-

DAX Elliott Wave Signals Bullish Breakout Toward 25,450

Read MoreDAX continues to break to new all-time high suggesting the trend remains bullish. This article and video looks at the upside target of DAX.

-

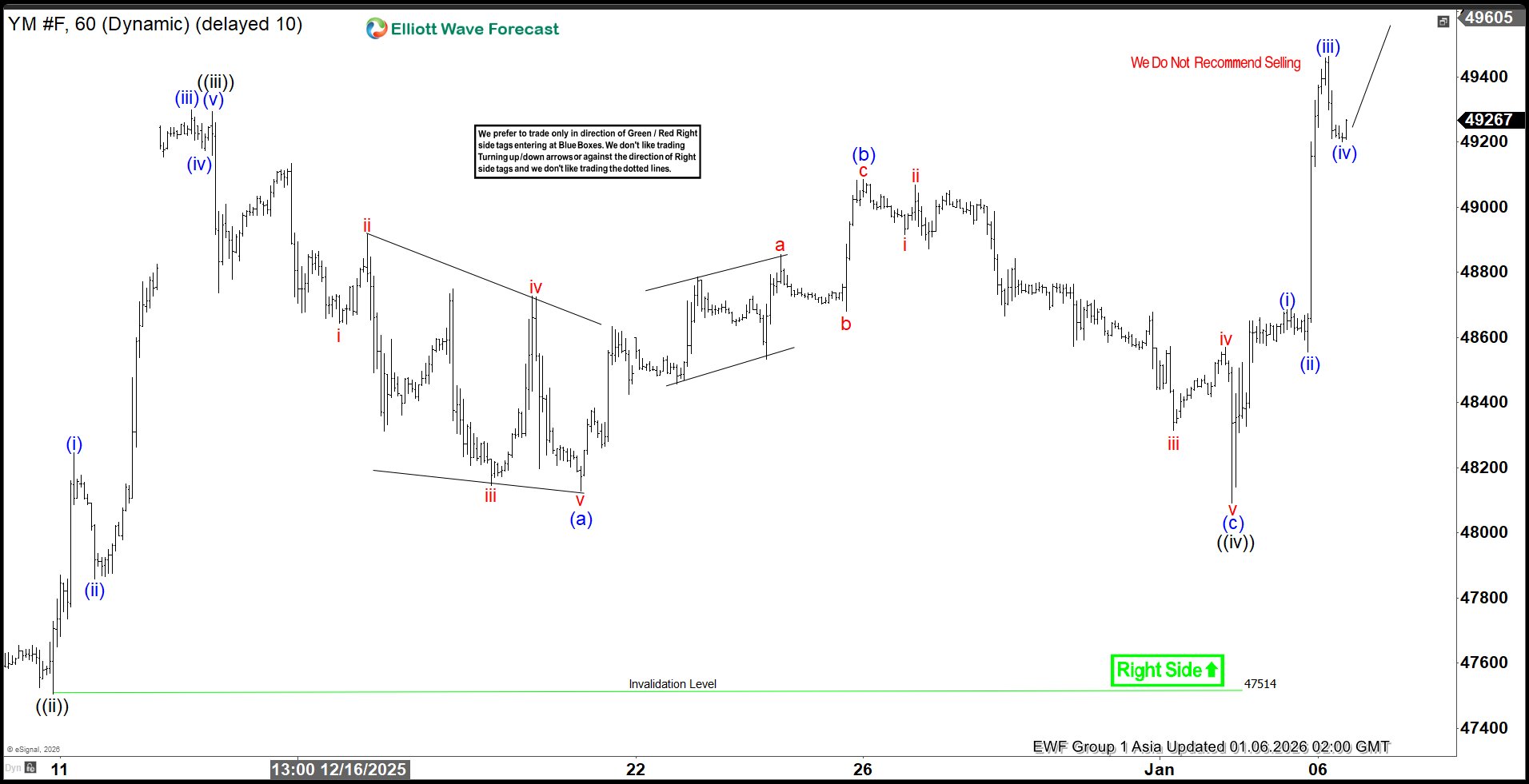

$YM (Dow Futures) Final Wave ((v)) Set to Wrap Short‑Term Cycle from Nov 21

Read MoreDow Futures (YM) is looking to complete cycle from November 21, 2025 low as a diagonal. This article and video look at the Elliott Wave path.

