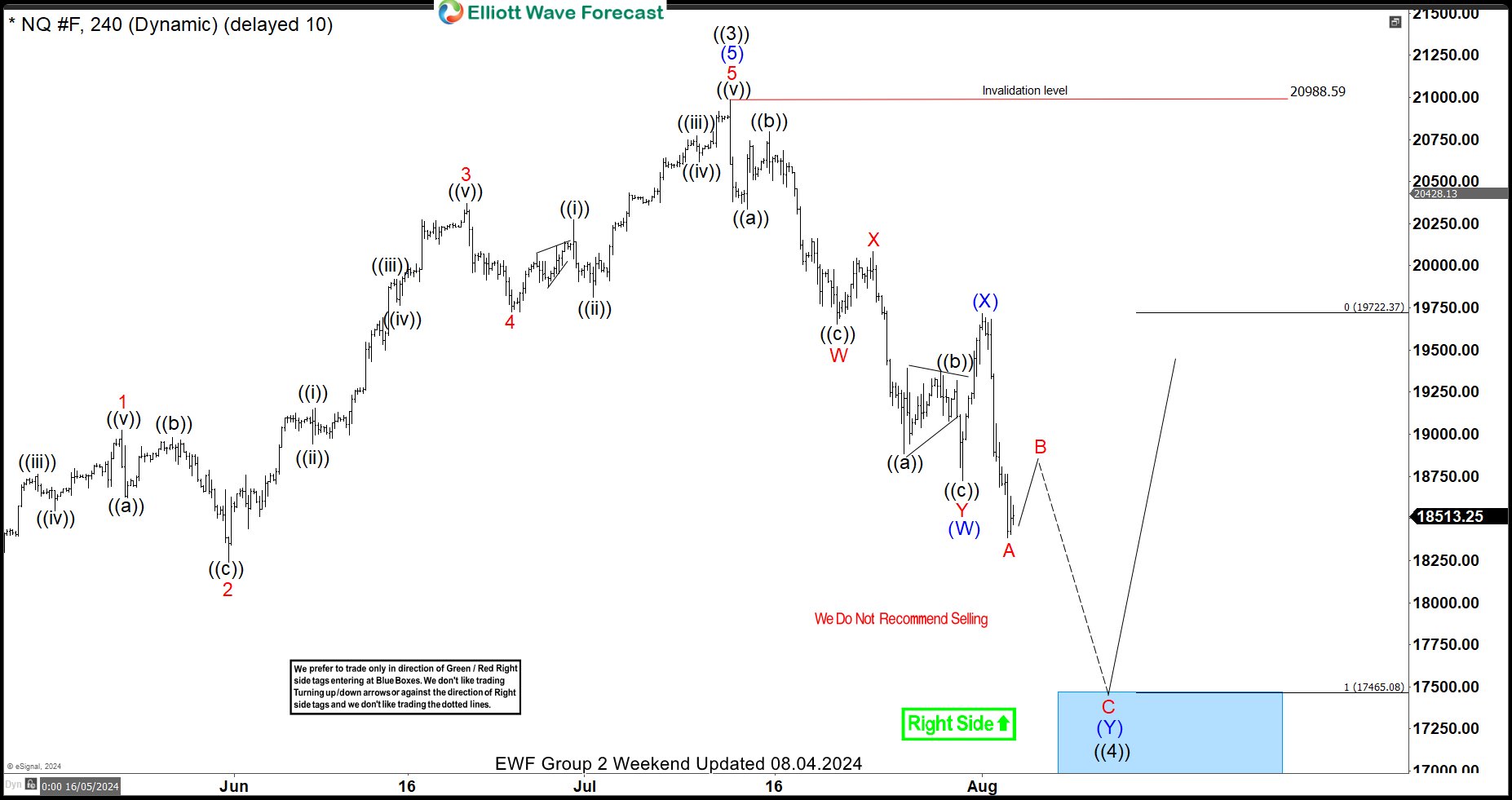

NASDAQ (NQ_F) Nice Reaction Higher From Blue Box Area

Read MoreIn this blog, we take a look at the past performance of NASDAQ (NQ_F) charts. The index is showing a very nice reaction higher from the blue box area.

