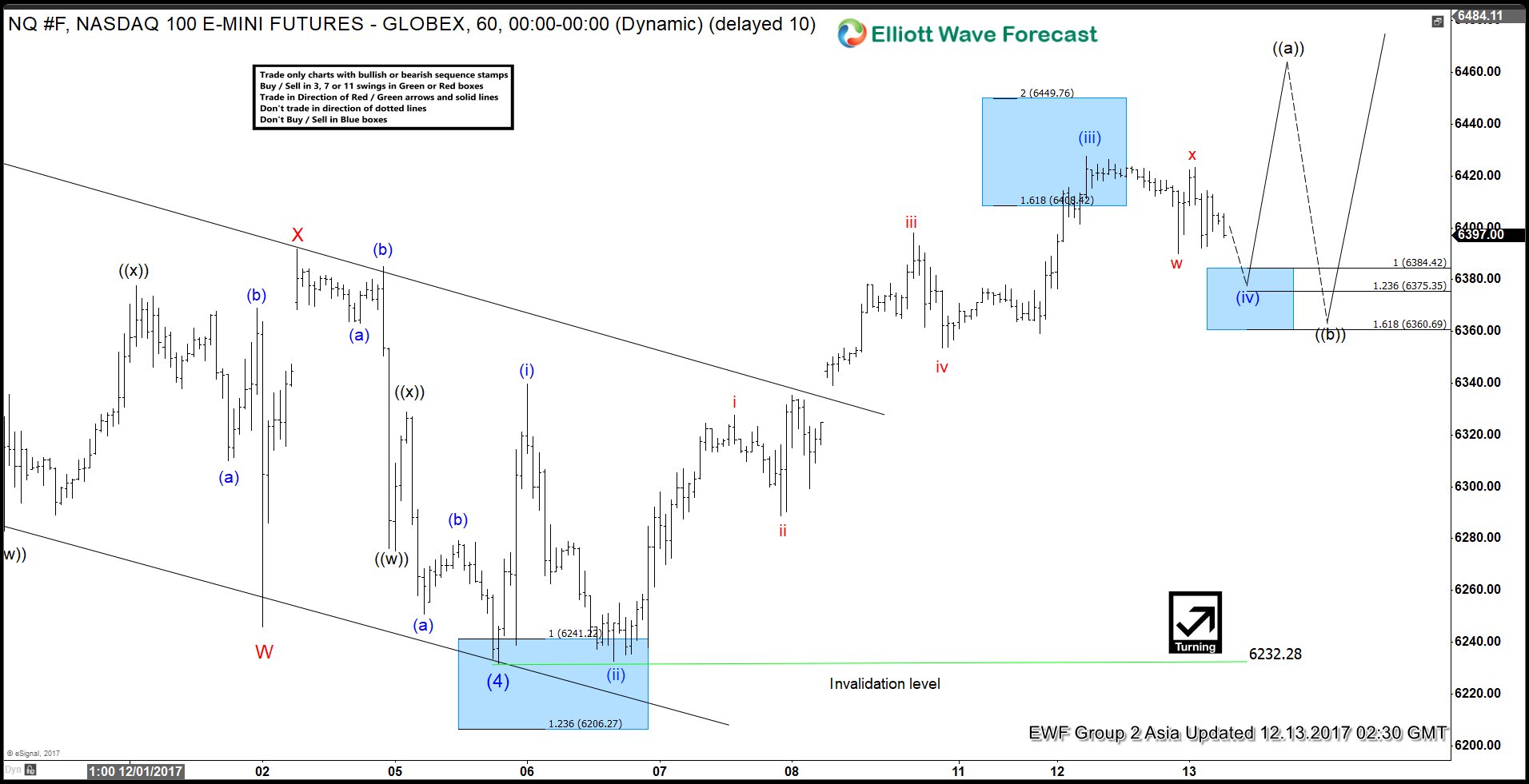

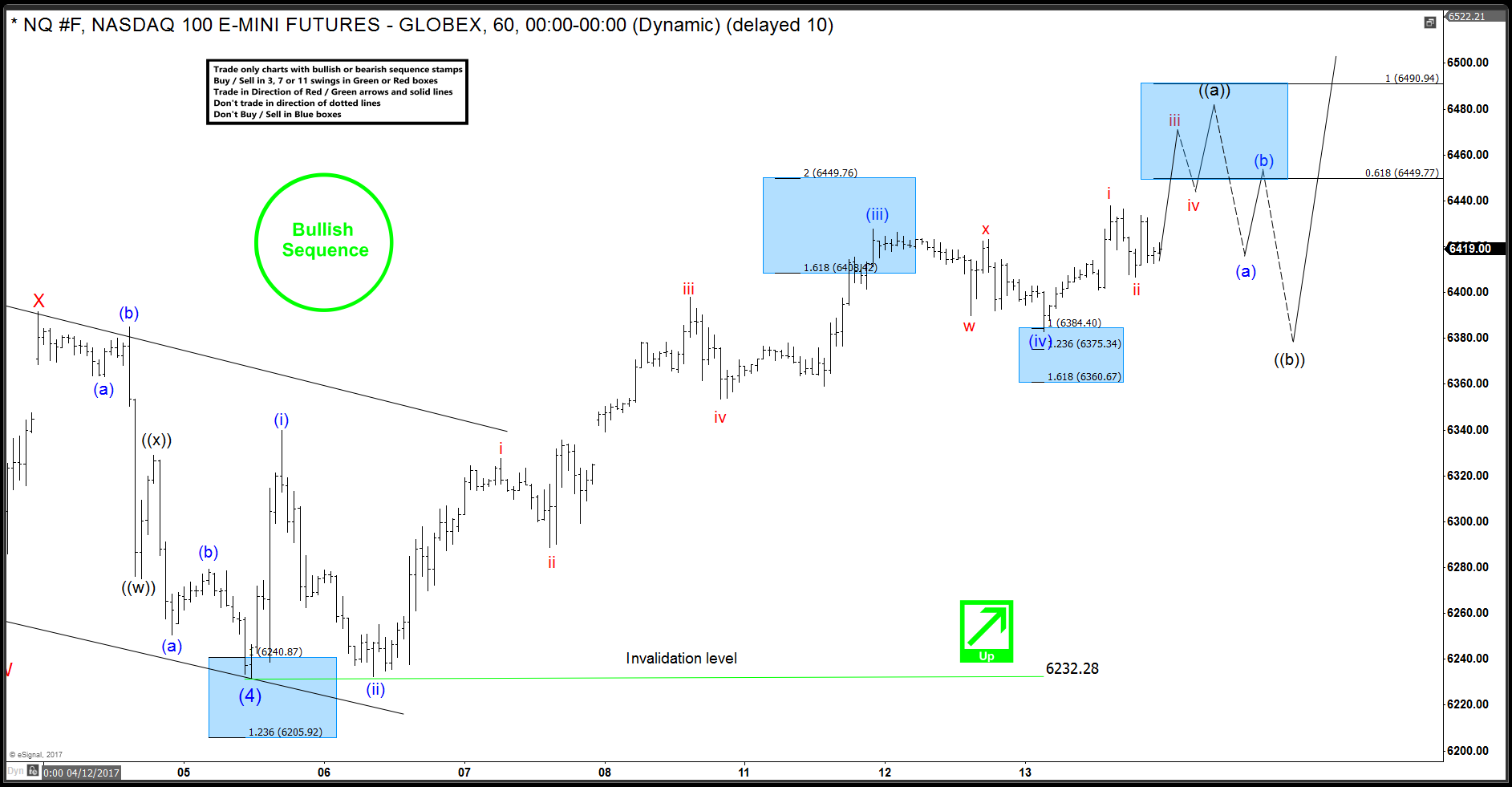

NASDAQ (NQ #F) rally from 6232.28 low has unfolded as a 5 Waves Impulse where wave (i) completed at 6339.75, wave (ii) ended at 6232.50, wave (iii) completed at 6427.75 and dip to 6383 completed wave (iv). Index has already made a new high above 6427.75 and also reached inverse 1.236 Fibonacci extension of wave (iv) dip which meets minimum requirement of wave (v) rally and thus, it has enough number of swings in place to call wave ((a)) completed at 6437.75. However, as far as Index is trading above 6383 low, wave (v) can extend and could see 6449 – 6490 area to complete a 5 waves Impulse in wave ((a)). Afterwards, Index should pull back in wave ((b)) to correct the cycle from 6232.28 low and then resume the rally in wave ((c)). Break below 6383 would suggest wave ((a)) has completed already at 6437.75 and wave ((b)) pull back is already in progress.

Wave ((b)) is a corrective wave so it can take any corrective structure like a Zigzag (5-3-5), Double three or even a FLAT (3-3-5). Once wave ((b)) is completed, Index should turn higher to resume the rally and surpass the peak of wave ((a)). Wave ((b)) pull back should hold above 6232.28 low for this wave count to remain valid. As there are enough number of swings in place to call wave ((a)) completed at 6437.75, we don’t like chasing the long side here and as this chart has a Green Arrow and a Bullish sequence stamp, we are only looking for buying opportunities in the dips and don’t like selling into wave ((b)) pull back either. Once wave ((a)) is complete, we expect wave ((b)) dip to find buyers in the sequence of 3, 7 or 11 swings.

NASDAQ (NQ #F) 12/13 Elliott Wave Analysis

NASDAQ (NQ #F) 5 Waves Impulse

If you would like to get more updates on US and other World Indices, you can sign up here and new members can save 25% on All Monthly plans in our Holidays Promotion.

Back