Bank of Montreal (BMO) provides diversified financial services primarily in North America. The company’s personal banking products & services include checking & savings accounts, credit cards, mortgages, financial & investment advice services & commercial banking products & services. It is based in Montreal, Canada, comes under Financial services sector & trades as “BMO” at NYSE.

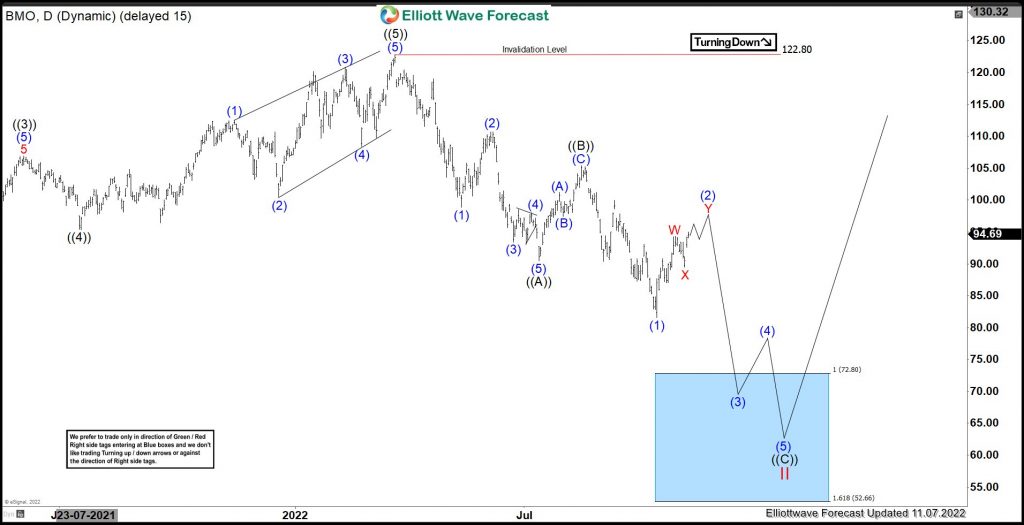

As discussed in last blog, BMO started impulse from March-2020 low & ended wave I at $122.77 high. Below there, it favors a corrective pullback in II as proposed zigzag structure.

BMO – Elliott Wave View from 8/07/2022 :

Above March-2020 low, it placed ((1)) at $55.34 high & ((2)) at $43.26 low. ((2)) was 0.618 Fibonacci retracement against ((1)). Above there, it started third wave extension & ((3)) ended at $106.88 on 6/04/2021 high. It favored ended ((4)) at $95.37 low on 7/20/2021 as shallow correction. It finally ended ((5)) as ending diagonal at $122.77 as ATH on 3/22/2022 as wave I. Below there, it correcting in II as zigzag down.

BMO – Elliott Wave Latest Weekly View :

Below wave I high, it placed ((A)) at $90.44 low & ((B)) at 105.40 high. While below there, it confirms lower low in ((C)) leg, calling for more weakness to continue. It placed (1) at $81.57 low. Above there, it expect a corrective bounce in (2), which expect to fail below ((B)) high to resume lower in (3) of ((C)) leg. ((C)) leg expect to extend towards $72.80 – $52.66 area to finish II correction. We like to buy the dips towards blue box area, when reached.

BMO – Elliott wave Latest Short term Daily view:

Elliottwave Forecast updates 1-hour charts four times a day & 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market at the moment. You can try us for 14 days for only $9.99.

Back