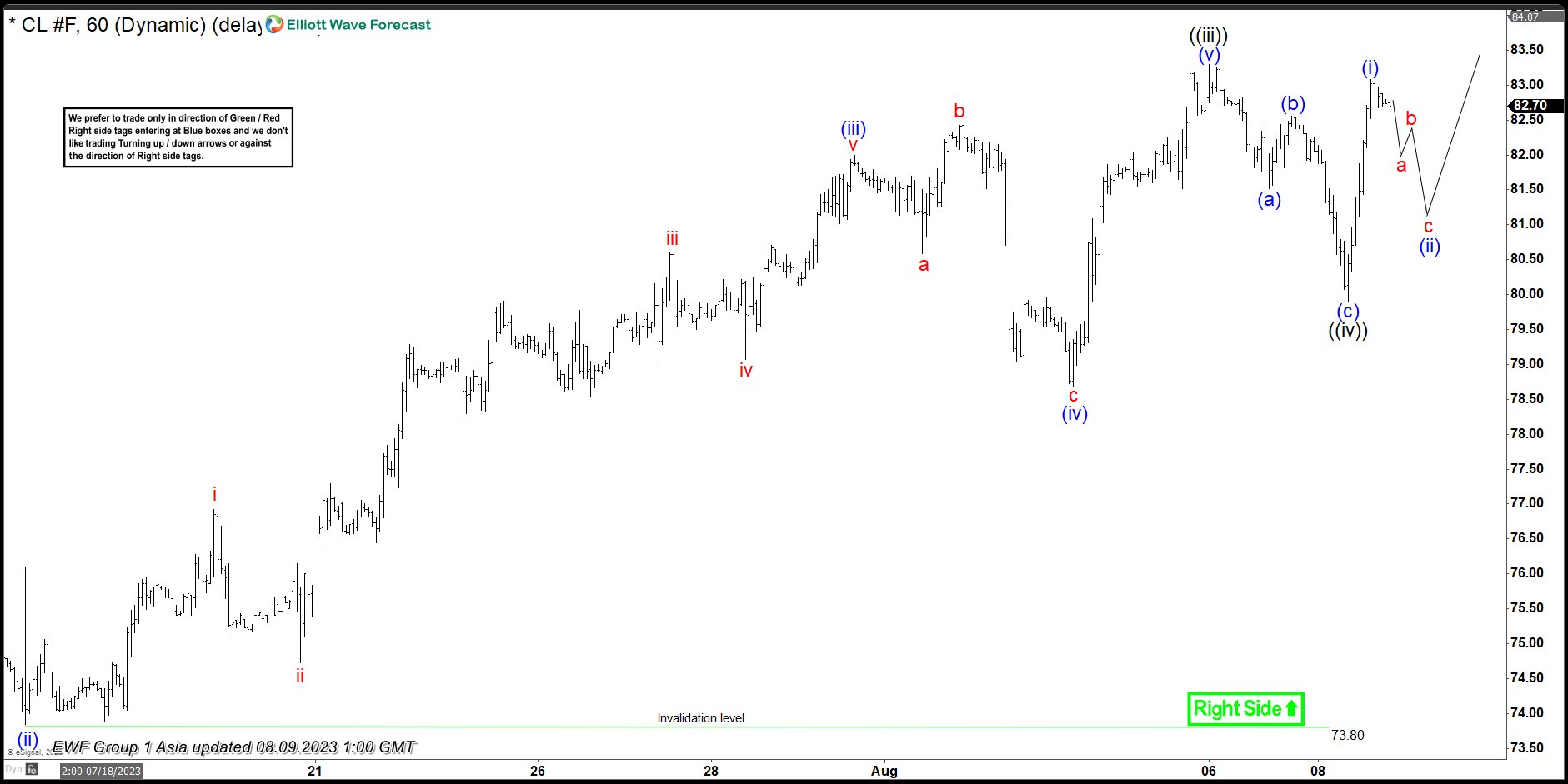

The short-term Elliott wave view in the OIL futures ($CL_F) suggests that the cycle from the 12 June 2023 low is unfolding in an impulse sequence that supports more upside in the instrument. Up from that low, the wave ((i)) ended at $72.72 high in a lesser degree 5 waves. While wave ((ii)) ended at 67.05 low and wave ((iii)) also unfolded in a lesser degree 5 waves sequence. In which, wave (i) of ((iii)) ended at $77.33 high.

Down from there, the pullback to the $73.84 low ended wave (ii) & the instrument rallied higher again. The rally to the $82 high ended wave (iii) & a pullback in wave (iv) ended at $78.69 low. Then a push higher towards $83.30 high ended wave (v) and thus completed the wave ((iii)). From there, OIL did a 3 wave pullback within wave ((iv)) as a zigzag structure where wave (a) ended at $81.52. Wave (b) ended at $82.55 and wave (c) ended at $79.90 low. Near-term, as far as dips remain above the $79.90 low the OIL is expected to resume the upside in wave ((v)) towards $84.09- $85.39 area, which is the inverse 123.6-161.8% target area of wave ((iv)) minimum before a pullback happens.