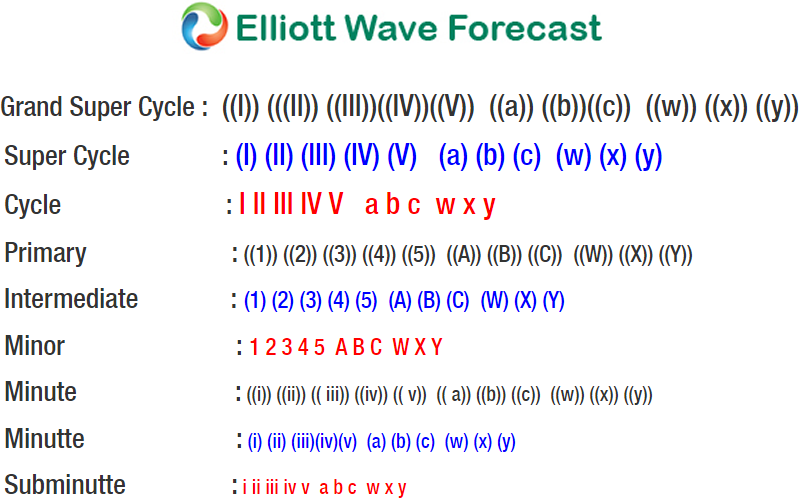

IBEX short-term Elliott wave view suggests that a decline to 8850.20 low ended Minor wave A of a zigzag structure. The internals of that decline unfolded as 5 waves impulse structure where Minute wave ((i)) ended at 9471.20 low. Minute wave ((ii)) ended in 3 swings at 9542.80 high. Minute wave ((iii)) ended in lesser degree 5 waves at 8971.30 low. Then Minute wave ((iv)) bounce ended at 9120.80 high and Minute wave ((v)) ended at 8850.20 low.

Up from there, the index made a 3 wave bounce to 9141.92 high & ended Minor wave B in lesser degree zigzag structure. Where Minute wave ((a)) ended at 9021.10. Minute wave ((b)) ended at 8986.80 low. And Minute wave ((c)) at 9141.92 high. Down from there, the index has made new lows already confirming the next extension lower in Minor wave C and creating a short-term bearish sequence from 9/21/2018 peak. Where a decline to 8639.70 low ended Minute wave ((i)) of C. Near-term, while below 9141.92 high expect index to fail in Minute wave ((ii)) of C in 3, 7 or 11 swings for more downside. We don’t like buying it and expect bounces to fail in 3, 7 or 11 swings against 9141.92 high.