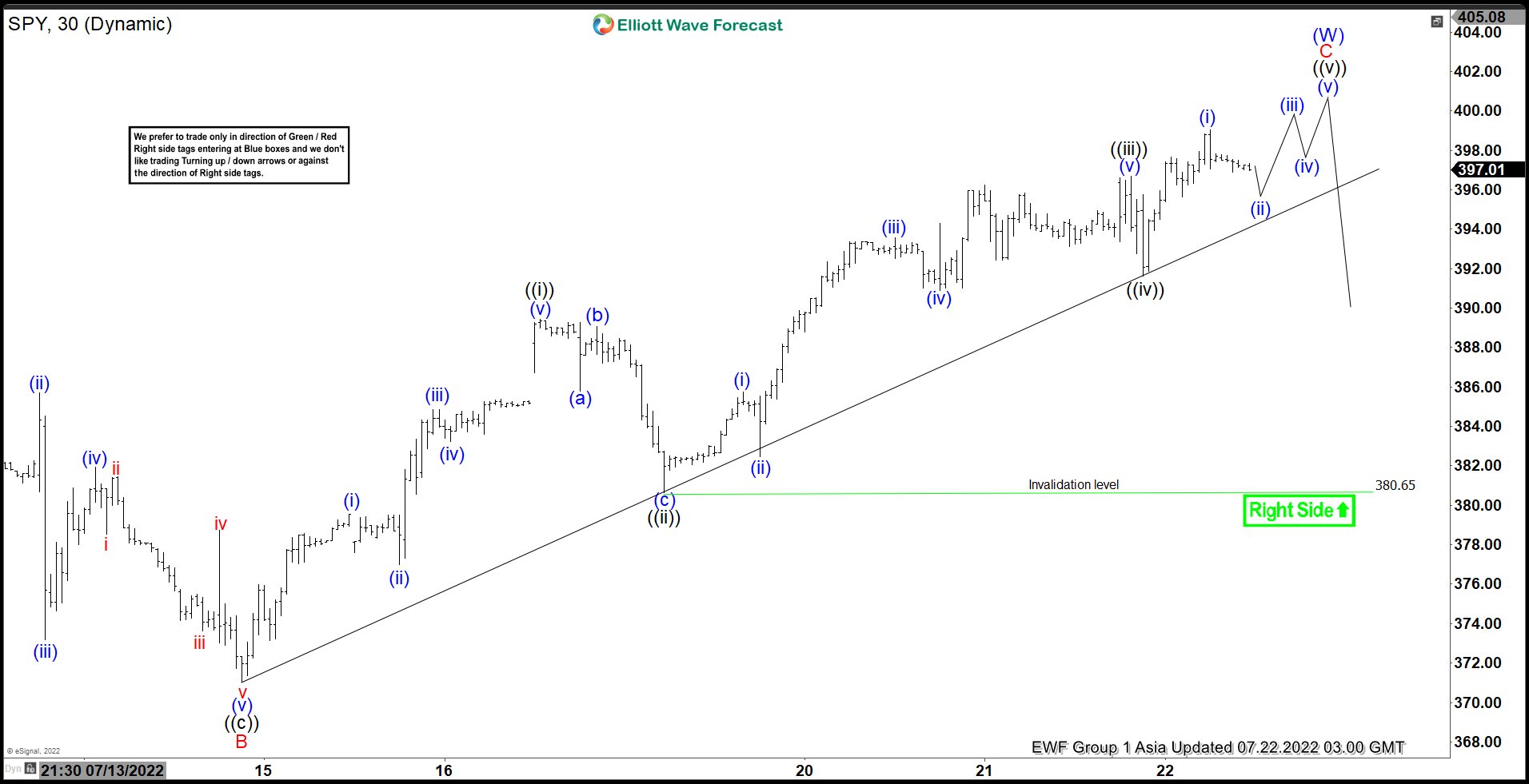

Short Term Elliott Wave view in SPY suggests that rally from 6.17.2022 low is unfolding as a double three structure. A double three is a complex correction and sometimes referred to as a double zigzag. In Elliott Wave, the label is WXY. Wave W subdivides in 3 waves, wave X in 3 waves, and wave Y also in 3 waves. The 3 waves subdivision within wave W and Y is usually a zigzag structure, hence the name double zigzag. Up from 6.17.2022 low, the first zigzag is forming with wave A ended at 393.16 and wave B ended at 371.04.

Wave C is in progress as a 5 waves impulse. Up from wave B, wave ((i)) ended at 389.45 and dips in wave ((ii)) ended at 380.65. The ETF then extends higher again in wave (((iii)) towards 396.71, and wave ((iv)) dips ended at 391.63. Near term, as far as pivot at 380.65 low stays intact, expect further upside within wave ((v)) of C towards 402 – 421 area. This is the 100% – 161.8% Fibonacci extension of wave A and this area should complete wave C and wave (W) in higher degree. Once wave (W) is completed, expect wave (X) pullback to correct cycle from 6/17/2022 low in 3, 7, or 11 swing before the rally resumes.