ASML Holding N.V., (ASML) provides lithography solutions for the development, production, marketing, sales, upgrading & servicing semiconductor equipment systems. It also offers hardware, software & services to chipmakers to produce the patterns of integrated circuits. It comes under Technology sector & trades as ‘ASML’ ticker at Nasdaq.

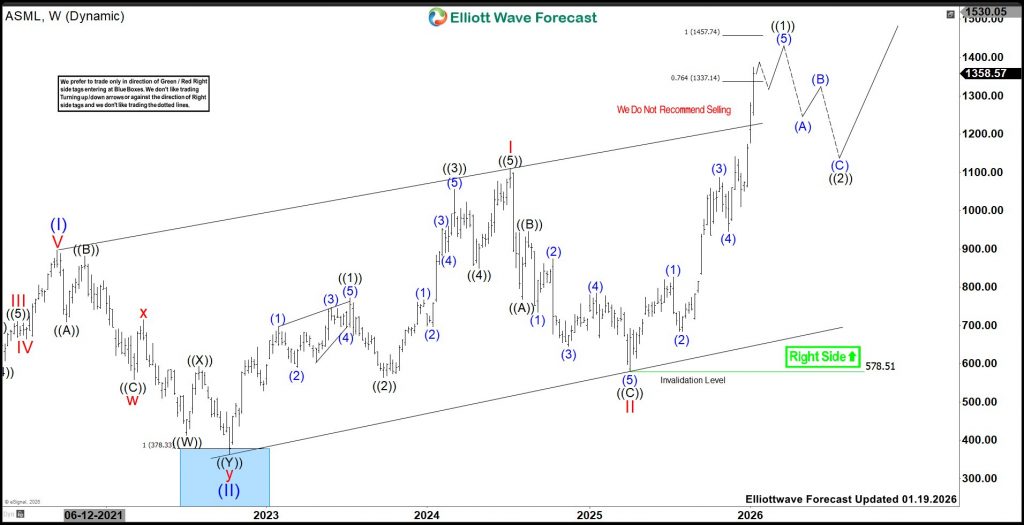

ASML trading at ATH, broke the price channel in weekly, favoring rally against April-2025 low. It favors upside in (5) of ((1)) & expect further upside towards $1457.74 before correcting next.

In weekly, it ended (I) at $895.93 in September-2021 & (II) at $363.15 low in October-2022. Above there, it is showing nest structure & favors rally to continue against April-2025 low. Above October-2022 low, it ended I of (III) at $1110.09 high & II at $578.51 low. Within I, it placed ((1)) at $771.98 high, ((2)) at $564 low, ((3)) at $1056.34 high, ((4)) at $849.14 low & ((5)) at $1110.09 high. Within ((2)), it ended ((A)) at $767.41 low, ((B)) at $945.05 high & ((C)) at $578.51 low in zigzag correction.

ASML – Elliott Wave Latest Weekly View:

Above II low, it favors rally in ((1)) of III. It ended (1) at $826.56 high, (2) at 684.24 low, (3) at $1086.11 high, (4) at $946.11 low & favors upside in (5). Within (5), it ended 1 at $1141.72 high, 2 at $1010.01 low & favors upside in 3. It expects soon to end 3 of (5) and pullback in 4 against 12.15.2025 low before final push to end ((1)). It should extend rally towards $1334.14 – $1457.74 area to end ((1)) before correcting next. Buyers can look to buy the next pullback in 3, 7 or 11 swings in ((2)) against April-2025 low in daily. It already broke channel, indicates bullish bias. The rally within III already extend above $1327.3 level as equal leg area of I, indicates more upside is likely.

ASML is not the part of regular service at EWF. But we provide time to time updates on instruments under blog section. Elliottwave Forecast updates 1-hour charts four times a day & 4-hour charts once a day for all our 78 instruments. We do a daily live session, where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market at the moment. You can try us for 14 days for only $0.99 (limited time offer). Also, you can check out the Educational section to learn Elliott wave theory & its application through different packages available & 1-1 coaching for doubts.

Back