-

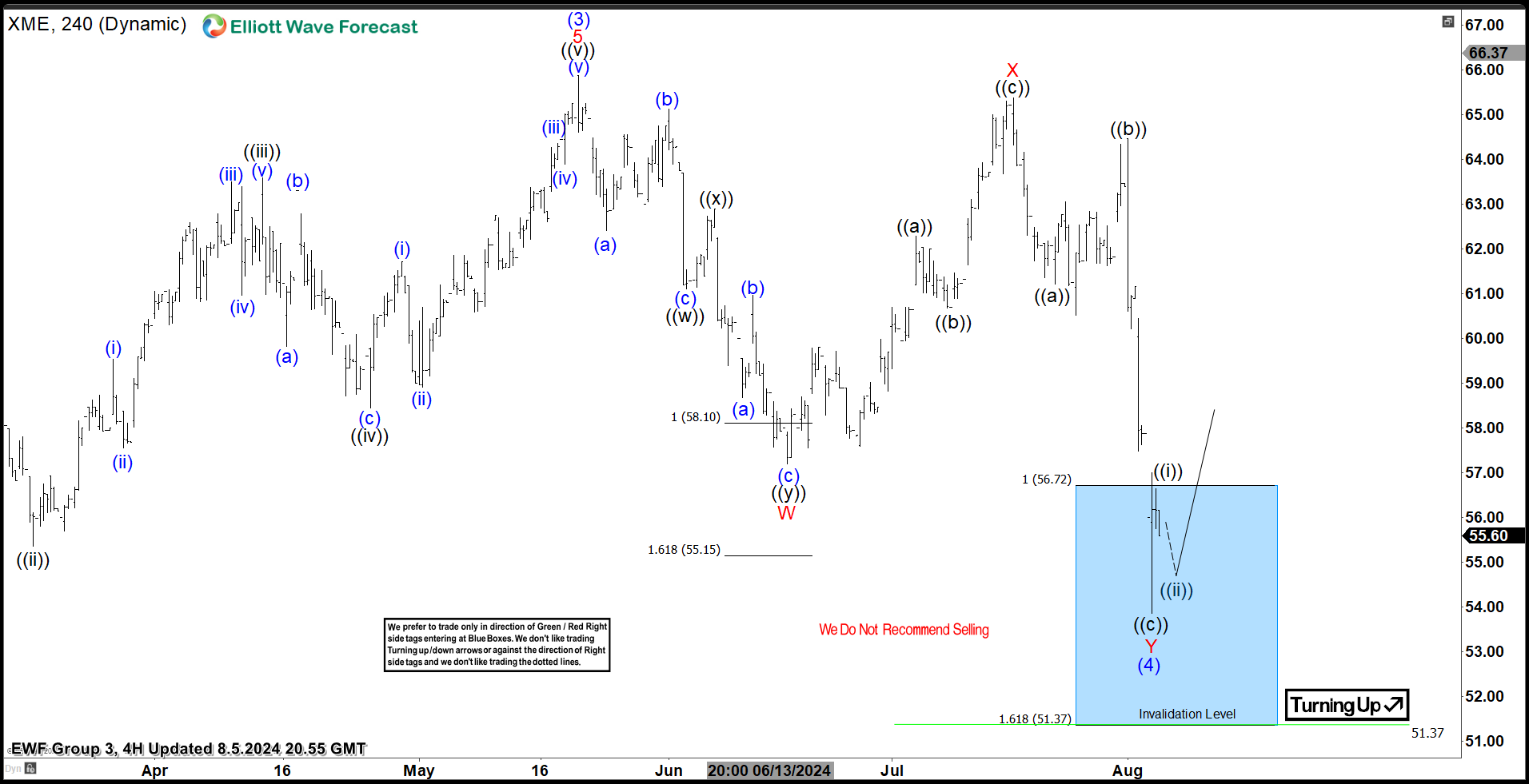

SPDR Metals & Mining ETF ( $XME ) Found Buyers At The Blue Box Area.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of SPDR Metals & Mining ETF ($XME). The rally from 5.31.2023 low unfolded as 5 waves impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the structure […]

