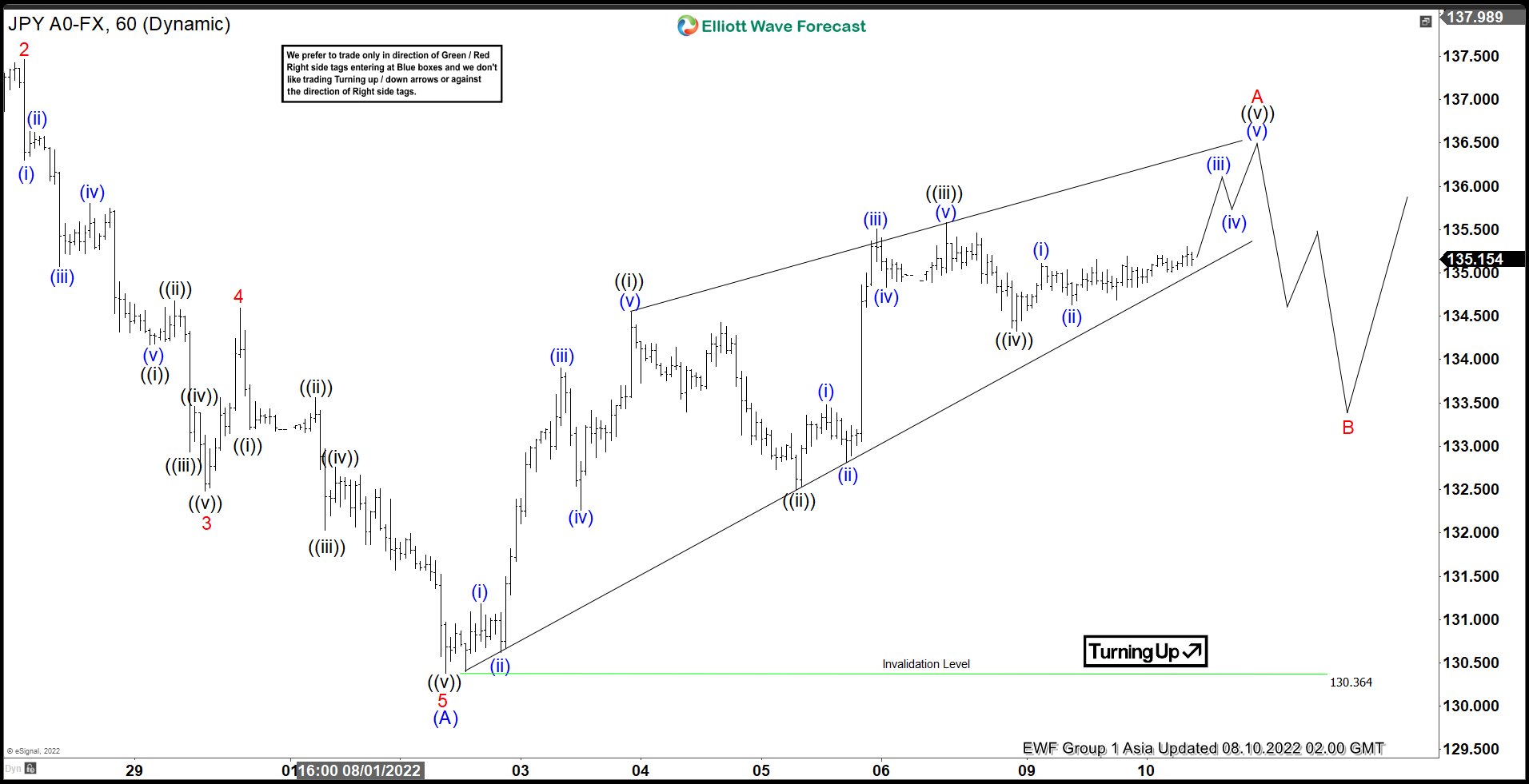

Short Term Elliott Wave View in USDJPY suggests decline from 7.11.2022 high is unfolding as a zigzag Elliott Wave structure. Down from 7.11.2022 high, wave 1 ended at 135.54 and rally in wave 2 ended at 137.46. Pair then extended lower in wave 3 towards 132.48, and rally in wave 4 ended at 134.59. Final leg lower in wave 5 ended at 130.364 which completed wave (A) in higher degree.

Wave B rally is currently in progress with internal subdivision as another zigzag in lesser degree. First leg wave (A) unfolded as a 5 waves diagonal. Up from wave (A), wave ((i)) ended at 134.55, and pullback in wave ((ii)) ended at 132.5. Pair then extended higher again in wave ((iii)) towards 135.58, and dips in wave ((iv)) ended at 134.33. Expect pair to extend 1 more leg before ending wave ((v)) and this should complete wave A in higher degree. Pair should then pullback in wave B to correct cycle from 8.2.2022 low before the next leg higher in wave C. Near term, as far as pivot at 130.364 low stays intact, expect dips to find support in 3, 7, 11 swing for further upside.