GDXJ, or the VanEck Vectors Junior Gold Miners ETF, is an exchange-traded fund that tracks the performance of small-cap gold mining companies. It provides investors exposure to junior gold mining companies, which are typically smaller and more volatile than their larger counterparts. This ETF offers a convenient way for investors to gain diversified exposure to the junior gold mining sector without having to select individual stocks. Below we update the Elliott Wave outlook for the ETF.

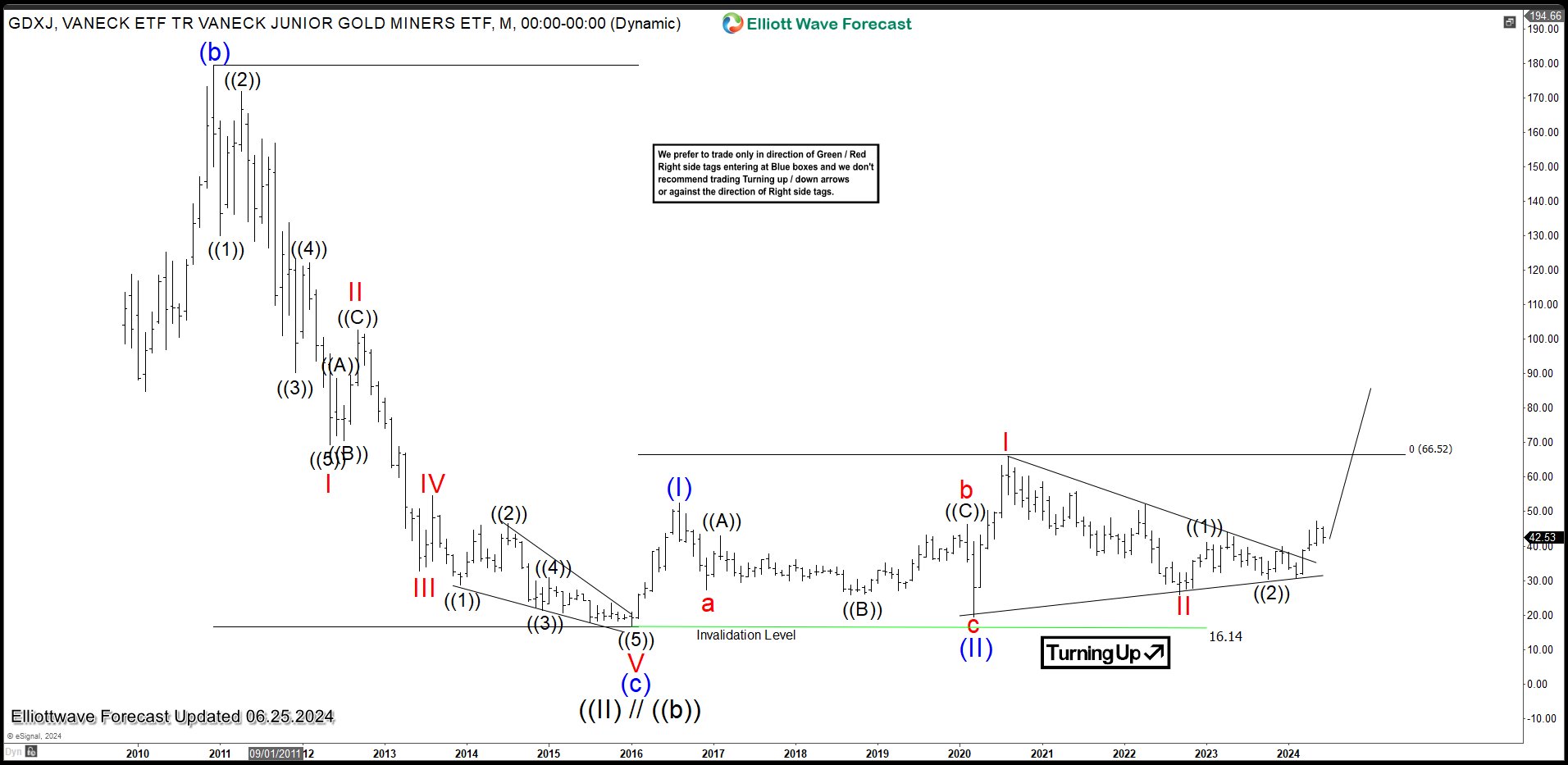

GDXJ Monthly Elliott Wave View

Monthly chart of Gold Miners Junior ETF (GDXJ) above shows a multi year consolidation in the ETF. The consolidation seems to be broken to the upside. Pullback in wave ((II)) grand super cycle ended at 16.14. The ETF then turns higher from there. Up from 16.14 low, rally in wave (I) ended at 52.5 and wave (II) pullback ended at 19.52. The ETF then turned higher. Up from 19.52 low, Wave I of (III) rally ended at 65.95 and dips in wave II pullback completed at 25.80. While pivot at 16.14 low is intact, expect dips to find support in 3, 7, 11 swing and the ETF to extend higher.

