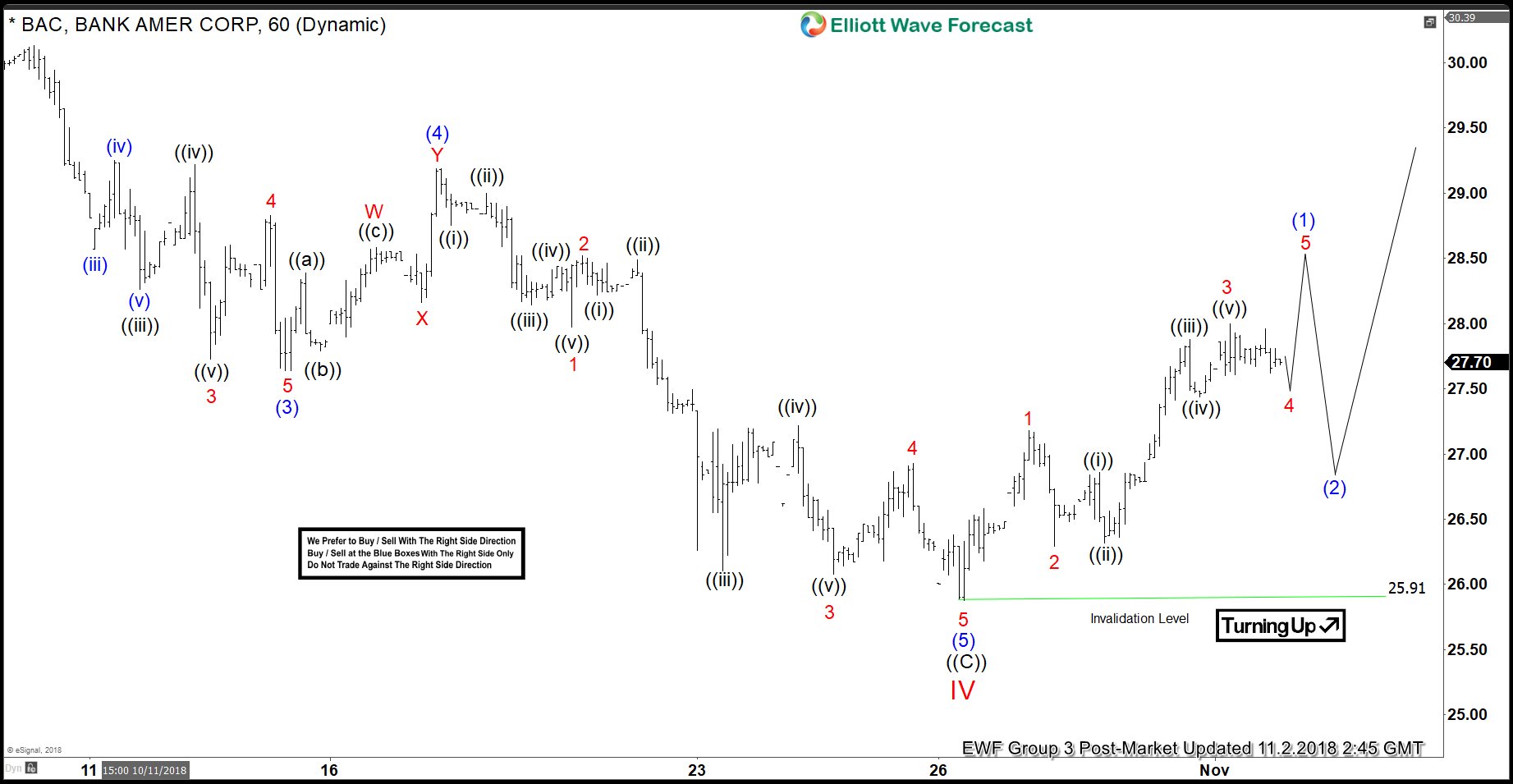

Bank of America corporation ticker symbol: BAC short-term Elliott wave analysis suggests that a decline to $27.26 low ended intermediate wave (3). The internals of that decline unfolded in 5 waves impulse structure in lesser degree cycles. Up from there a 3 wave bounce to $29.19 high ended intermediate wave (4) as double three structure. Down from there, the stock declined lower in another lesser degree 5 waves structure. That completed the intermediate wave (5) lower at $25.91 low. Which then also completed primary degree wave ((C)) & the cycle degree wave IV pullback.

Above from there, the stock is expected to resume the upside in cycle degree wave V ideally. Or should do a larger 3 wave bounce to correct the cycle from 3/12/2018 peak. Currently, the rally from $25.91 low is nesting higher as impulse structure looking to extend higher 1 more push higher to end intermediate wave (1). Afterwards, the stock is expected to do a pullback in intermediate wave (2) in 3, 7 or 11 swings before further upside extensions are seen provided the pivot at $25.91 low stays intact. We don’t like selling the stock as we are expecting BAC to turn higher against $25.91 low pivot.