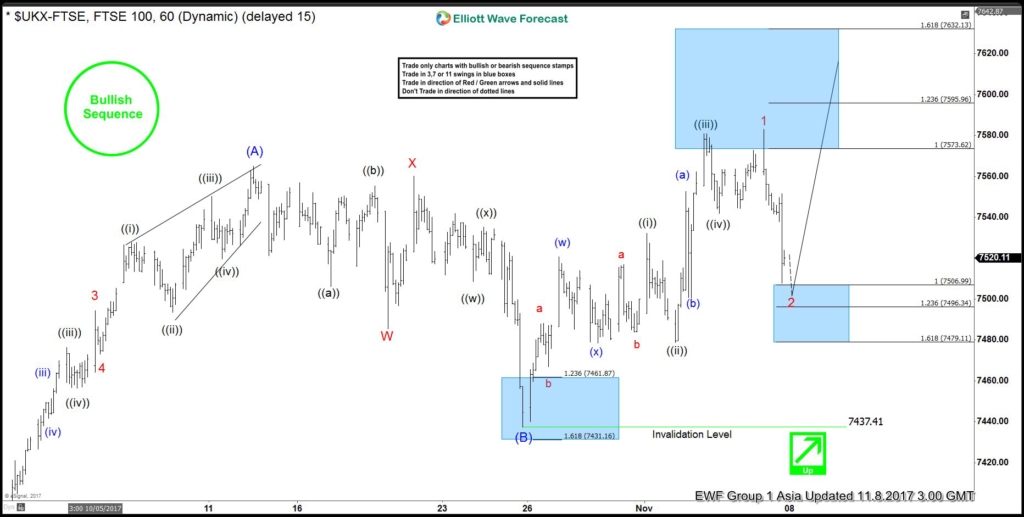

Short term FTSE Elliott Wave view suggests that decline to 7199.5 ended Primary wave ((4)). Up from there, the rally is unfolding as a zigzag Elliott Wave structure where Intermediate wave (A) ended at 7565.11 and pullback to 7437.42 ended Intermediate wave (B). Internal of Intermediate wave (A) unfolded as an impulse Elliott Wave structure where Minor wave 1 ended at 7327.5, Minor wave 2 ended at 7289.75, Minor wave 3 ended at 7527.72, Minor wave 4 ended at 7493.68, and Minor wave 5 of (A) ended at 7565.11.

Intermediate wave (B) pullback ended at 7437.42 as a double three Elliott Wave structure where Minor wave W ended at 7485.42, Minor wave X ended at 7560.04, and Minor wave Y ended at 7437.42. Intermediate wave (C) is currently in progress as 5 waves where Minor wave 1 ended at 7582.85. Minor wave 2 pullback is in progress and should find buyers at 7479.11 – 7507 area for further upside or at least 3 waves bounce. As far as the dips stays above 10/25 low (7437.41), expect the Index to extend higher. We don’t like selling the Index.

FTSE 1 Hour Elliott Wave Analysis

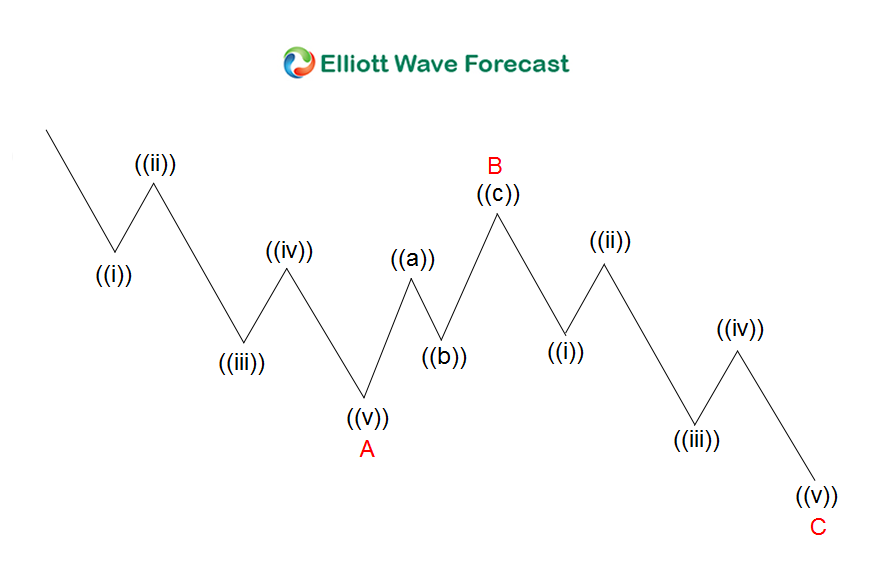

Zigzag is a 3 waves corrective pattern which is labelled as ABC. The subdivision of wave A is in 5 waves, either as impulse or diagonal. The subdivision of wave B can be any corrective structure. Finally, the subdivision of wave C is also in 5 waves, either as impulse or diagonal. Thus, zigzag has a 5-3-5 structure. Wave C typically ends at 100% – 123.6% of wave A.

Back