Boston Scientific Corporation (BSX) develops, manufactures & markets medical devices for use in various interventional medical specialties worldwide. It operates through MedSurg & Cardiovascular segments. It offers devices to diagnose & treat different medical conditions & offer remote patient management systems. It comes under Healthcare sector & trades as “BSX” ticker at NYSE.

BSX favors rally in V started from $85.98 low of 4.07.2025 as double correction ended in daily blue box area. It expects rally to extend towards $112.20 – $120.29 area to finish the impulse started from March-2020 low.

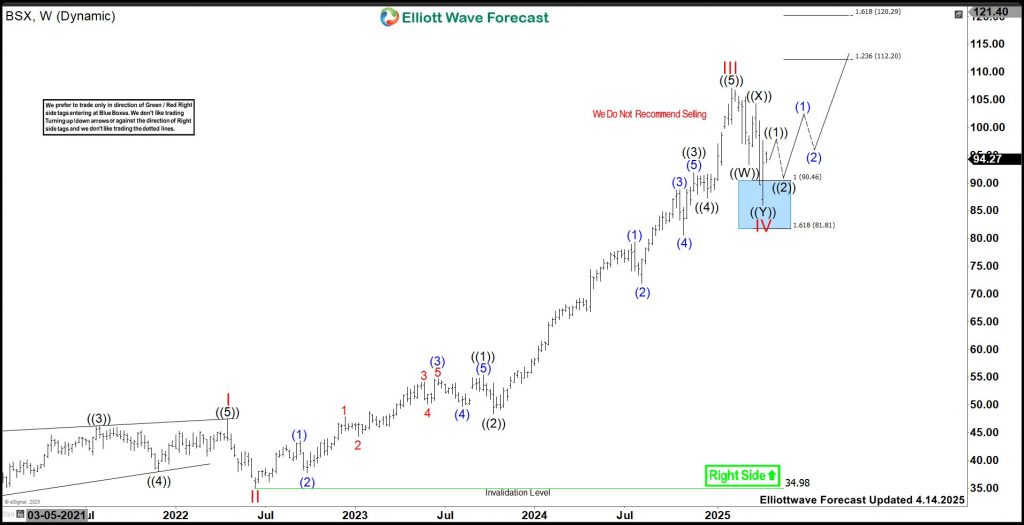

BSX – Elliott Wave Latest Weekly View:

In weekly sequence, it placed (II) at $24.10 low in March-2020 & II of (III) at $34.98 low in June-2022. Above there, it placed III of (III) at $107.17 high of 2.05.2025 & IV pullback at $85.98 low in daily blue box area on 4.07.2025. Within III, it ended ((1)) at $55.38 high, ((2)) at $48.35 low, ((3)) as extended wave at $91.93 high, ((4)) at $87.25 low & finally ((5)) at $101.17 high. The pullbacks of ((2)) & ((4)) are shallow in III, which indicates the strong bullish sequence.

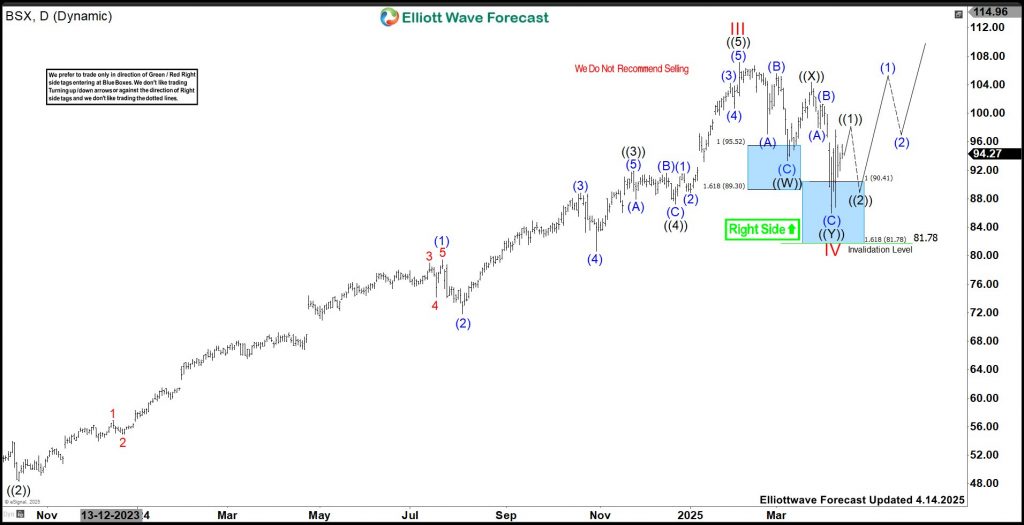

BSX – Elliott Wave View From 3.17.2025:

In IV pullback, it placed ((W)) at $93.29 low as 3 swing pullback & ((X)) at $104.35 low. It reacted higher from the blue box area as expected in earlier article from 3.17.2025. Later, the correction extends as double correction & ((Y)) ended at $85.98 low. It placed (A) of ((Y)) at $97.85 low, (B) at $101.28 high & (C) at $85.98 low in blue box area. We like to remain long from daily blue box area with risk free long position as it reacted above 50 % of ((Y)) leg. It favors one more push higher in ((1)) of V. It expects V to extend towards $112.20 or higher levels. Until, it breaks above III high, the correction can extend, if breaks the 4.07.2025 low. If it extend higher & erase momentum divergence in daily, it can turn out nest in daily.

BSX – Elliott Wave Latest Daily View:

Elliottwave Forecast updates 1-hour charts four times a day & 4-hour charts once a day for all our 78 instruments. We do a daily live session, where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market at the moment. You can try us for 14 days for only $9.99.

Back