-

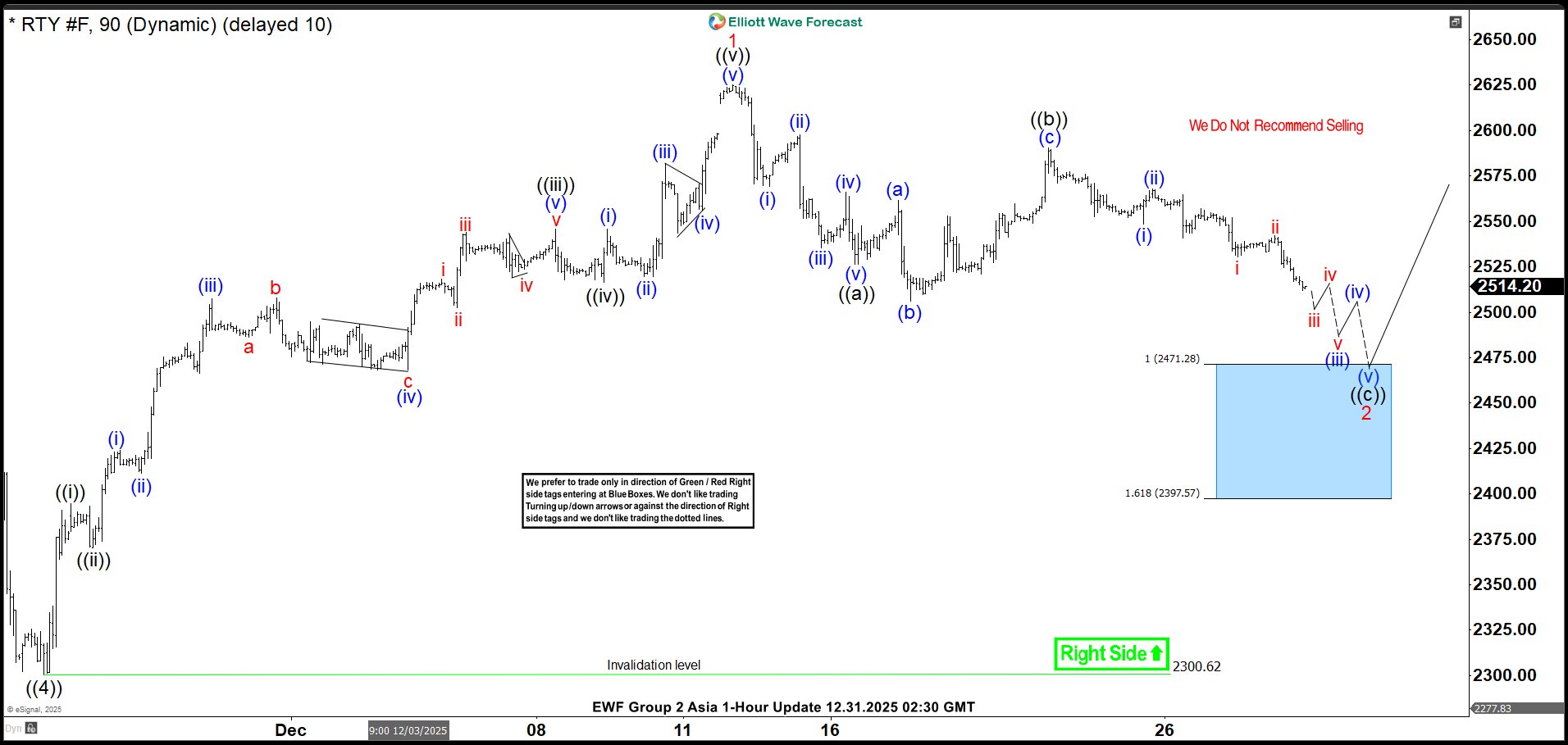

Russell 2000 Futures (RTY): Zigzag Correction Likely to Find Support for Extension to New Highs

Read MoreRussell 2000 Futures (RTY) is correcting in zigzag pattern. This article and video look at the Elliott Wave path of the Index.

