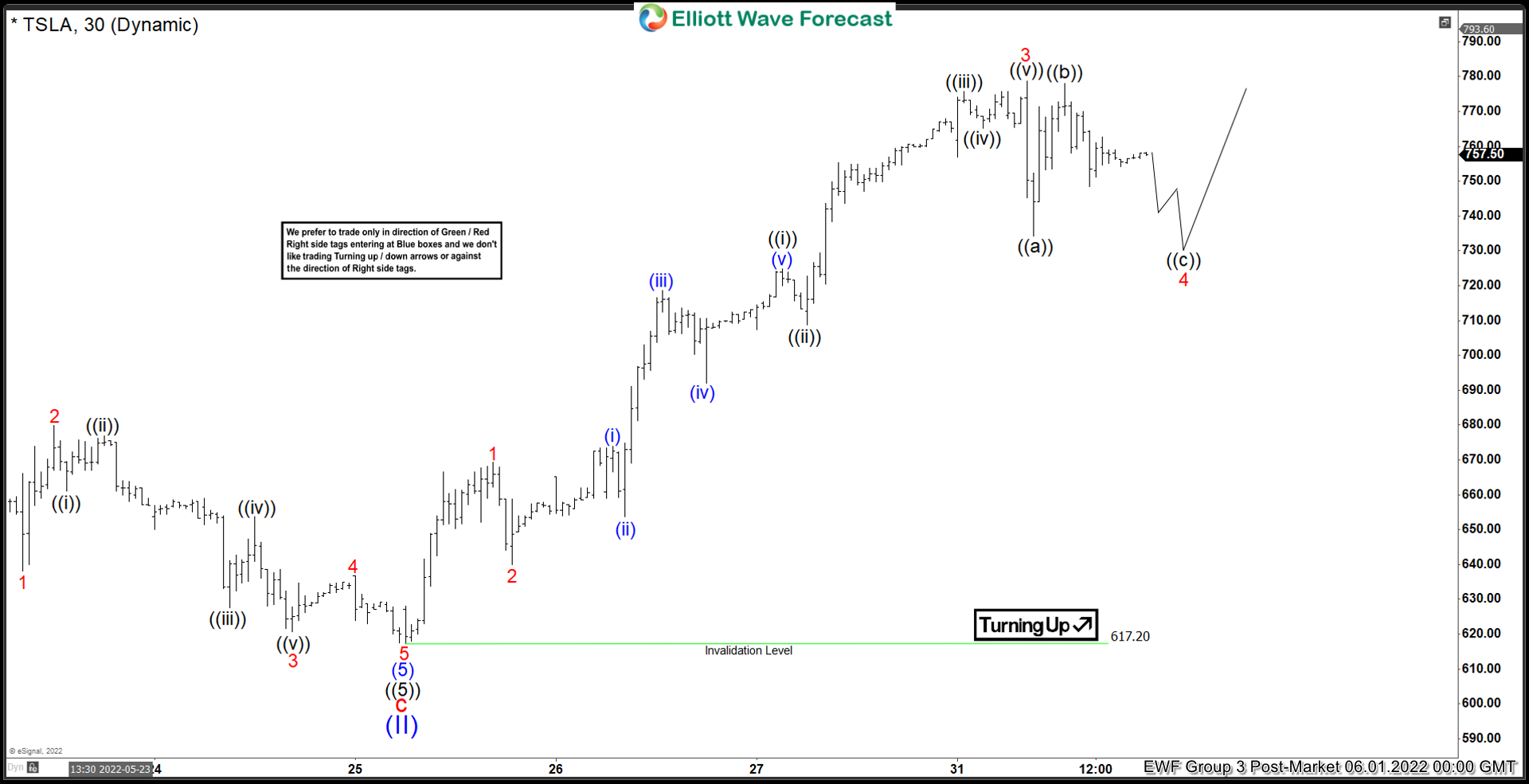

Short Term Elliott Wave View in Tesla (TSLA) suggests cycle from 11/4/2021 peak ended at 617.20 as wave (II). The stock should now either start the next rally in super cycle wave (III) or else do a 3 waves rally at least. The rally from wave (II) low looks impulsive. Up from wave (II) low, wave 1 ended at 669.32 and pullback in wave 2 ended at 640. Wave 3 ended at 778.80 with internal subdivision as 5 waves impulse in lesser degree.

Up from wave 2, wave ((i)) ended at 724.89 and pullback in wave ((ii)) ended at 708.65. The stock extends higher again in wave ((iii)) towards 775.78, pullback in wave ((iv)) ended at 765.20, and final leg higher wave ((v)) ended at 778.80. Stock is now pulling back in wave 4 with internal subdivision as a zigzag. Down from wave 3, wave ((a)) ended at 734.23, and rally in wave ((b)) ended at 778.10. Expect wave ((c)) lower towards 706 – 733 to complete wave 4 before the rally resumes. Near term, as far as 5/25/2022 low pivot at 617.20 remains intact, expect pullback to find support in 3, 7, or 11 swing for further upside.