Hello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Bank Of America ( $BAC ). As our members know BAC made 5 waves up in the cycle from the 26.01 low . The Stock was expected to find buyers in 3,7,11 swings against the 26.01 low. In the following article, we’re going to explain the Elliott Wave Forecast .

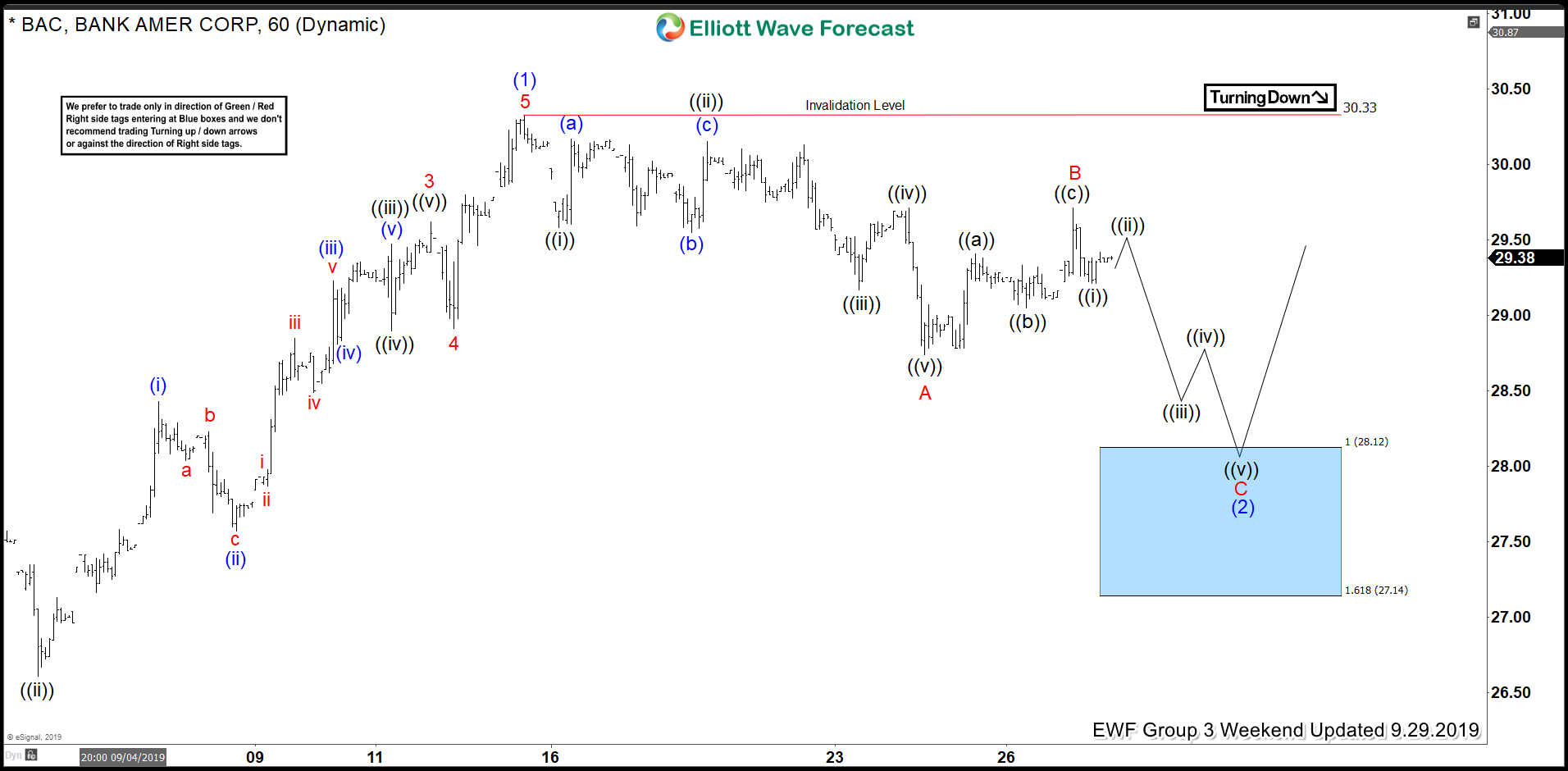

BAC 1 Hour Elliott Wave Analysis 9.29.2019

The Stock ended August cycle at the 30.33 hgih as wave (1) blue. We are now doing wave (2) pull back. The price made 5 waves down from the 30.33 peak, so we’re assuming that pull back is unfolding as Elliott Wave Zig Zag pattern. Wave B of (2) is already counted completed at 29.71 high. As far as the price stays below 29.71 high, we can be doing next leg down: C of (2) as shown on the chart. Pull back has scope to reach 28.12-27.14 area ( Blue Box- buyers zone ). At that area Elliott Wave Zig Zag should ideally complete.

You can learn more about Elliott Wave Zig Zag Patterns at our Free Elliott Wave Educational Web Page.