-

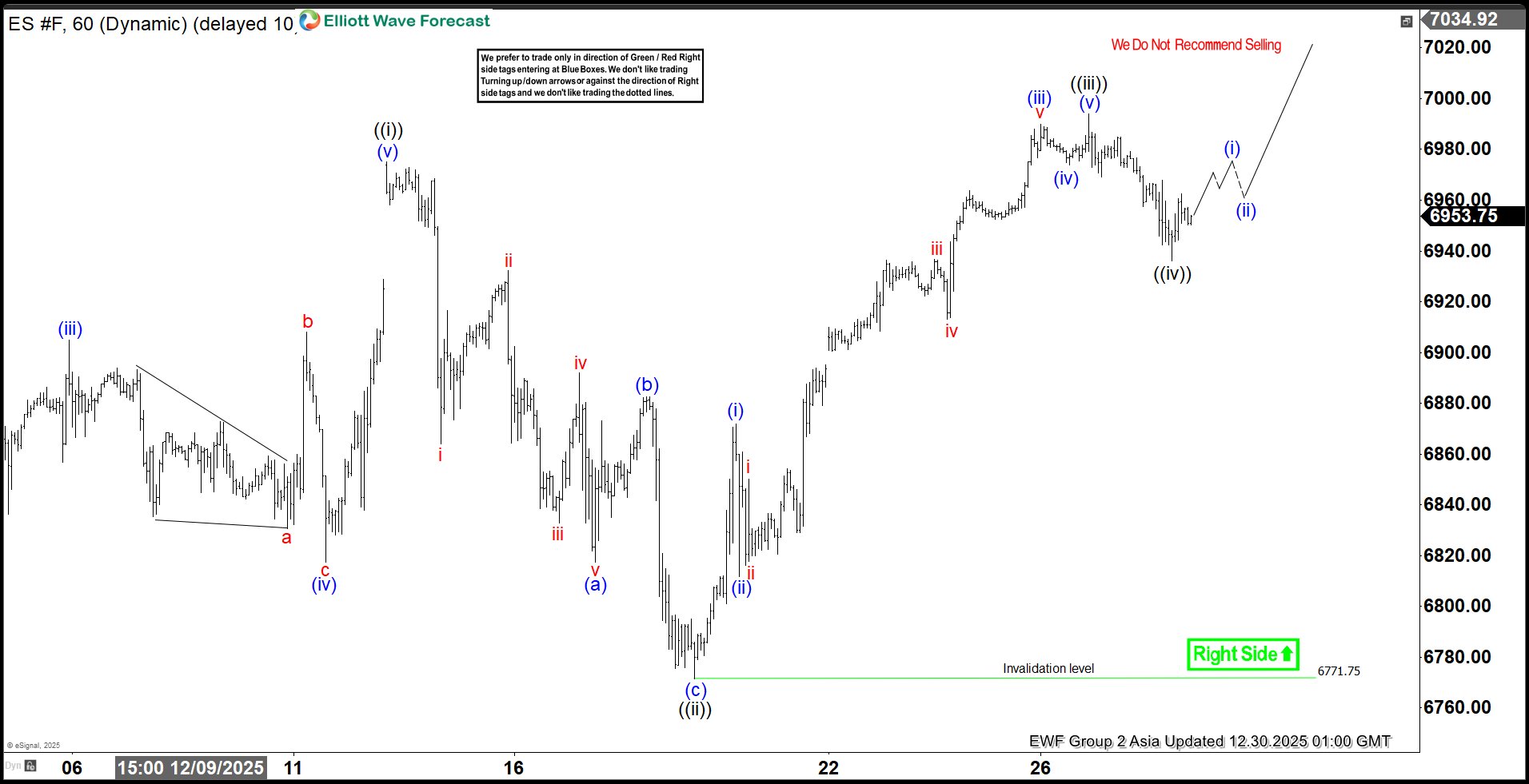

S&P 500 E‑Mini (ES) Maintains Bullish Structure, Eyeing Further Upside

Read MoreS&P 500 E-Mini Futures (ES) continues to rally to new all-time high with incomplete bullish structure. This article and video look at the Elliott Wave path.

