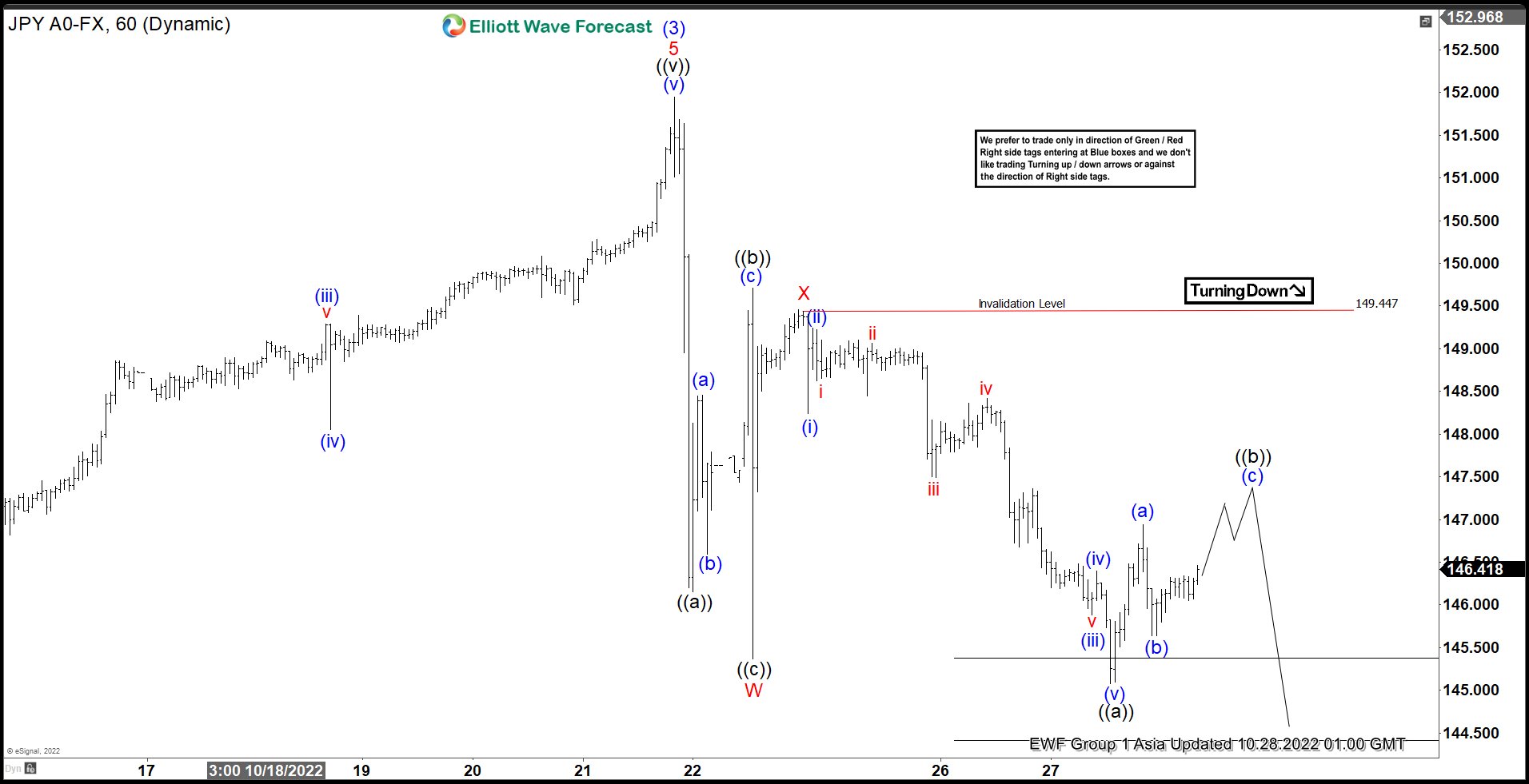

Short Term Elliott Wave structure of USDJPY shows a 5 swing sequence from 10.21.2022 high. This suggests the decline can extend lower into a 7 swing double three structure. Rally to 10.21.2022 high at 151.94 ended wave (3). Pullback in wave (4) is in progress with subdivision as a double three Elliott Wave structure. Down from wave (3), wave ((a)) ended at 146.15, rally in wave ((b)) ended at 149.71, and wave ((c)) lower ended at 145.37. This completed wave W.

Corrective rally in wave X ended at 149.44 and the pair has resumed lower. Wave Y is now in progress as a zigzag structure. Down from wave X, wave (i) ended at 148.24, and rally in wave (ii) ended at 149.24. Pair resumes lower in wave (iii) towards 145.88 and wave (iv) ended at 146.39. Final leg wave (v) ended at 145.08 which completed wave ((a)). Wave ((b)) rally is in progress to correct cycle from 10.24.2022 high in 3, 7, or 11 swing before the decline resumes. Near term, as far as pivot at 149.44 holds, expect rally to fail for further downside towards 141.3 – 142.8 area to end wave (4). This area, if reached, should see buyers for the next leg higher.