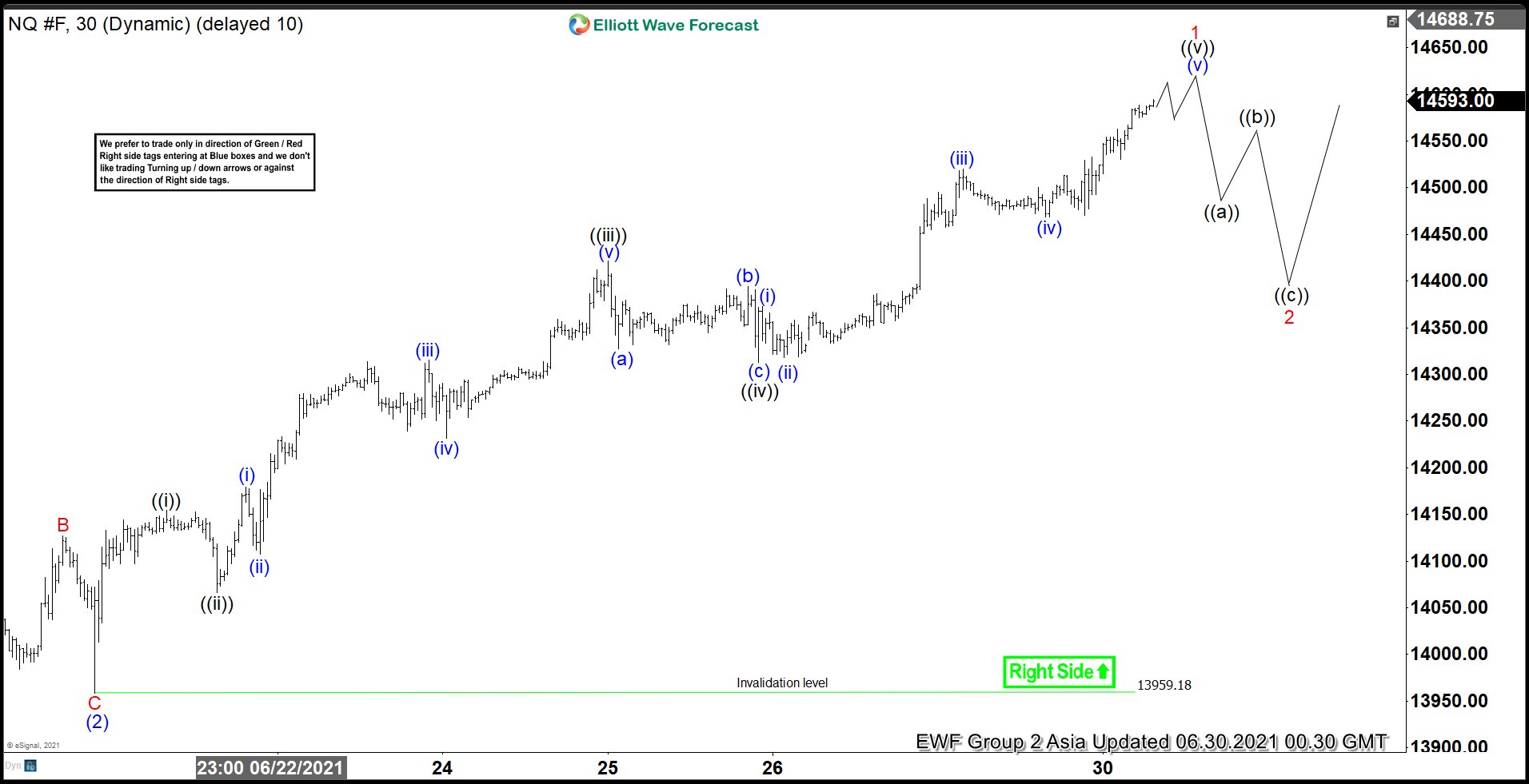

Short term Elliott Wave View in Nasdaq Futures (NQ_F) suggest that the decline to 13959.18 ended wave (2). The Index has resumed higher in wave (3) from there with internal unfolding as an impulse Elliott Wave structure. Up from wave (2), wave ((i)) ended at 14154 and pullback in wave ((ii)) ended at 14066.50. The Index then rallied again in wave (i) towards 14179, pullback in wave (ii) ended at 14112. Wave (iii) ended at 14315.75, wave (iv) ended at 14231.75, and last leg wave (v) ended at 14422. This completed wave ((iii)) in higher degree. Pullback in wave ((iv)) has also ended at 14313.25.

Wave ((v)) is currently in progress with internal as a 5 waves impulse in lesser degree. Up from wave ((iv)), wave (i) ended at 14372.75, and pullback in wave (ii) ended at 14317.75. Index then resumed higher in wave (iii) towards 14519.75, and wave (iv) pullback ended at 14468.75. Expect the Index to complete wave (v) of ((v)) soon and this should also complete wave 1 in larger degree. Afterwards, it should pullback in wave 2 to correct cycle from June 21 low (13959.18) before the rally resumes. As far as June 21 low pivot at 13959.18 stays intact, expect dips to find support in 3, 7, or 11 swing for further upside.