-

Silver Extends Higher as Wave ((iii)) Remains in Progress

Read MoreSilver (XAGUSD) maintains a bullish Elliott Wave structure with pullbacks offering buying opportunities It continues to trade firmly higher and maintains a bullish structure. Price action respects the broader Elliott Wave sequence and keeps favoring the upside while key support levels hold. The rally from the prior swing low remains impulsive and shows no signs […]

-

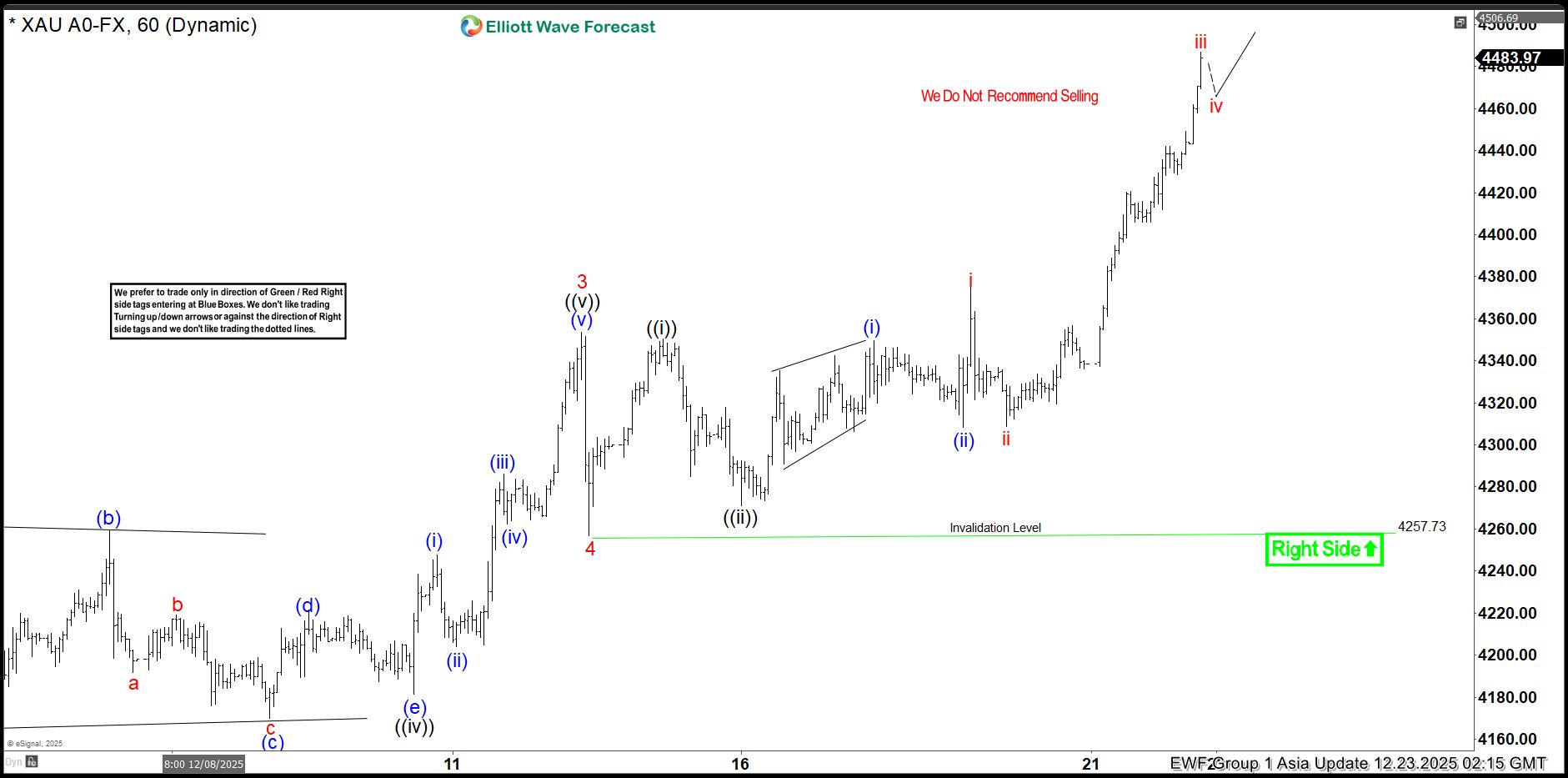

Gold Wave 5 Extends Higher After Wave 4 Pullback

Read MoreGold resumes its bullish trend from the 4258 low as wave ((iii)) unfolds within wave 5. XAUUSD has turned higher after completing the pullback in wave 4 at 4258. This move confirms that the broader bullish trend remains intact. Price is now advancing within wave 5, and the structure continues to favor higher levels. From […]