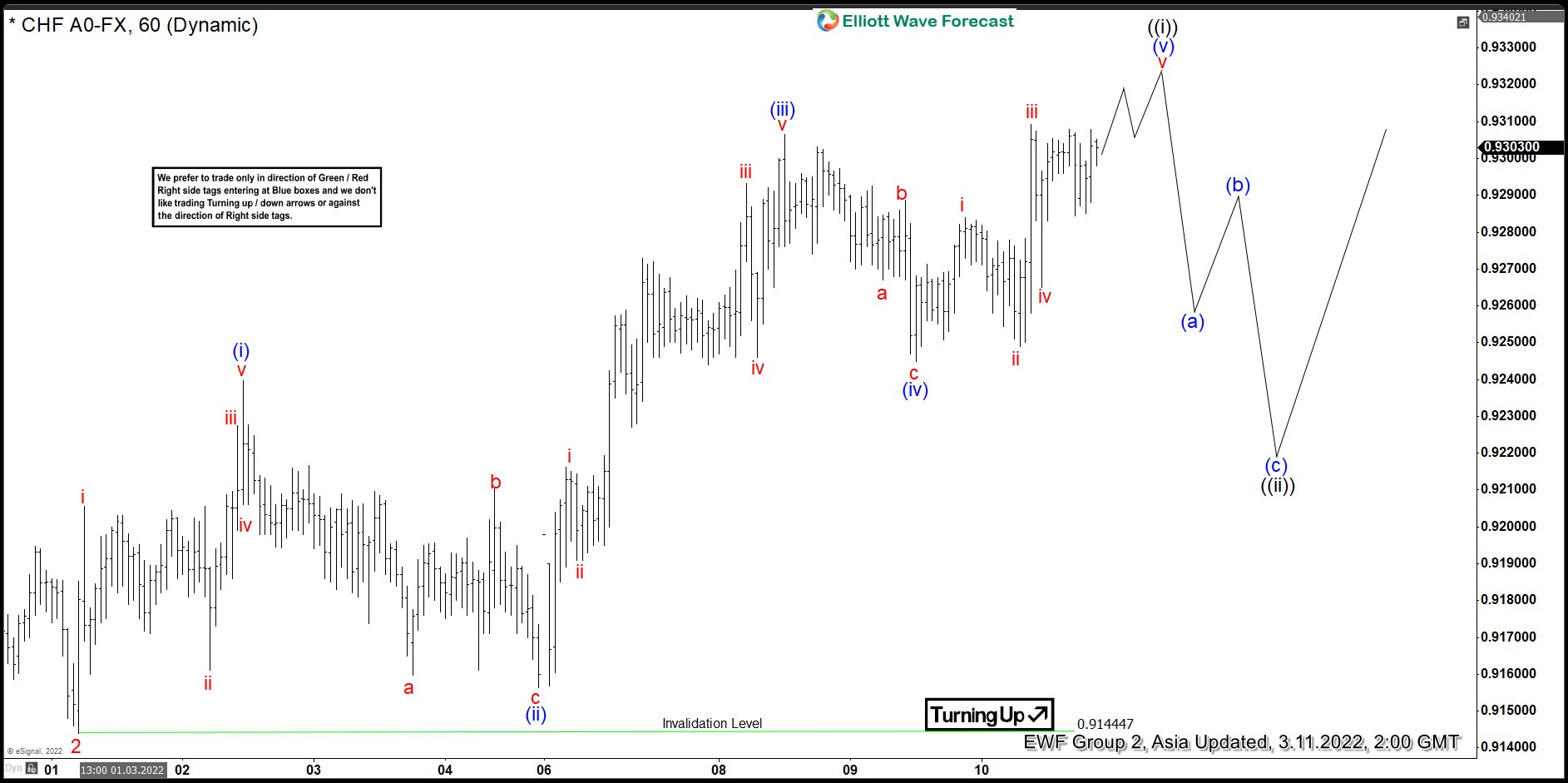

Short Term Elliott Wave View in USDCHF suggests the rally from January 13, 2022 low is unfolding as a 5 waves impulse. Up from January 13 low, wave 1 ended at 0.9343 and pullback in wave 2 ended at 0.9144. The 60 minutes chart below shows pair has turned higher again in wave 3. Internal subdivision of wave 3 is unfolding as another 5 waves in lesser degree. Up from wave 2, wave (i) ended at 0.9239 and dips in wave (ii) ended at 0.9156. Pair then resumes higher in wave (iii) towards 0.9306 and pullback in wave (iv) ended at 0.9245. Expect wave (v) to end soon which should also complete wave ((i)).

Pair should then pullback in wave ((ii)) to correct cycle from March 1 low before the next leg higher. Near term, as far as pivot at 0.914 low stays intact, expect pullback to find support in the sequence of 3, 7, or 11 swing for further upside in wave ((iii)). The bias to the upside will get further validation if pair can break above wave 1 on January 31, 2022 at 0.934. Break above wave 1 should create a higher high (bullish ) sequence from January 13, 2022 low confirming the upside bias.