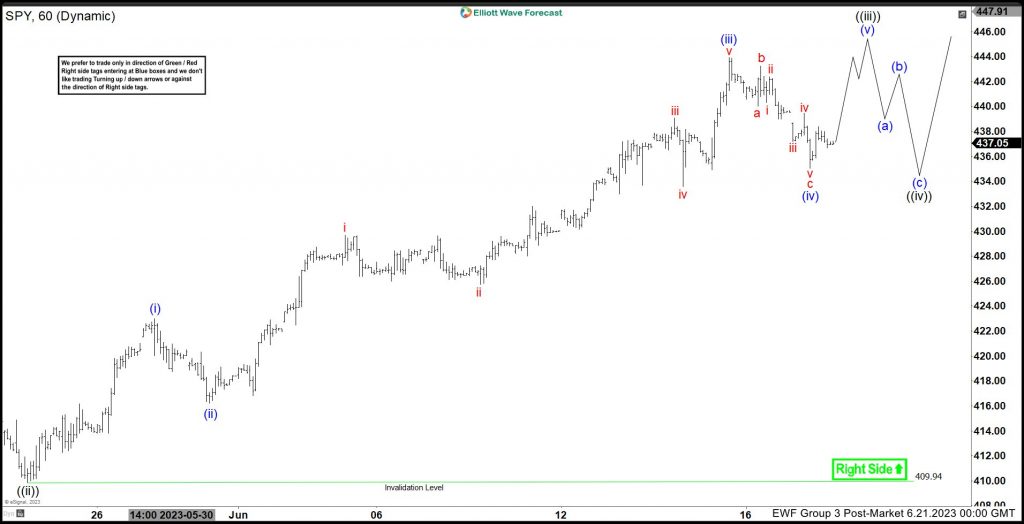

Short term, SPY favors higher in impulse Elliott wave sequence started from 5.04.2023 low and expect further strength to continue in wave 3. SPY finished wave 1 at 417.62 high started from 3.13.2023 low. It placed ((i)) at 402.49 high and ((ii)) at 389.33 low as 0.618 Fibonacci retracement. It finished ((iii)) of 1 at 416.06 high and ((iv)) at 403.78 low. Finally, it ended ((v)) at 417.62 high as wave 1. It corrected lower in 2, ended at 403.74 low as 0.382 Fibonacci retracement of wave 1. Above there, it favors higher in wave 3 and expect further strength to continue before correcting in 4. Within wave 3, it placed ((i)) at 420.87 high and ((ii)) at 409.88 low as 0.618 Fibonacci retracement of ((i)).

Above 409.88 low, it favors higher in ((iii)) of 3. It placed (i) at 422.99 high and (ii) at 416.22 low. It finished (iii) at 443.90 high, in which it ended i at 429.67 high, ii at 425.75 low, iii at 439.06 high, iv at 433.59 low and v at 443.90 high as (iii). It proposed ended (iv) at 435.03 low. Within (iv), it placed at 440.01 low, b at 443.25 high and c in zigzag at 435.03 low as 3 swing reaction lower. Above there, it favors higher in (v) to finish ((iii)) of 3. As long as price remain above 409.88 low of ((ii)), it expect at least one more high. Alternate view can be ended ((iii)) at last high and correcting in ((iv)) as double correction, which may extend lower below 435.03. In that case, it can find support at next extreme areas before upside resumes.