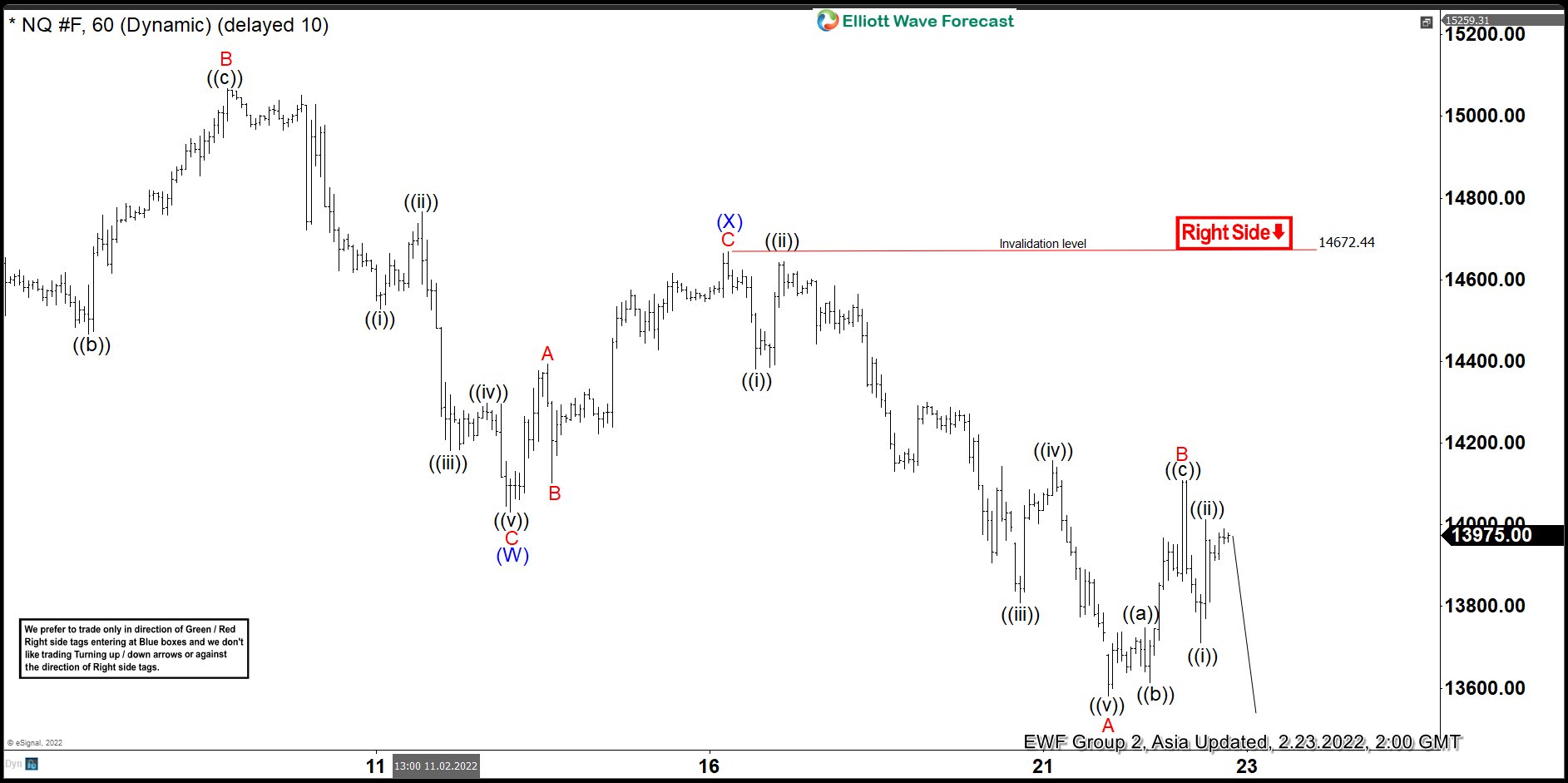

Short Term Elliott Wave in Nasdaq (NQ) suggests that the decline from February 2, 2022 peak is unfolding as a double three Elliott Wave structure. Down from February 2, wave A ended at 14362.75, and rally in wave B ended at 15068. Index then resumes wave C lower towards 14031. This completed wave (W) in higher degree. Corrective rally in wave (X) ended at 14672.44 with internal subdivision as a zigzag structure.

Up from wave (W), wave A ended at 14394 and pullback in wave B ended at 14102. Wave C higher ended at 14672.44 which completes wave (X) in higher degree. Wave (Y) lower is in progress with internal subdivision as a zigzag. Down from wave (X), wave ((i)) ended at 14381 and wave ((ii)) ended at 14645, Wave ((iii)) ended at 13809.75, wave ((iv)) ended at 14157.50, and final leg lower wave ((v)) ended at 13580.25. This completed wave A of (Y). Wave B of (Y) rally is proposed complete at 14108.25 and Index has turned lower. Near term, as far as pivot at 14672.44 high stays intact, expect rally to fail in 3 or 7 swing for further downside.