-

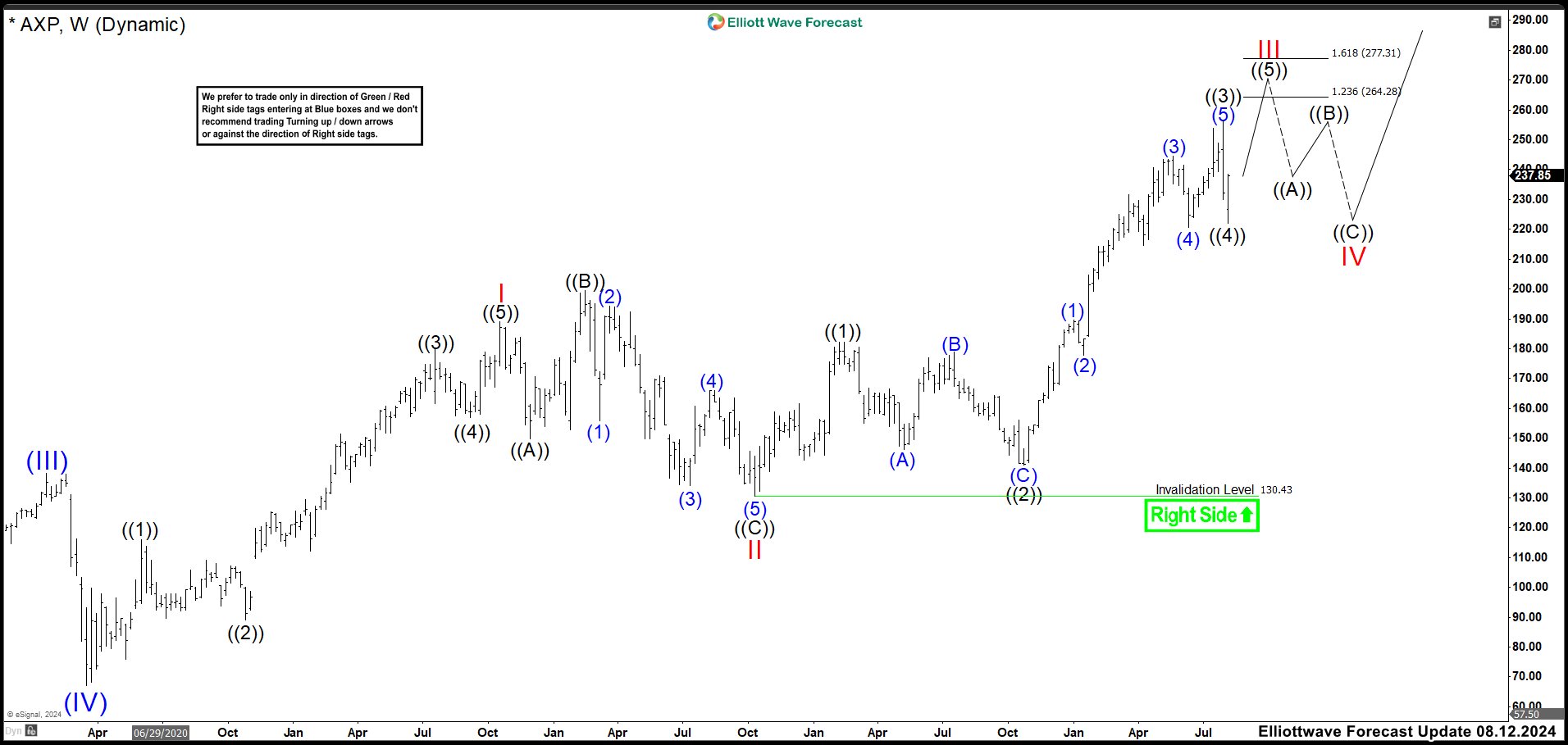

Could be the Last Buying Opportunity on American Express (AXP)?

