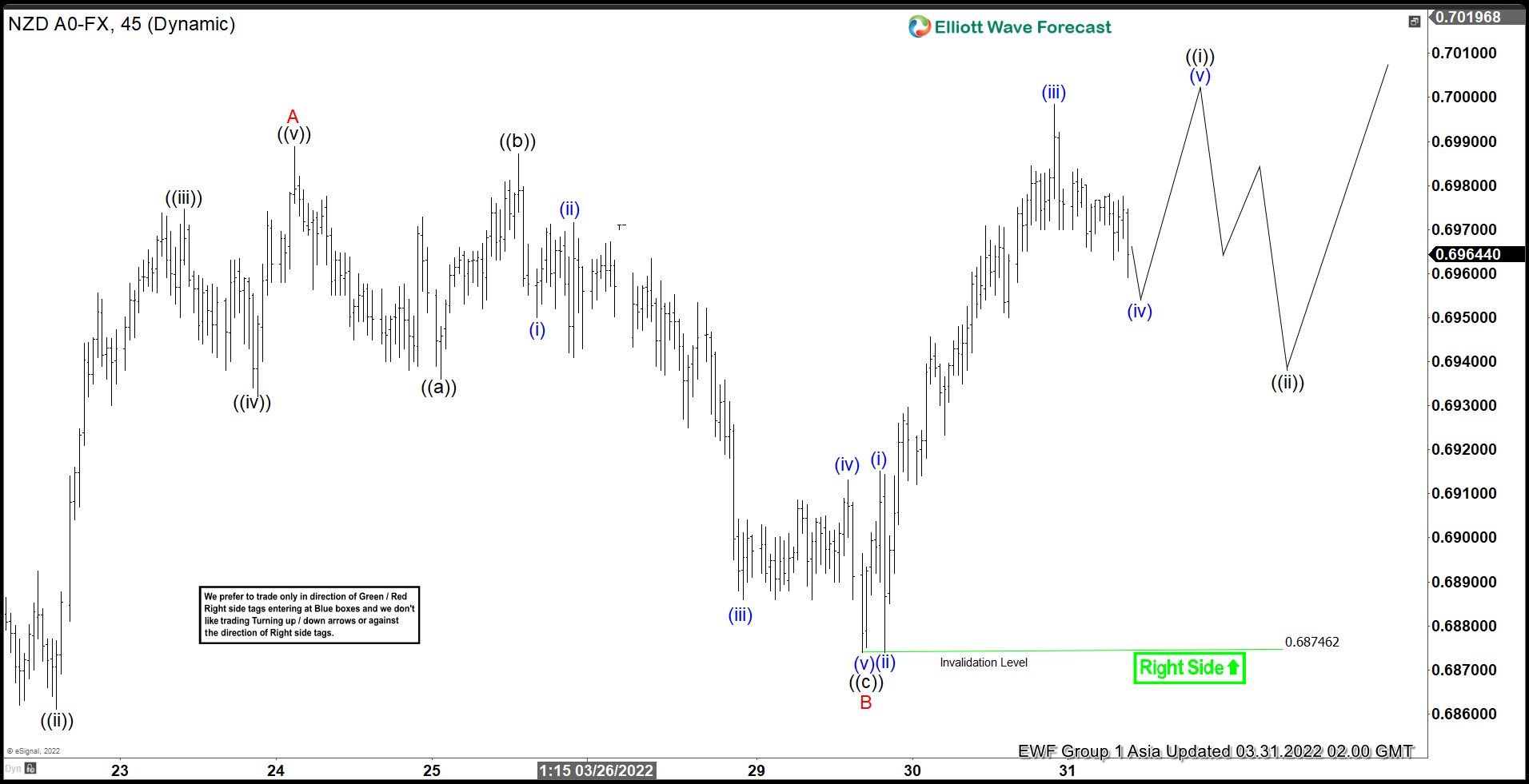

Short Term outlook in NZDUSD suggests rally from March 15, 2022 low is unfolding as a zigzag Elliott Wave structure. Up from March 15 low, wave ((i)) ended at 0.679 and dips in wave ((ii)) ended at 0.6738. Pair then rallies again in wave ((iii)) towards 0.692, and pullback in wave ((iv)) ended at 0.686. Final leg higher wave ((v)) ended at 0.6988. This completed wave A. Pullback in wave B finished at 0.687 with internal subdivision of a zigzag in lesser degree. Down from wave A, wave ((a)) ended at 0.693, wave ((b)) ended at 0.698, and wave ((c)) ended at 0.687.

Pair has resumed higher in wave C which subdivided in a 5 waves impulse in lesser degree. Up from wave B, wave (i) ended at 0.6915, and wave (ii) ended at 0.687. Wave (iii) ended at 0.70 and pullback in wave (iv) ended at 0.696. Near term, pair has scope to extend 1 more leg before ending wave (v) and ((i)) in higher degree. Afterwards, it should pullback in wave ((ii)) to correct cycle from March 29, 2022 low (0.6875) before the rally resumes. Near term, as far as pivot at 0.6875 low stays intact, expect dips to find support in 3, 7, or 11 swing for further upside.