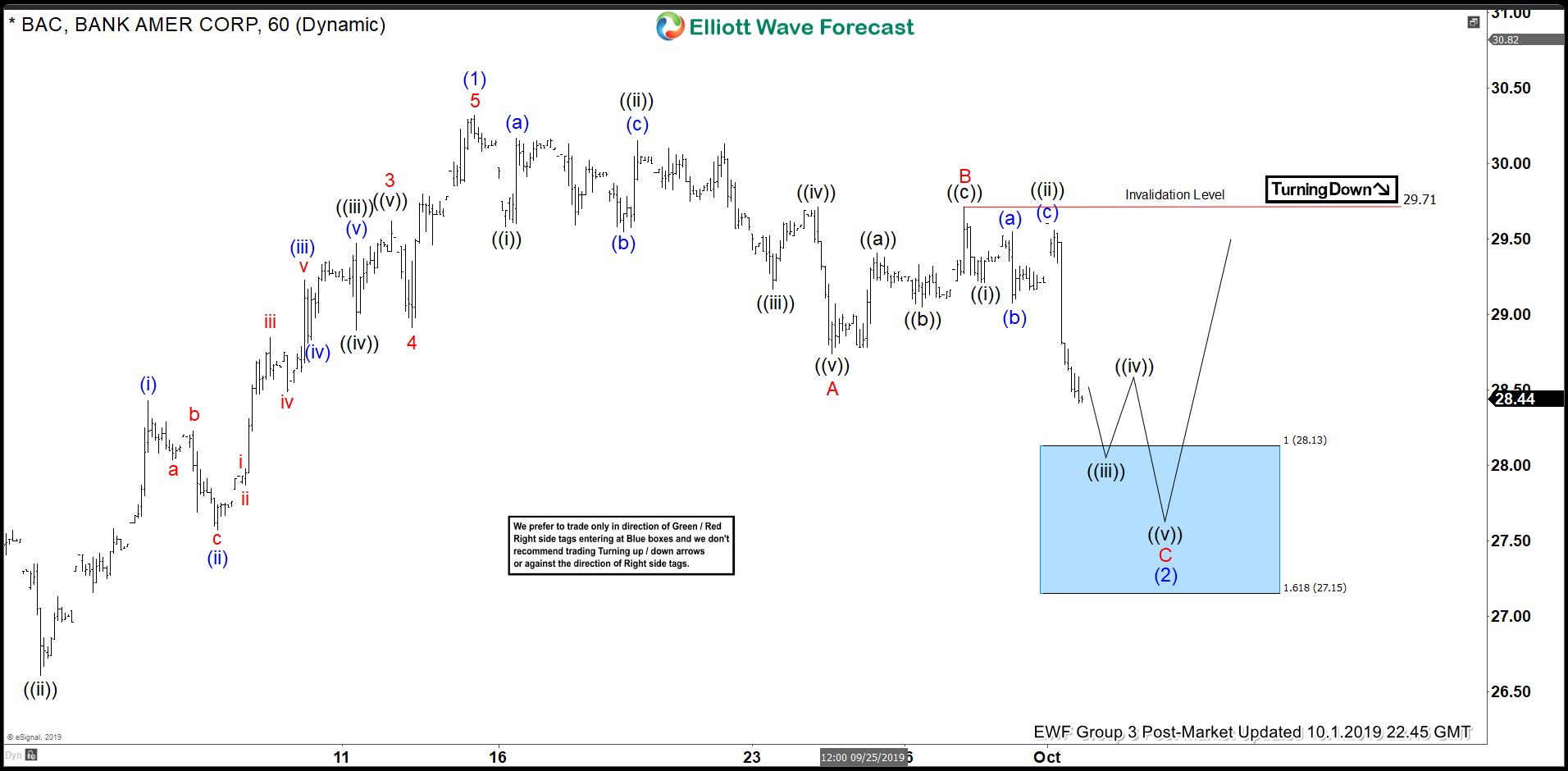

BAC 1 Hour Elliott Wave Analysis 10.1.2019

As we can see on the chart below, 29.71 high held well during short term bounces and we got new short term low confirming C leg is in progress. Now pull back looks incomplete , looking more short term weakness. We are calling for more downside toward A-B red equal legs area that comes at 28.12-27.14 ( blue box- buying area) . At that area we expect buyers to appear for proposed rally or 3 wave bounce alternatively. Although we expect to see more weakness , we advised members to avoid selling the stock. As our members know, Blue Boxes are no enemy areas , giving us 85% chance to get a bounce. We expect to see reaction in 3 waves up from the blue box at least.

Reminder: Turning Black arrows shows the path we prefer , but highest probability path is not the same as highest probability trade which is why we focus on green / red right side tags or bullish / bearish sequence combined with blue boxes to trade.

BAC 1 Hour Elliott Wave Analysis 10.16.2019

Buyers appeared right at the equal legs when Elliott Wave Zig Zag completed at 27.19 low. We got expected rally from the blue box when the price broke above previous peak: 30.33. Now as far as the price holds pivot at 27.19 low we can see more strength as proposed on the chart. Short term cycle from the 27.19 low in unfolding as 5 waves structure. Once we get proposed pull back in wave 2 red, $BAC should ideally provide us with intraday long opportunities.

Keep in mind that market is dynamic and presented view could have changed in the mean time. Best instruments to trade are those having incomplete bullish or bearish swings sequences. We put them in Sequence Report and best among them are shown in the Live Trading Room. You can check most recent charts in the membership area of the site.

Elliott Wave Forecast

We cover 78 instruments in total, but not every chart is trading recommendation. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.

Welcome to Elliott Wave Forecast !