Hello traders and investors! In this technical article, we’re going to take a quick look at the Elliott Wave charts of the Nasdaq ETF QQQ, published in the members area of the website. As our members know, QQQ is showing impulsive bullish sequences in the cycle from the August 420.16 low. As a result, we are favoring long side at this stage. However, we believe the H4 pullback is still incomplete and could provide another leg down. We will explain the reasons behind this Elliott Wave forecast and how to trade it further in this article.

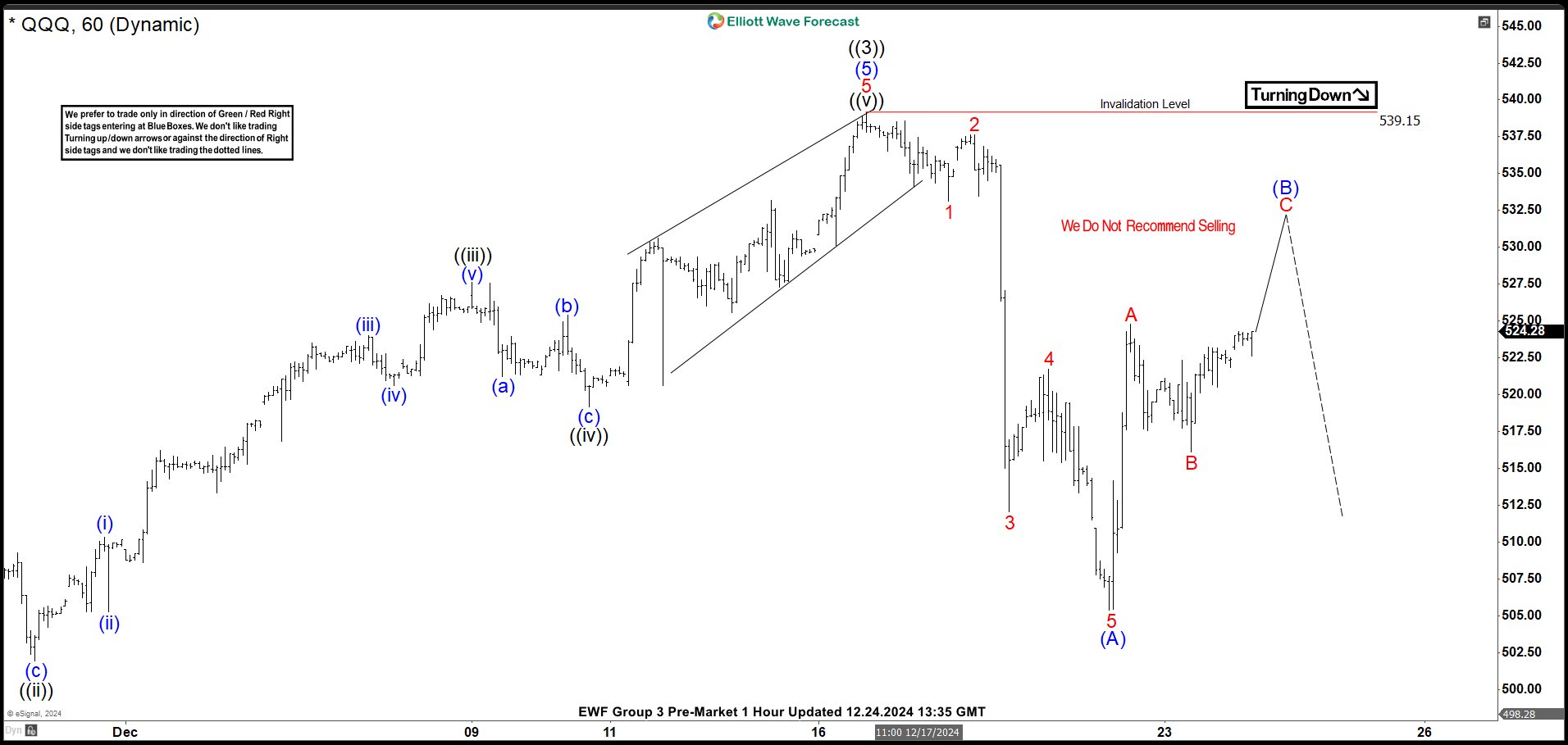

QQQ H1 Update 12.24.2024

The ETF shows 5 waves down from the 539.15 peak, suggesting we have ended only a first leg of potential Zig Zag pattern. QQQ is currently doing 3 waves recovery against the 539.15 high, labeled as (B) blue. Structure of the bounce looks incomplete, suggesting another leg up ideally before turn lower takes place .