GDXJ Daily Elliott Wave View

Daily Elliott Wave Chart of GDXJ above shows dips in wave II ended at 25.8. Wave III higher is now in progress as a 5 waves impulse. Up from wave II, rally in wave ((1)) ended at 41.16. Pullback in wave ((2)) unfolded as expanded flat and ended at 30.56. The ETF then turns higher again with wave (1) ended at 47.25. Pullback in wave (2) is is proposed complete at 40.91 and the ETF has turned higher.

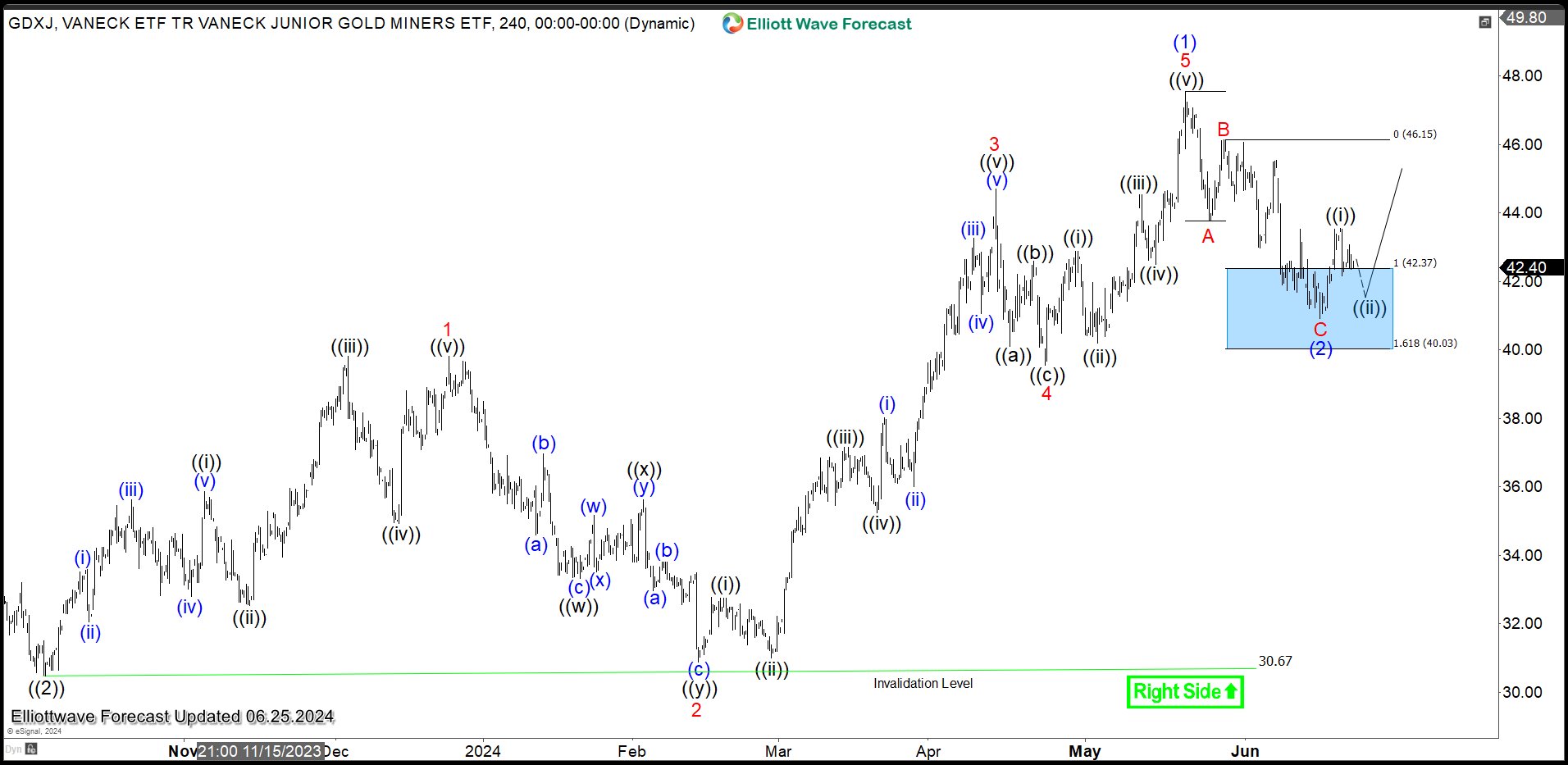

GDXJ 4 Hour Elliott Wave View

4 Hour Elliott Wave view of GDXJ above shows that rally from wave ((2)) low at 30.67 ended with wave (1) at 47.54 as impulse. Pullback in wave C of (2) ended at 40.91 in the 100% – 161.8% fibonacci extension of wave A. The ETF has turned higher again in wave (3). As far as it stays above 30.67, expect any pullback to find support in 3, 7, 11 swing for more upside.

We do not cover GDXJ as part of our regular service. However, we cover GDX, Gold, and other commodities, stocks, forex, and crypto currencies. If you’d like to check our service, you can take our 14 days trial here –> 14 days Trial

Back