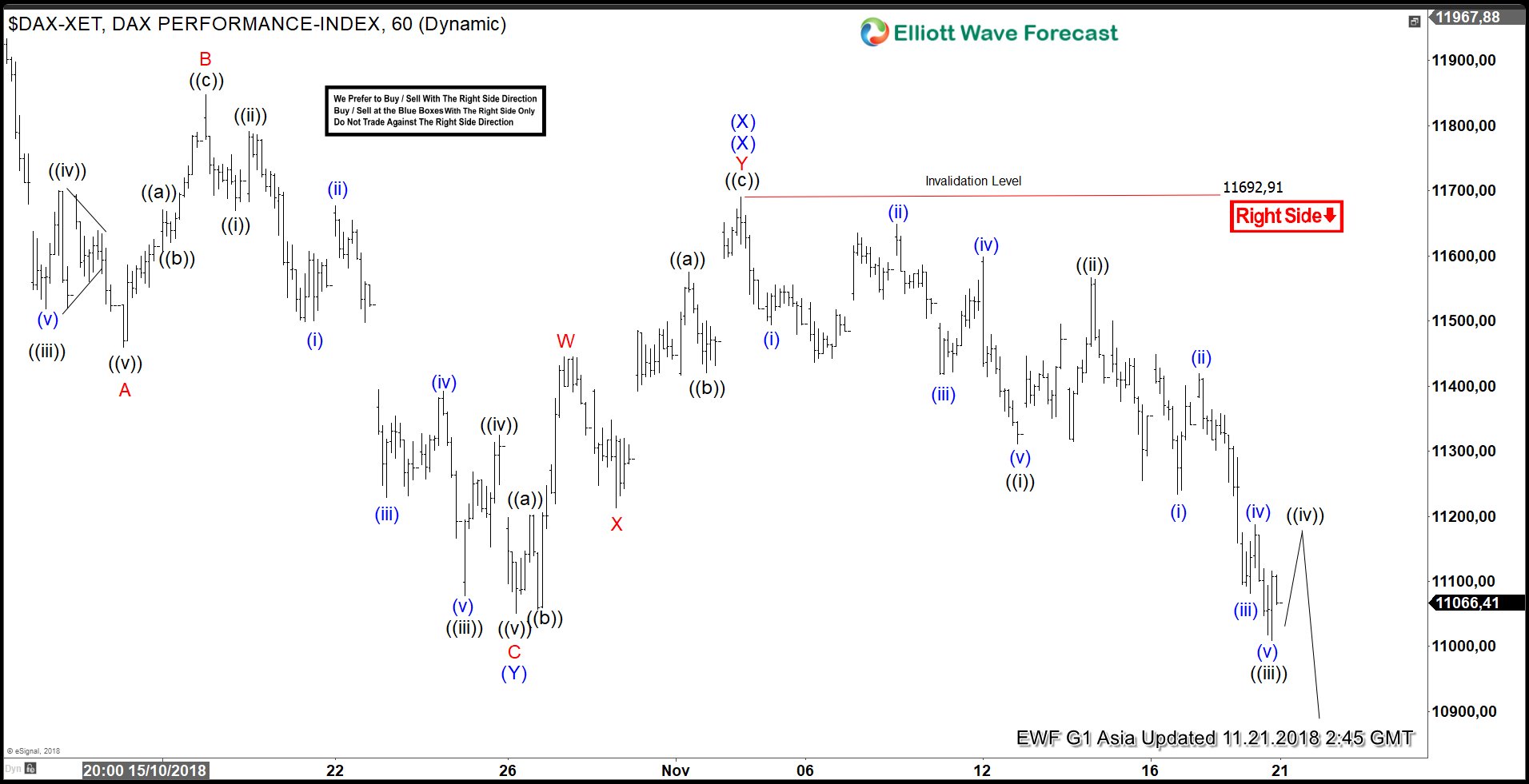

DAX has broken below Oct 26 low (11051) and suggests that the Index has resumed the decline lower. We are calling the decline from July 27 high (12886.83) as a triple three Elliott Wave Structure. Decline to 11051.04 low on Oct 26 ended Intermediate wave (Y). From there, rally to 11692.91 high on Nov 2 ended second Intermediate wave (X).

Down from 11692.91, short term Elliott Wave view suggests that the decline has resumed with the break below Intermediate wave (Y) at 11051.04. Structure of the decline is unfolding as an impulse Elliott Wave structure. Minute wave ((i)) ended at 11310.72, Minute wave ((ii)) ended at 11566.79, and Minute wave ((iii)) ended at 11009.25. As a 5 waves, the internal of wave ((i)), ((iii)), and ((v)) also need to be in 5 waves. We can see the internal of Minute wave ((i)) subdivided as a 5 waves diagonal of a lesser Minutte degree. The internal of Minute wave ((iii)) on the other hand unfolded as 5 waves impulse of lesser Minutte degree.

Currently Minute wave ((iv)) rally is in progress and while the bounce fails below 11692.91, we expect Index to extend lower. We don’t like buying the Index and expect rally to fails in 3, 7, or 11 swing as far as pivot at Nov 2 high (11692.91) stays intact.

DAX 1 Hour Elliott Wave Chart

Back