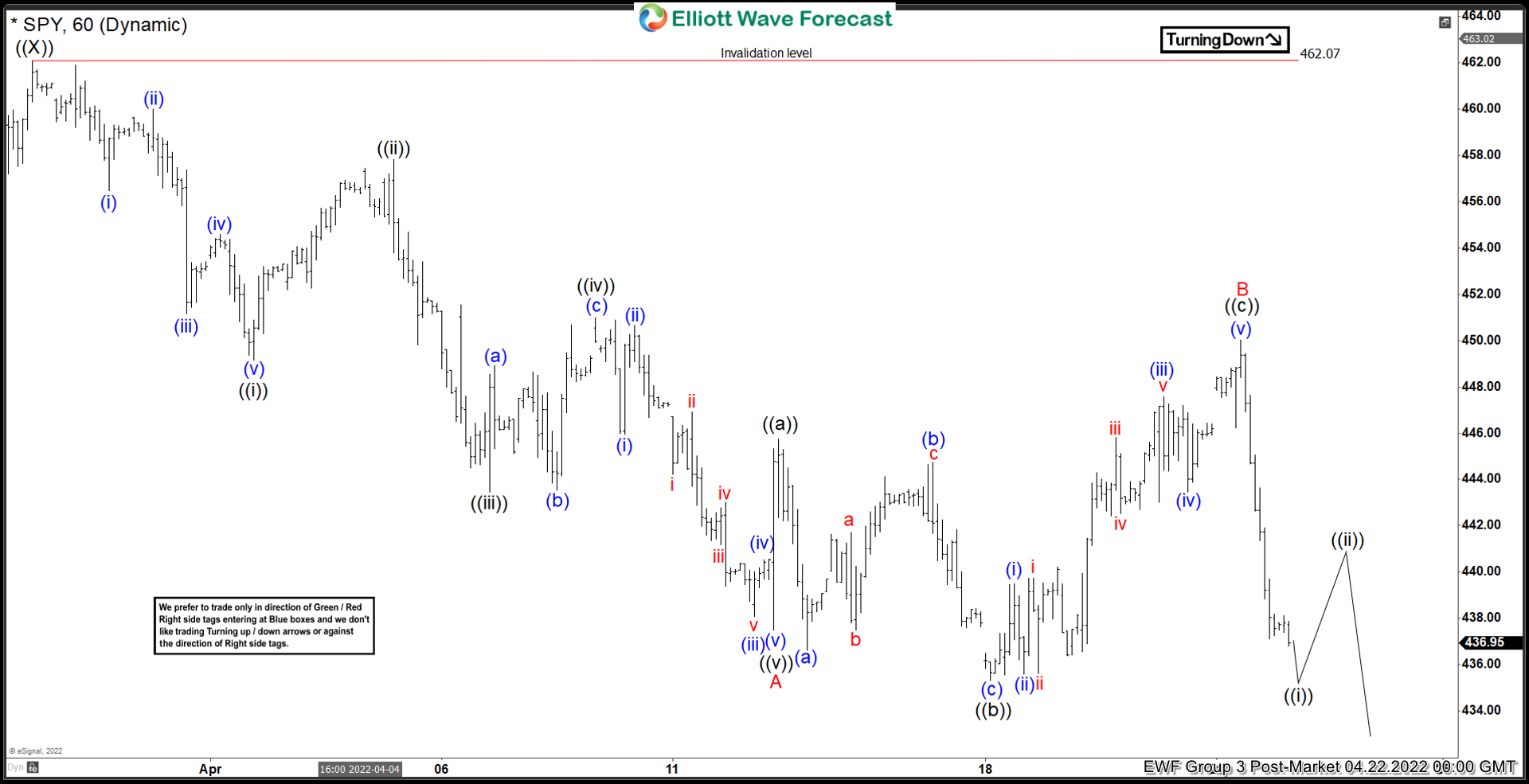

Short term Elliott Wave view in SPY suggests the decline from January 4, 2022 high is unfolding as a double three Elliott Wave structure. Down from January 4 high, wave ((W)) ended at 420.76 and wave ((X)) ended at 462.07. Wave ((Y)) lower is currently in progress. Down from wave ((X)), wave ((i)) ended at 449.14 and rally in wave ((ii)) ended at 457.83. The ETF then extends lower in wave ((iii)) towards 443.47. Bounce in wave ((iv)) ended at 451, and final leg lower wave ((v)) ended at 437.50. This completed wave A in higher degree. Correction in wave B ended at 450.01 with internal subdivision as an expanded flat.

Up from wave A, wave ((a)) ended at 445.75, pullback in wave ((b)) ended at 435.32, and wave ((c)) higher ended at 450.01. This completed wave B in higher degree. The ETF has resumed lower in wave C. Near term, expect wave ((i)) to complete soon. It should then rally in wave ((ii)) to correct the decline from 450.01 before the next leg lower. As far as pivot at 462.07 high stays intact, expect rally to fail in 3, 7, or 11 swing for more downside.