Johnson Controls International plc, (JCI) engages in engineering, manufacturing, commissioning & retrofitting building products & systems in United States, Europe, Asia -Pacific and internationally. It operates in four segments like Building Solutions in North America, Building Solutions EMEA/LA, Building Solutions Asia-Pacific & Global products. It is based in Ireland, comes under Industrials sector & trades as “JCI” ticker at NYSE.

JCI has completed impulse sequence as wave I at $81.77 on 12/27/2021 started from March-2020 low. It proposed ended wave II at $45.52 low in zigzag correction & favors higher in ((1)) of III. It needs to breaks above I high to confirms the further upside.

JCI – Elliott Wave Latest Weekly View:

It placed (II) correction at $22.77 low against 11/28/2016 high before new sequence started in wave I of (III). Above there, it placed ((1)) at $31.34 high & ((2)) at $26.23 low. Wave ((2)) was 0.618 Fibonacci retracement of ((2)) against ((1)). Later, it started third wave extension. It favored ended ((3)) at $81.15 high & ((4)) at $74.36 low. ((4)) was shallow correction followed by upside in ((5)). Finally, it finished ((5)) at $81.77 high on 12/27/2021 high as wave I.

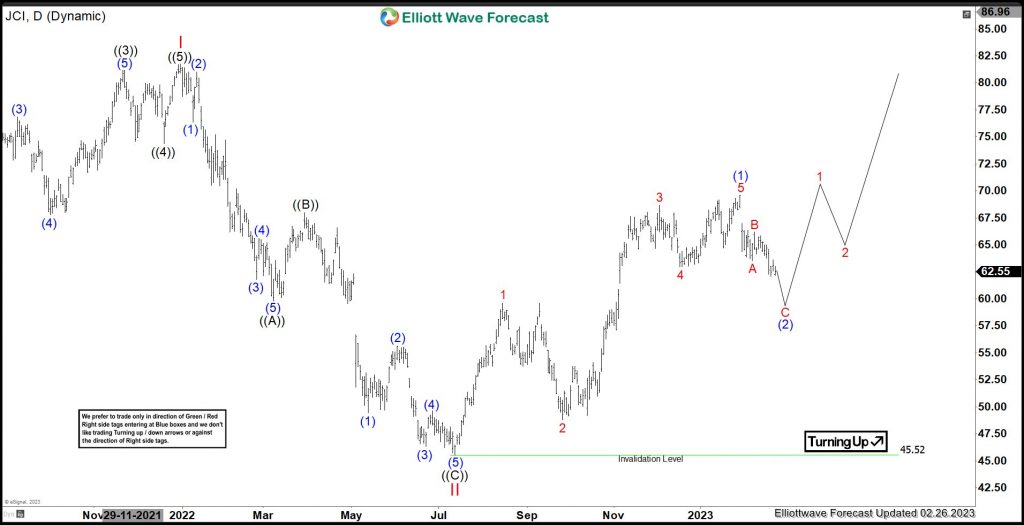

JCI – Elliott Wave Latest Daily View:

Below wave I high, it retraced in wave II as zigzag correction at $45.52 low in blue box area, where it found support for the next leg higher or at least larger 3 swing bounce. It placed ((A)) at $59.82 low, ((B)) at $67.99 high & ((C)) at $45.52 low. Above wave II low, it placed 1 of (1) at $59.58 high & 2 at $48.82 low as flat correction. It finished 3 at $68.65 high & 4 at $62.95 low as 0.236 Fibonacci retracement. Finally, it ended 5 at $69.60 high as (1). Below there, it favors pullback in (2) in 3, 7 or 11 swings, which should find support at extreme areas to see at least one more leg higher, while dips remain above $45.52 low.

Elliottwave Forecast updates 1-hour charts four times a day & 4-hour charts once a day for all our 78 instruments. We do a daily live session, where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market at the moment. You can try us for 14 days for only $9.99.

Back