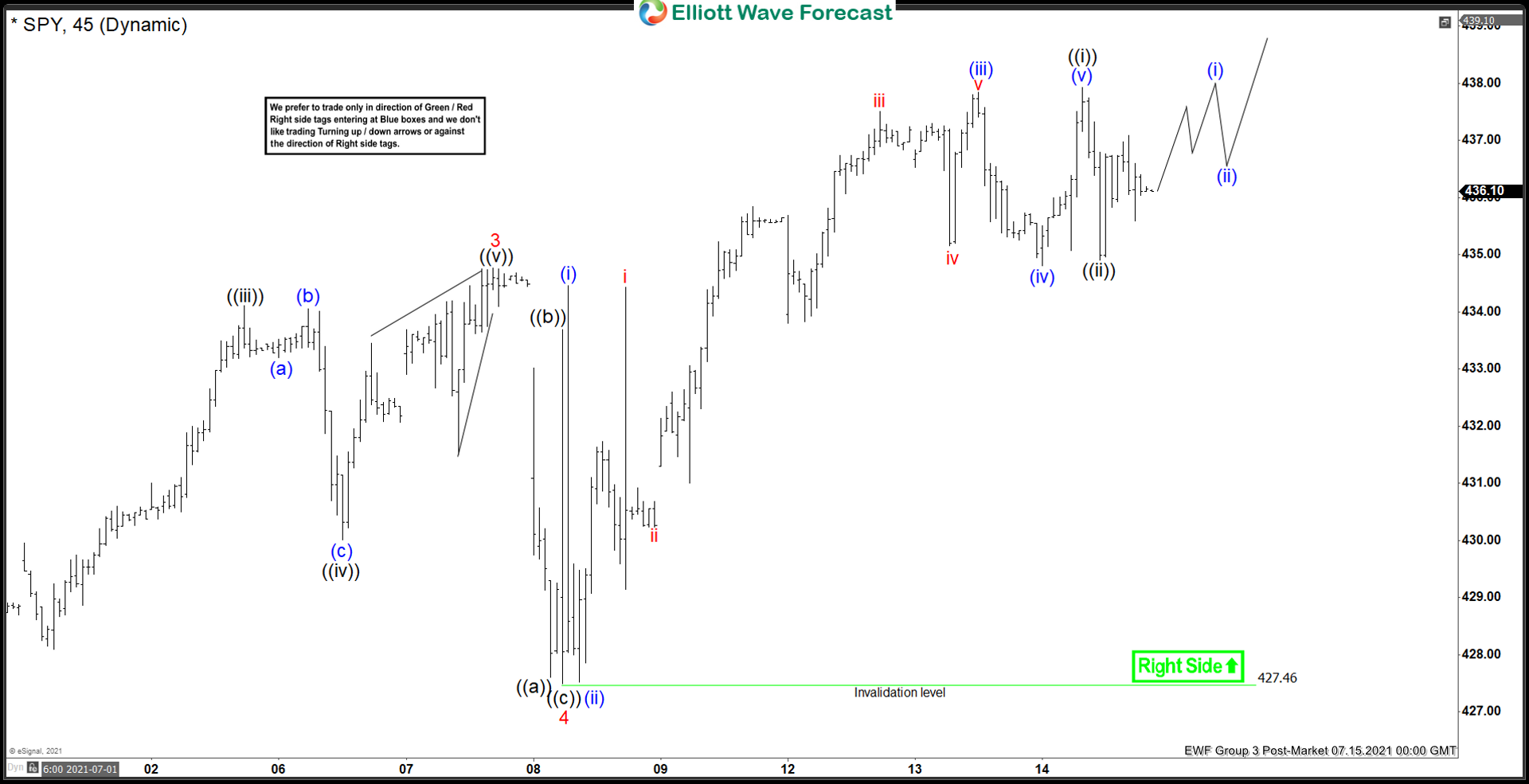

Short term Elliott Wave in SPY suggests the rally from May 13, 2021 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from May 13 low, wave 1 ended at 425.99 and pullback in wave 2 ended at 412.94. The ETF resumes higher in wave 3 towards 434.76 and pullback in wave 4 ended at 427.49. Internal subdivision of wave 4 took the form of a zigzag Elliott Wave structure. Down below wave 3, wave ((a)) ended at 427.60, wave ((b)) rally ended at 433.69, and wave ((c)) ended at 427.49.

Wave 5 is currently in progress and the internal subdivides in 5 waves in lesser degree. Up from wave 4, wave (i) ended at 434.46 and pullback in wave (ii) ended at 427.52. The ETF then resumes higher in wave (iii) towards 437.84. Dips in wave (iv) ended at 434.80 and final leg higher wave (v) ended at 437.92. This completed wave ((i)) of 5 in higher degree. Pullback in wave ((ii)) ended at 434.91. The ETF should continue higher in wave ((iii)) while above wave ((ii)) low at 434.91. Near term, as far as July 8 low pivot at 427.46 stays intact, expect dips to find support in 3, 7, or 11 swing for more upside.