Economists often tie the overall health of the economy with the health of the financial sector which took the hardest hit in the 2008 crisis as big companies struggled and Lehman Brothers filled for bankruptcy . People lost faith in the financial system while many others saw the hit as new investing opportunity after the ” Too big to fail ” companies found a way out of the crisis .

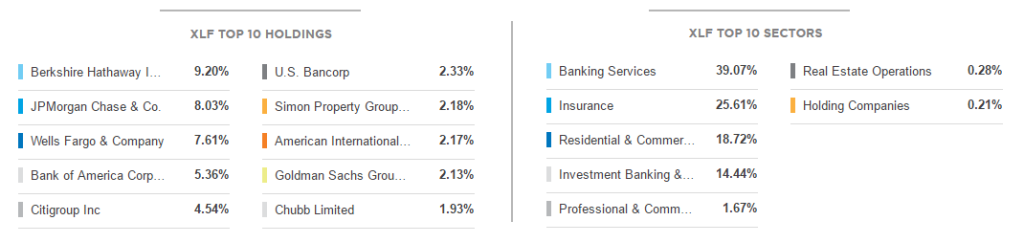

Tracking the Financial Select Sector SPDR Fund ( XLF ) which represents one of the largest portions of the S&P 500 as it consists of the banks , insurance, real estate investment trust, capital markets, consumer finance, financial services and mortgage finance representing the most largest and recognizable financial institutions in the world such as JPMorgan , Wells Fargo , Bank of America , Citigroup , Goldman Sachs , American International Group , Chubb Limited and Warren Buffett’s company Berkshire Hathaway.

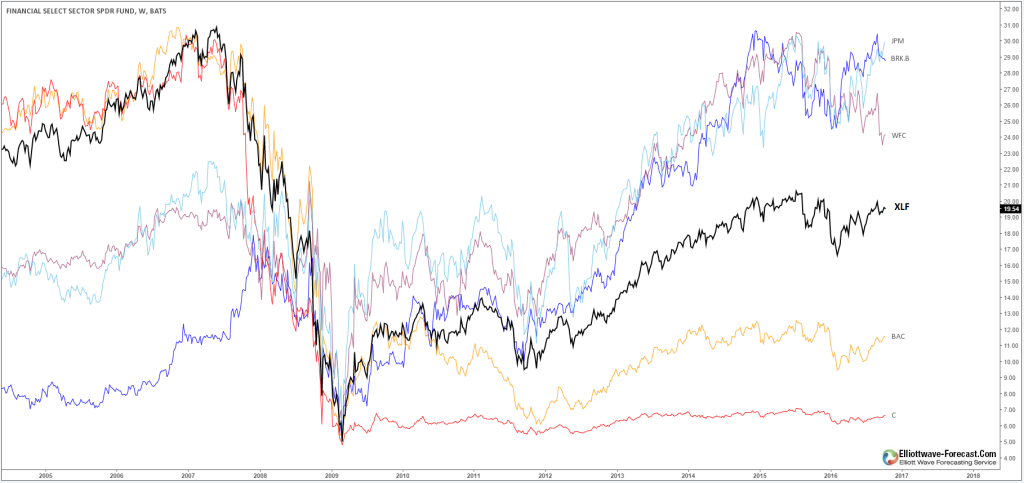

After the the sharp drop in the 2008 financial crisis , an influx of government regulation and restructuring took place, which made the financial sector over the last five years considerably stronger as it rebounded giving investors an annual average return of 10.55% . Focusing on the top 5 holding Companies of XLF you notice that BRK , JPM , WFC are leading the recovery as their stock price already overtook the 2007 peaks while BAC and C keeps struggling like many other financial companies which didn’t even surpass 30 % of the decline.

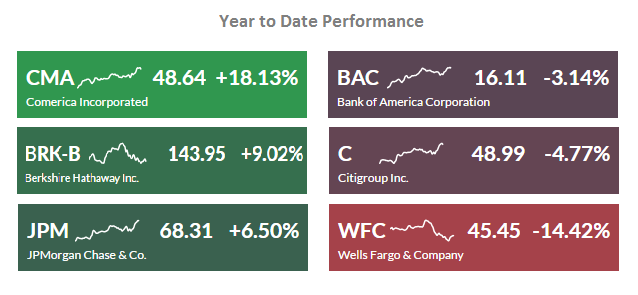

Shifting to the current 2016 performance of these companies we notice that only BRK & JPM are positive for the year while WFC is deeply in red with -14% . However The surprise came from Comerica ( CMA ) which is another large financial holding company that only represent 0.27% of XLF , the bank is up +18% and looking to add more gains in the coming months .

With Q3 earnings coming out this week for most of the financial sector top companies , the overall performance could change rapidly but the bigger picture will remain the same so don’t worry as investing opportunities will always come out at the right time . We are always seeking the right side of the market that’s why we at EWF use Elliott Wave in a different way combining it with market correlation, cycles, sequence of swings and distribution . Before buying or selling we search for the strongest & weakest instruments to find the right sequence that could provide a trading opportunities , that’s why Comerica & Wells Fergo stocks represent the best exemple if you are looking to invest in the financial sector.

For further information on how to find levels to trade forex, indices, and stocks using Elliott Wave and the 3 , 7 or 11 swings technique, try us free for 14 days. You will get access to Professional Elliott Wave analysis in 4 different time frames, Daily Elliott Wave Setup Videos , Live Trading Room and 2 live Analysis Session done by our Expert Analysts every day, 24 hour chat room support, market overview, weekly technical videos and much more so if you are not a member yet, use this opportunity and sign up to get your free trial . If you enjoyed this article, feel free to read other diversified articles at our Technical Blogs and also check Chart of The Day .