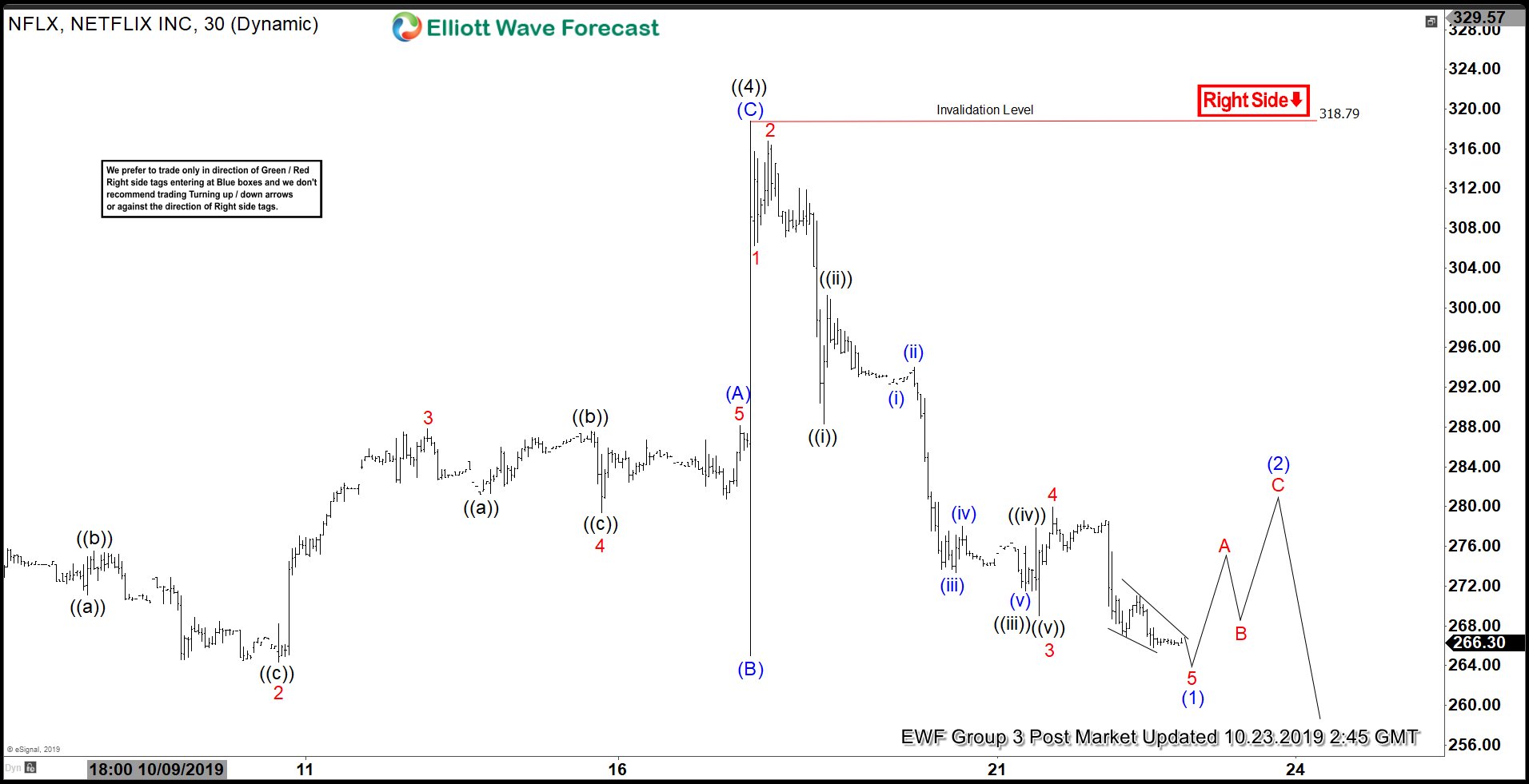

Short Term Elliott Wave view on Netflix (Ticker: NFLX) suggests that the spike to $318.79 on October 17, 2019 ended wave ((4)). Internal subdivision of wave ((4)) unfolded as a zigzag Elliott Wave structure where wave (A) ended at 288.17, wave (B) ended at 265, and wave (C) ended at 318.79. Since then, the stock has reversed the gain and started the next leg lower in wave ((5)). Internal subdivision of wave ((5)) is unfolding as a 5 waves impulse Elliott Wave structure where wave (1) of ((5)) should end soon.

Down from 318.79, wave 1 ended at 306.23 and wave 2 bounce ended at 316.79. Stock then resumes lower in wave 3 as an extended nest with 5 waves subdivision in lesser degree. Afterwards, the stock corrected in wave 4 towards 279.94, and resumed lower again 1 more time in wave 5. The move lower should also complete wave (1) of ((5)) and expected to end soon. Netflix should then bounce in wave (2) to correct cycle from October 17 high before the decline resumes. Potential target to the downside is 100% – 123.6% Fibonacci extension from June 20, 2019 high which comes at $169 – $211.