Read MoreAmerican Express Company (Amex), symbol AXP, is an American multinational financial services corporation that specializes in payment cards. Headquartered in New York City, it is one of the most valuable companies in the world and one of the 30 components of the Dow Jones Industrial Average. AXP Weekly Chart April 2024 The stock was building […]

-

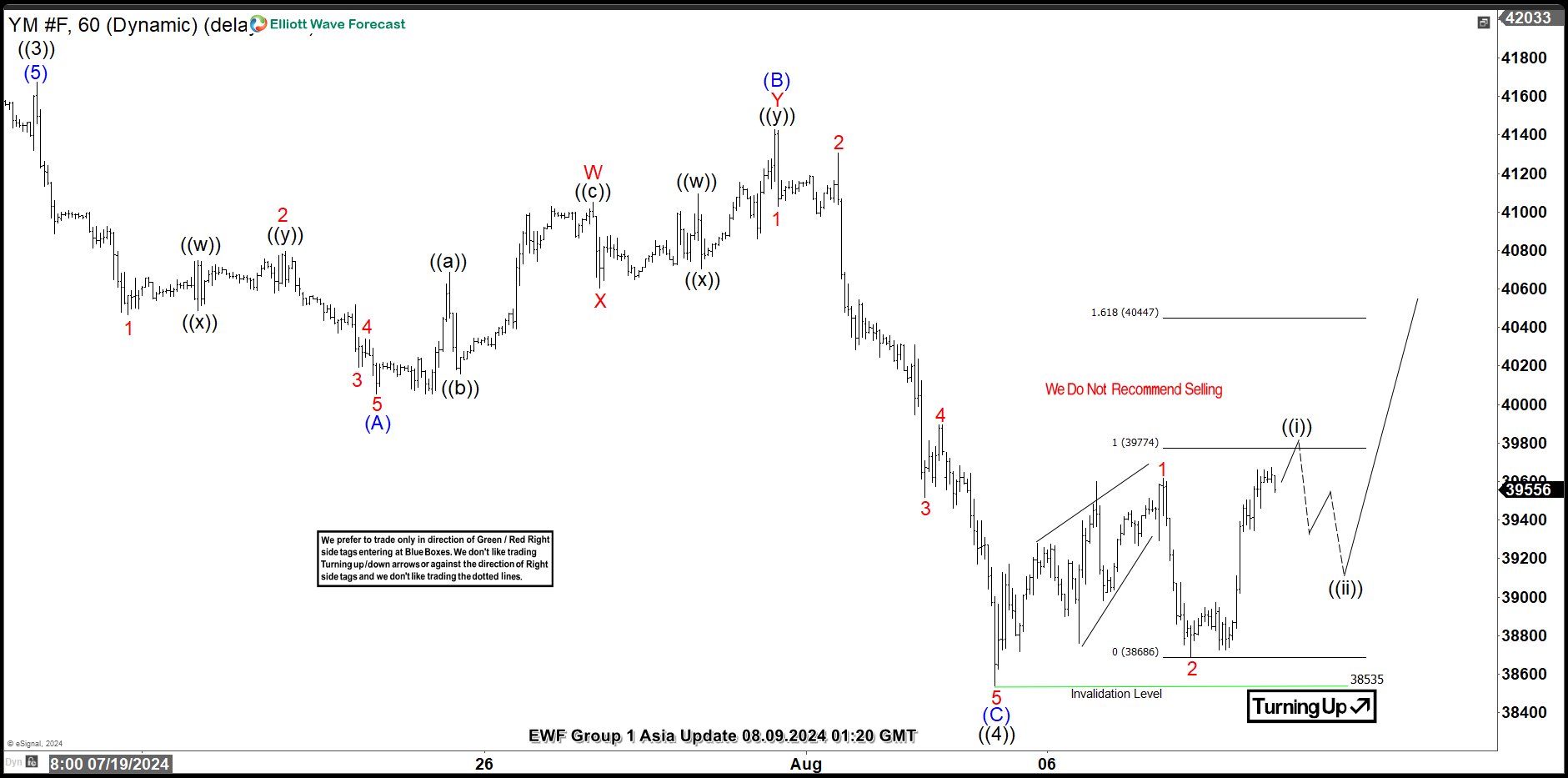

Elliott Wave Intraday Analysis: YM_F should Resume the Rally

Read MoreShort Term Elliott Wave View in E-Mini Dow Jones Futures (YM_F) suggests the trend should continue higher within the sequence started from April-2023 low as the part of daily sequence. It favors upside in wave ((5)) while dips remain above 38535 low. Since April-2024 high of (3), it starts to move sideways for almost 3 […]