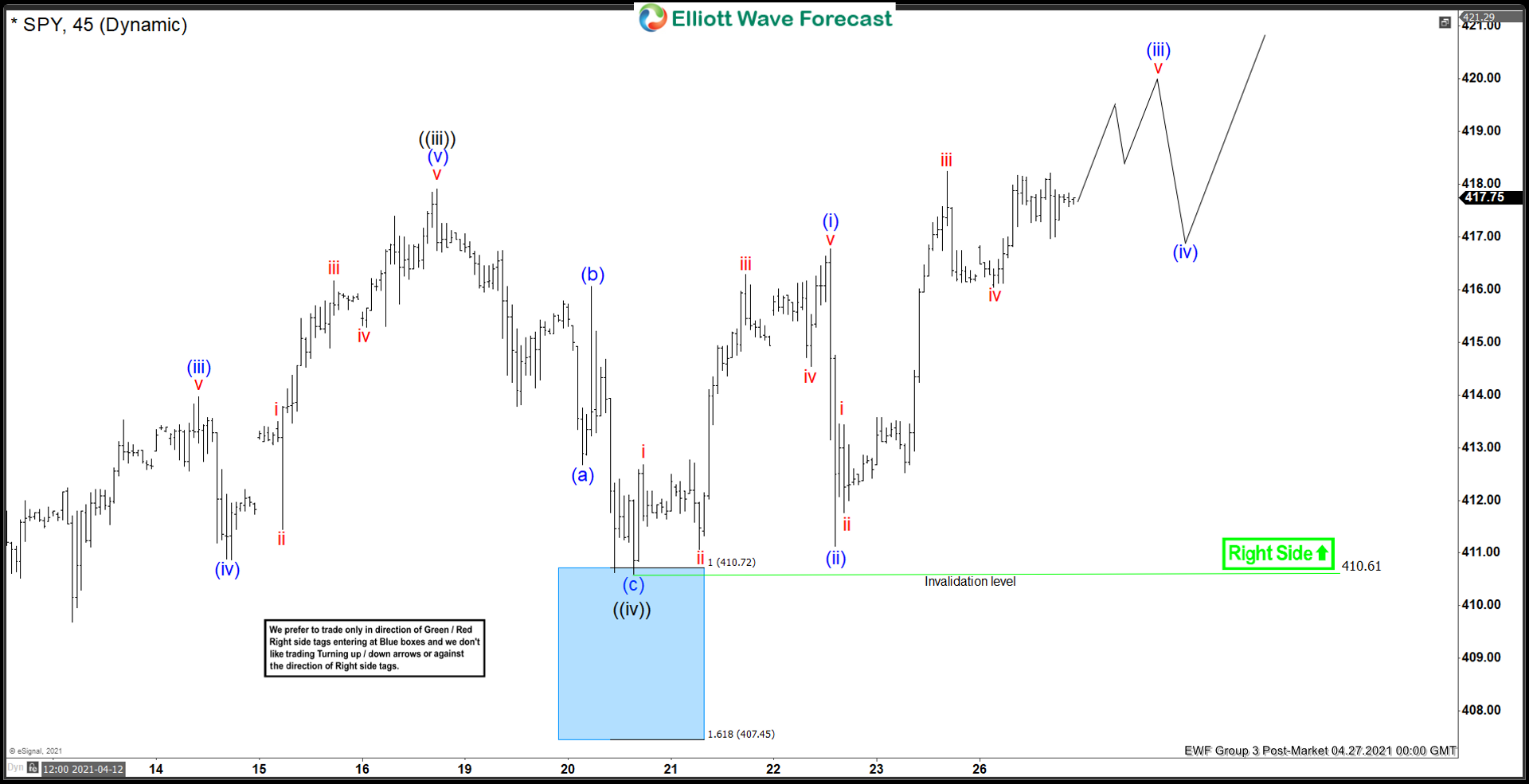

Short term Elliott wave view in SPY suggests the rally from March 5, 2021 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from March 5 low, wave ((i)) ended at 398.25 and pullback in wave ((ii)) ended at 383.90. The ETF then extended higher in wave ((iii)) towards 417.91 and dips in wave ((iv)) ended at 410.61. Internal subdivision of wave ((iv)) unfolded as a zigzag structure. Down from wave ((iii)), wave (a) ended at 412.68, wave (b) ended at 416.06, and wave (c) ended at 410.61.

The ETF has resumed higher and broken above wave ((iii)) suggesting the next leg higher in wave ((v)) has started. Up from wave ((iv)), wave i ended at 412.67, and pullback in wave ii ended at 411.07. The ETF extends higher again in wave iii towards 416.29, wave iv ended at 414.54, and wave v ended at 416.78. This completed wave (i) in higher degree. Pullback in wave (ii) ended at 411.13 and wave (iii) is currently in progress. Expect the ETF to extend a few more highs to end wave (iii). Afterwards, it should pullback in wave (iv) before the rally resumes higher. Near term, as far as pivot at 410.61 on April 21 low remains intact, expect dips to find support in 3, 7, or 11 swing for further upside.