In this technical blog, we are going to take a look at the past performance of 1 hour Elliott Wave Charts of Nike ticker symbol: $NKE, which we presented to members at elliottwave-forecast.com. In which the rally from June 3.2019 low ( $76.90) unfolded in 5 waves impulse structure. Thus suggested that it’s a continuation pattern and as per Elliott wave theory after 3 waves pullback it should do another extension higher in 5 waves impulse structure at least. Therefore, we advised members not to sell the instrument & trade the no enemy areas ( blue boxes) as per Elliott wave hedging remained the preferred path looking for 3 wave reaction higher at least. We will explain the structure & forecast below:

Nike 1 hour Elliott Wave Chart From 6/11/2019

Nike 1 hour Elliott Wave Chart from 6/11/2019 Post-Market update, in which stock ended the 5 waves rally in wave (A) from the lows at $84.34. Down from there, the stock was expected to correct the rally from 6/03/2019 low ( $76.79) in wave (B) pullback in 3, 7 or 11 swings before upside resume. We advised members not to sell it and preferred buying the dips in 3, 7 or 11 swings against $76.90 as per Elliott wave hedging at the blue box areas.

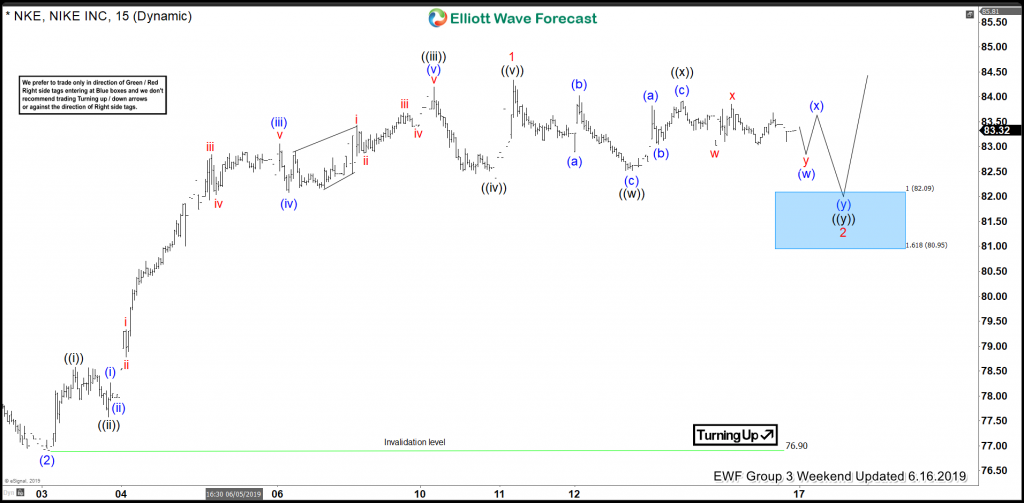

Nike 1 Hour Elliott Wave Chart From 6/16/2019

Nike 1 hour Elliott Wave Chart from the Weekend Update, in which the stock made a 3 wave pullback as expected. The internals of that pullback unfolded as double three structure & expected to reach $82.09-$80.95 100%-161.8% Fibonacci extension blue box area. From where the buyers were expected to appear in the stock looking for more upside or for 3 wave reaction higher at least. It’s important to note based on distribution system we adjusted the degree of labeling slightly but overall direction remained the same i.e called for more upside.

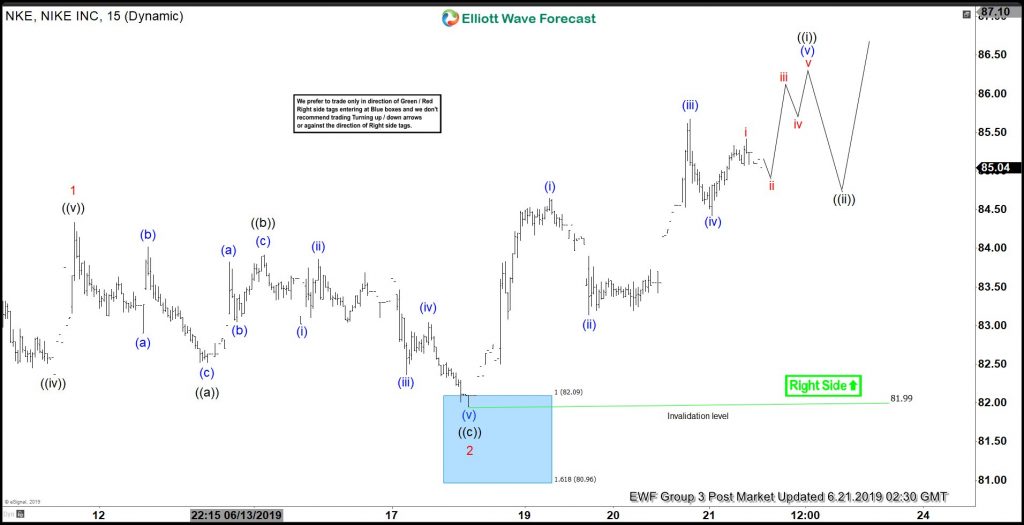

Nike 1 Hour Elliott Wave Chart From 6/21/2019

Nike 1 hour Elliott wave Chart from 6/21/2019 Post Market update, in which stock managed to reach blue box area at $82.09-$80.95 and offered good buying opportunity to the members. The stock then made a strong rally from the blue box area allowing members to go risk-free in the trade quickly.

If you are looking for real-time analysis in Nike along with other US stocks & ETFs then join us with a 14-day free trial for the latest updates & price action.

Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry. Stop loss and take profit levels with high accuracy and allows you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader. Then join our service by taking a Free Trial.

Back