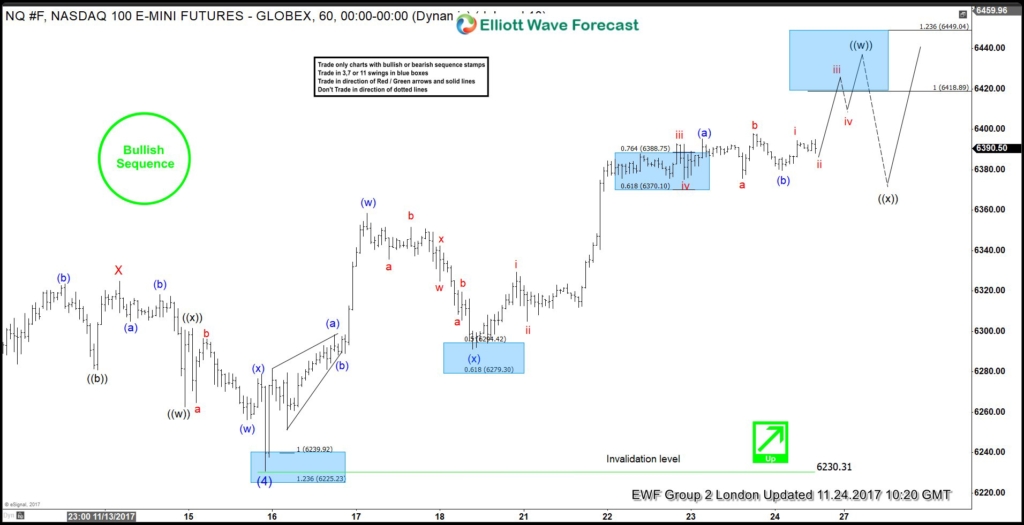

NASDAQ Short term Elliott Wave view suggests that the decline to 6230.31 on November 15 ended the intermediate wave (4) dip. A rally from there is unfolding as a double three Elliott wave structure and the index is already into new highs suggesting that next extension higher has started. As the structure of the 11/15 low 6230.31 low looks to be overlapping, hence suggesting its corrective structure, either W, X, Y or W, X, Y, Z.

The first leg lower ended in 3 swings at Minutte wave (w) ended at 6352.80 and dip to 6286.40 ended Minutte wave (x) dip in the index. Above from there, Minutte (y) leg higher in progress as a Zigzag structure and expected to see more upside to 641889-6449.04 100%-123.6% Fibonacci extension area to end the Minute wave ((w)) higher. Then from there index is expected to start the Minute wave ((x)) pullback for the correction of 11/15 cycle and should find the buyer’s in a sequence of 3, 7 or 11 swings for further upside. We don’t like selling it and intraday traders can look for buying opportunity in Minute wave ((x)) pullback in 3, 7 or 11 swings provided the pivot at 11/15 low 6230.31 stays intact.

NASDAQ 1 Hour Elliott Wave Chart

Back