Short term YM_F (Dow E-Mini Future) Elliott Wave view suggests the rally from 6/29 low is unfolding as a double three Elliott wave structure and ended with Minor wave W at 21628. Down from there, Minor wave X pullback unfolded as a running Elliott Wave flat. Minute wave ((a)) ended at 21457, Minute wave ((b)) ended at 21624, and Minute wave ((c)) of X ended at 21446. Index has since made a new high suggesting the next leg higher has started. Up from 21444 low, Minutte wave (w) ended at 21734 and Minutte wave (x) pullback ended at 21632. Near term, Index is pulling back in Sub Minutte wave ii to correct cycle from 7/27 low (2163) then it should turn higher again.

We don’t like selling the Index and favors buying the dips against 21446 low in the first degree. If pivot at 21446 low fails, then the move higher from 6/29 (21138) can be seen as a 5 waves diagonal. In this case, Index should pullback in 3, 7, or 11 swing to correct cycle from 6/29 low before the rally resumes.

Dow E-Mini Future 1 Hour Elliott Wave View

7 swings structure is one of the most common patterns in the theory of New Elliott Wave & it is also mainly known as double three Elliott Wave pattern. Market find this structure very often nowadays in many instruments in almost all time frames. It is a very reliable structure by which we can make a good analysis and what is more important is giving us good business inputs with clearly defined levels invalidation and destination areas.

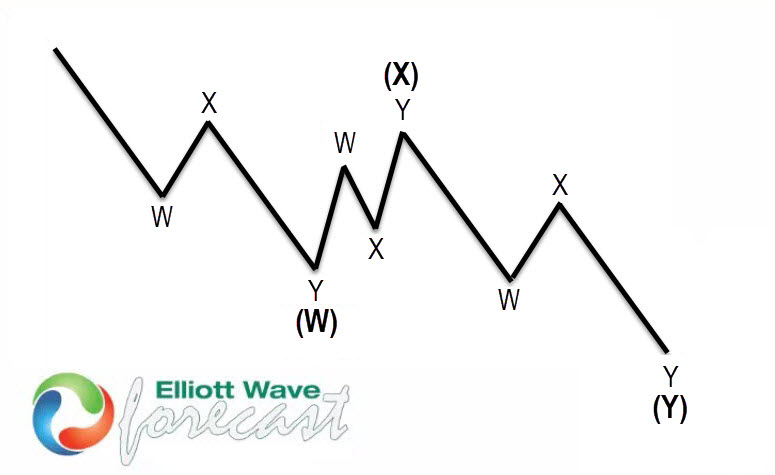

The image below shows what Elliott wave pattern Double Three looks like. It has (W), (X), (Y) and 3,3,3 internal structure, which means that all these 3 legs are corrective sequences. Each (W), (X) and (Y) is in three waves, and each leg has the structure W, X, Y in lesser degree as well. Elliott Wave principle is a form of technical analysis that traders use to analyze the cycles of financial markets and market trends forecast by identifying extremes in investor psychology, high and low prices, and other collective factors. Important to Note that 3 waves could also be labeled ABC (5-3-5) structure as well. The label depends on the internal price structure subdivisions waves i.e. whether the price action is corrective or motive.

Back