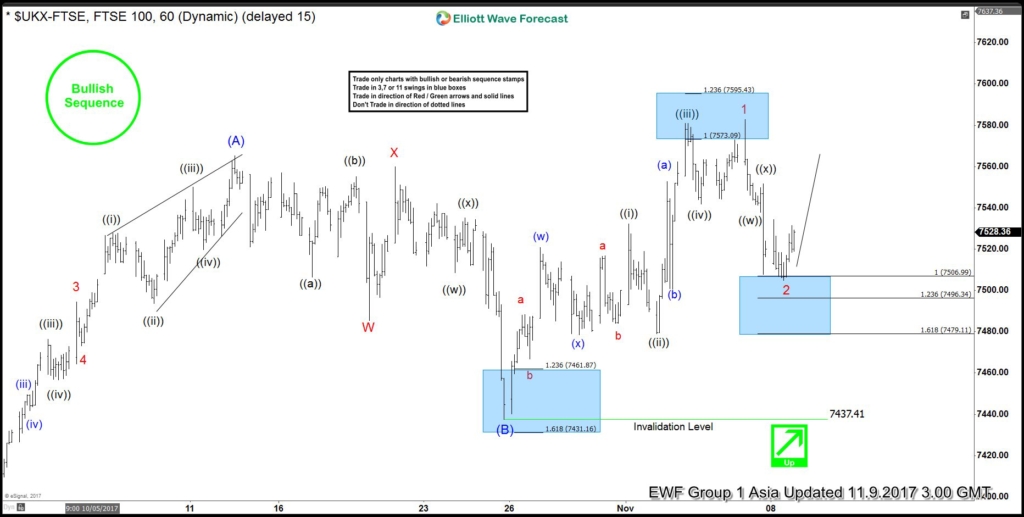

Short term FTSE Elliott Wave view shows Primary wave ((4)) ended with the decline to 7199.5. The rally from there is unfolding as a zigzag Elliott Wave structure where Intermediate wave (A) ended at 7565.11 and Intermediate wave (B) ended at 7437.42. Intermediate wave (A) has an internal subdivision of an impulse Elliott Wave structure. Minor wave 1 ended at 7327.5, pullback to 7289.75 ended Minor wave 2, Minor wave 3 ended at 7527.72, pullback to 7493.68 ended Minor wave 4, and Minor wave 5 of (A) ended at 7565.11.

Intermediate wave (B) pullback ended at 7437.42 with internal subdivision of a double three Elliott Wave structure. Minor wave W ended at 7485.42, Minor wave X ended at 7560.04, and Minor wave Y of (B) ended at 7437.42. Intermediate wave (C) is currently in progress as 5 waves where Minor wave 1 ended at 7582.85. Minor wave 2 pullback is is proposed complete at 7504.77. Index has since rallied again and anyone who bought at the blue box should be risk free already. As far as the dips stays above 7504.77, but more importantly above 10/25 low (7437.41), expect the Index to extend higher. We don’t like selling the Index.

FTSE 1 Hour Elliott Wave Analysis

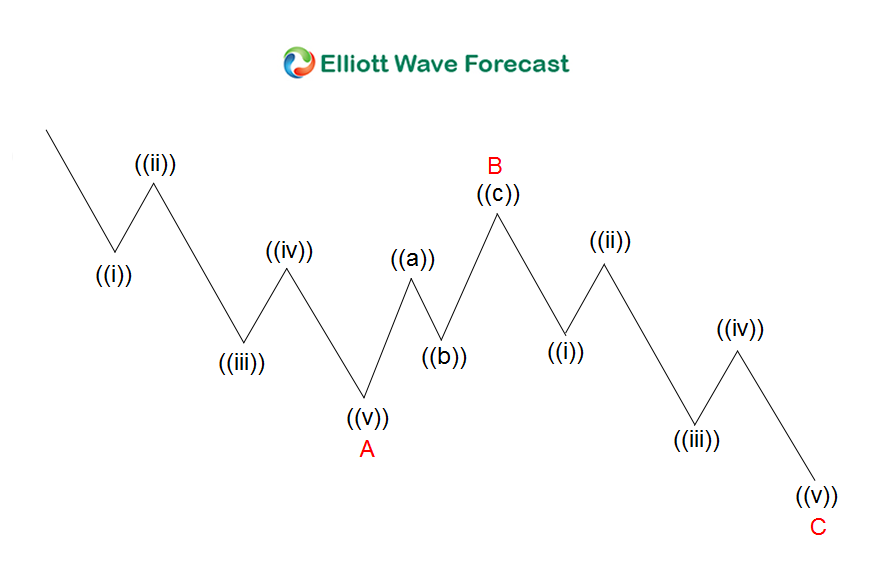

Zigzag is a 3 waves corrective pattern which is labelled as ABC. The subdivision of wave A is in 5 waves, either as impulse or diagonal. The subdivision of wave B can be any corrective structure. Finally, the subdivision of wave C is also in 5 waves, either as impulse or diagonal. Thus, zigzag has a 5-3-5 structure. Wave C typically ends at 100% – 123.6% of wave A.

Back