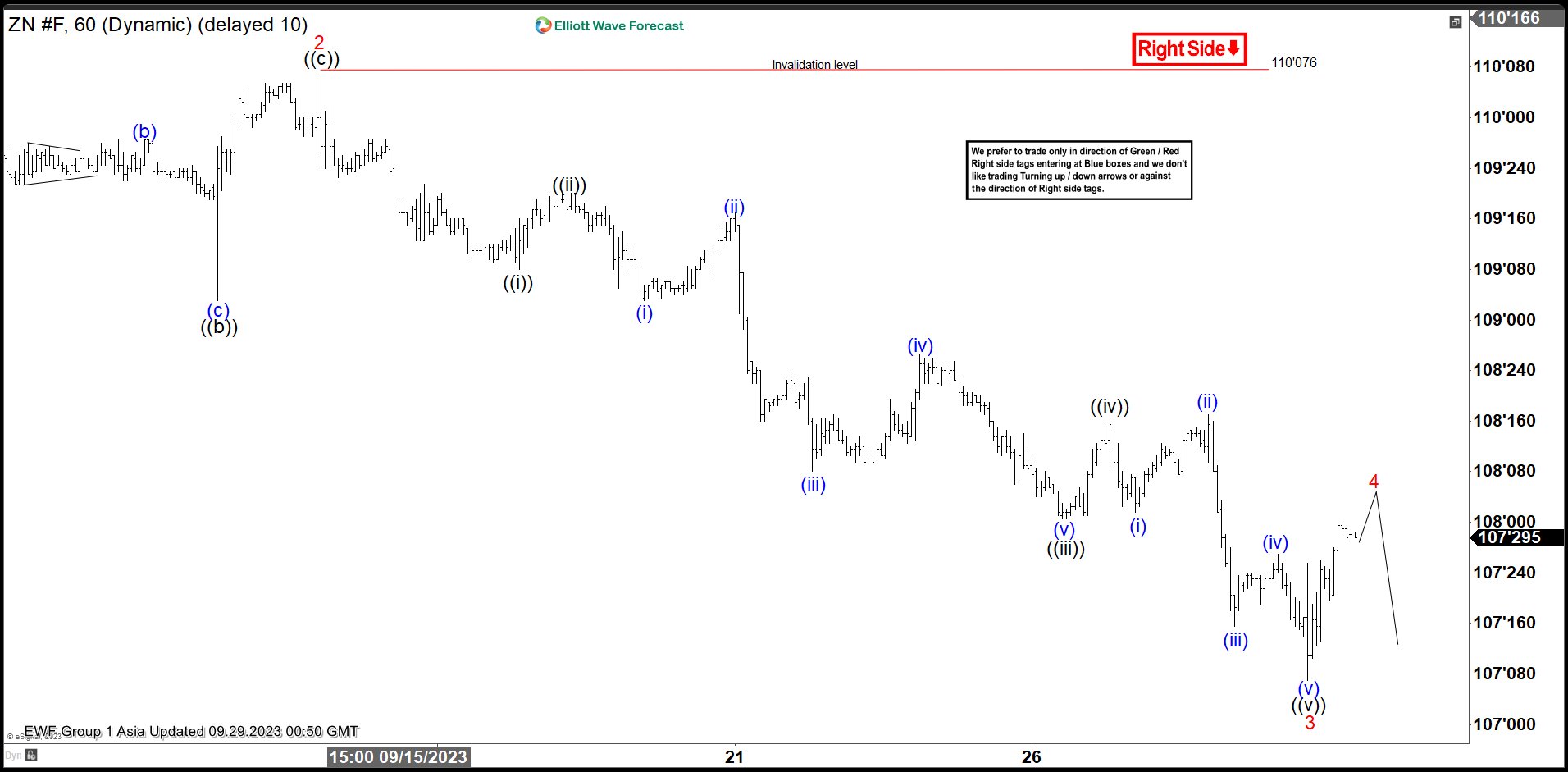

Short term Elliott Wave view suggests that cycle from 9.1.2023 high in Ten Year Notes ($ZN) remains incomplete. The decline is unfolding as a 5 waves impulse Elliott Wave structure. Down from 9.1.2023 high, wave 1 ended at 109’19 and rally in wave 2 ended at 110’07. The Notes extended lower in wave 3 as an impulse in lesser degree. Down from wave 2, wave ((i)) ended at 109’08 and wave ((ii)) rally ended at 109’2.

The Notes then extended lower in wave ((iii)) towards 108 and rally in wave ((iv)) ended at 108’17. Final leg wave ((v)) ended at 107’07 which completed wave 3. Wave 4 is in progress to correct the decline from 110’07. Potential target for wave 4 is 23.6 – 38.2% Fibonacci retracement of wave 3. This area comes at 107’29 – 108’11. Near term, as far as pivot at 110’07 high stays intact, expect rally in wave 4 rally to fail in 3, 7, 11 swing for further downside.