Reminder : You can learn more about Elliott Wave Patterns at our Free Elliott Wave Educational Web Page.

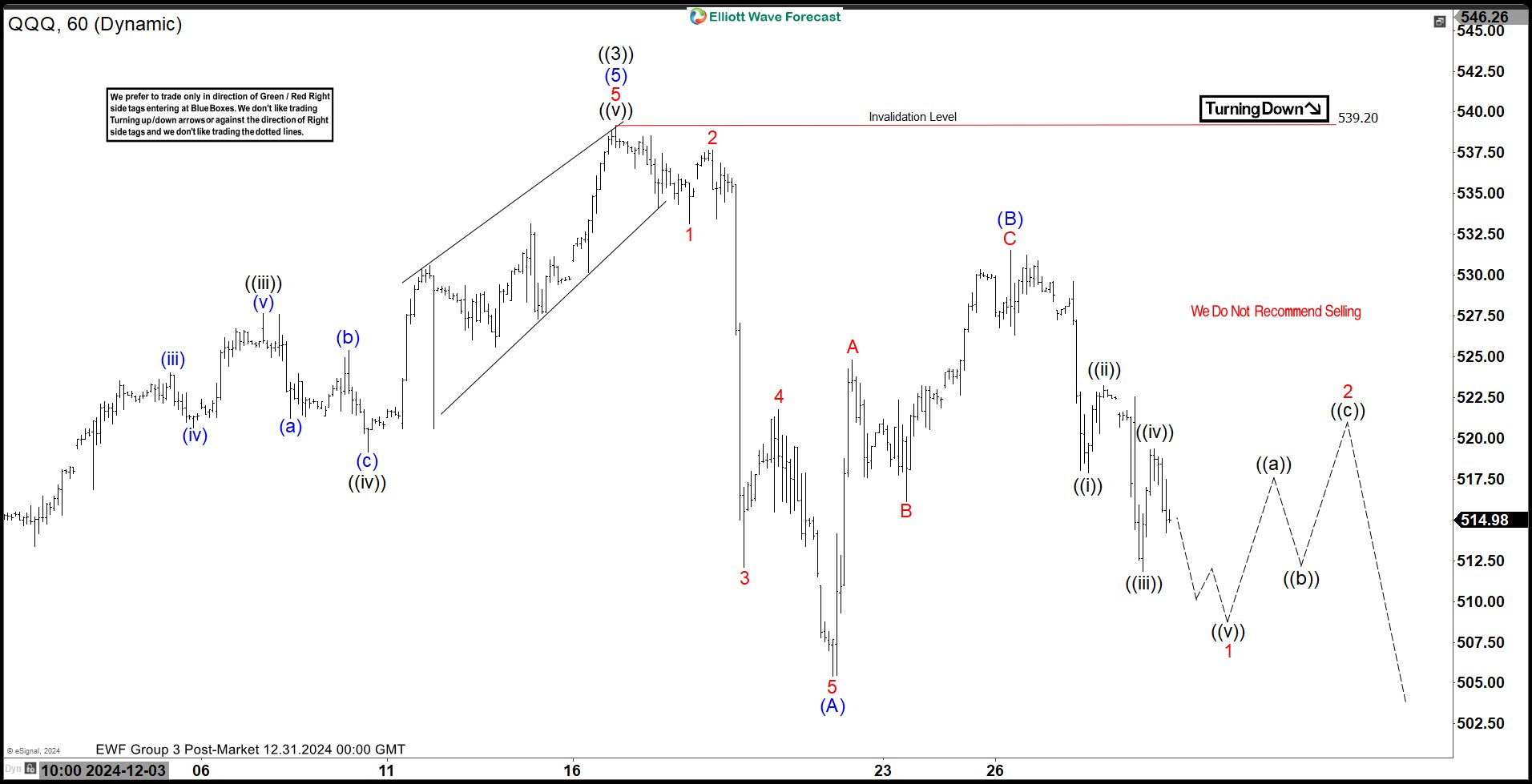

QQQ H1 Update 12.31.2024

QQQ made the proposed leg up and completed a 3-wave recovery at the 531.3 high. We consider the (B) recovery complete there. As long as the price remains below that level, we expect further weakness in the (C) leg. We don’t recommend selling against the main bullish trend and will use the (C) leg as a new buying opportunity if the next extreme zone is reached.

You can find detailed information on this trading setup in the membership area and in the Live Trading Room

90% of traders fail because they don’t understand market patterns. Are you in the top 10%? Test yourself with this advanced Elliott Wave Test