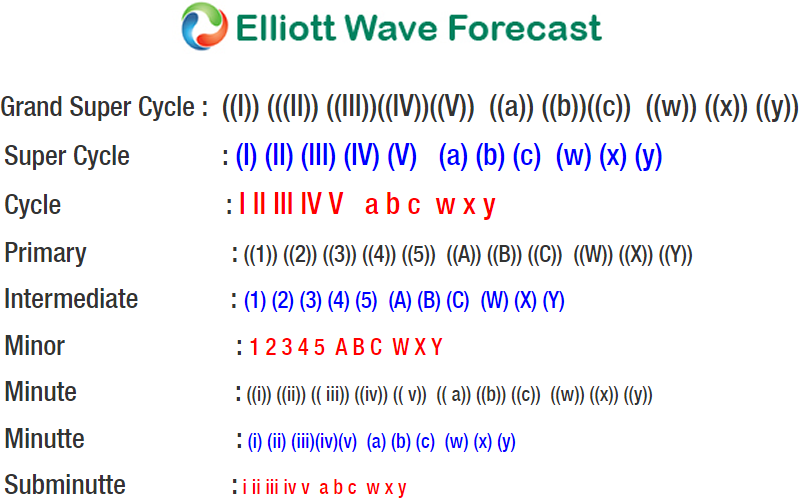

DAX Elliott Wave view in shorter cycles suggests that the rally from March 26.2018 low (11704) is extending higher in Impulse sequence with extension in the 3rd wave. It’s important to note that an impulse structure should have internal subdivision of lesser degree 5 waves impulse. And in particular, DAX’s case, Minute wave ((i)), ((ii)) and ((v)) within wave Minor degree should have an internal subdivision of 5 waves impulse Elliott Wave structure of lesser degree.

The rally to 12152.62 ended Minute wave ((i)) of 3 in 5 waves structure, Minute wave ((ii)) of 3 ended at 11792.29 low. Then the rally to 12639.73 high ended Minute wave ((iii)) of 3 in 5 waves and pullback to 12319.80 ended Minute wave ((iv)) of 3 as a Flat correction. Above from there, the rally is unfolding in another 5 waves structure in Minute wave ((v)) of 3. Near-term, although the index has a minimum amount of swings in placed already to end the Minor wave 3. But while dips remain above 12319.80 low index is expected to extend 1 more push higher towards 13276.55 area approximately. Afterwards, the index is expected to do a pullback in Minor wave 4 in 3, 7 or 11 swings before further upside is seen. We don’t like selling it.