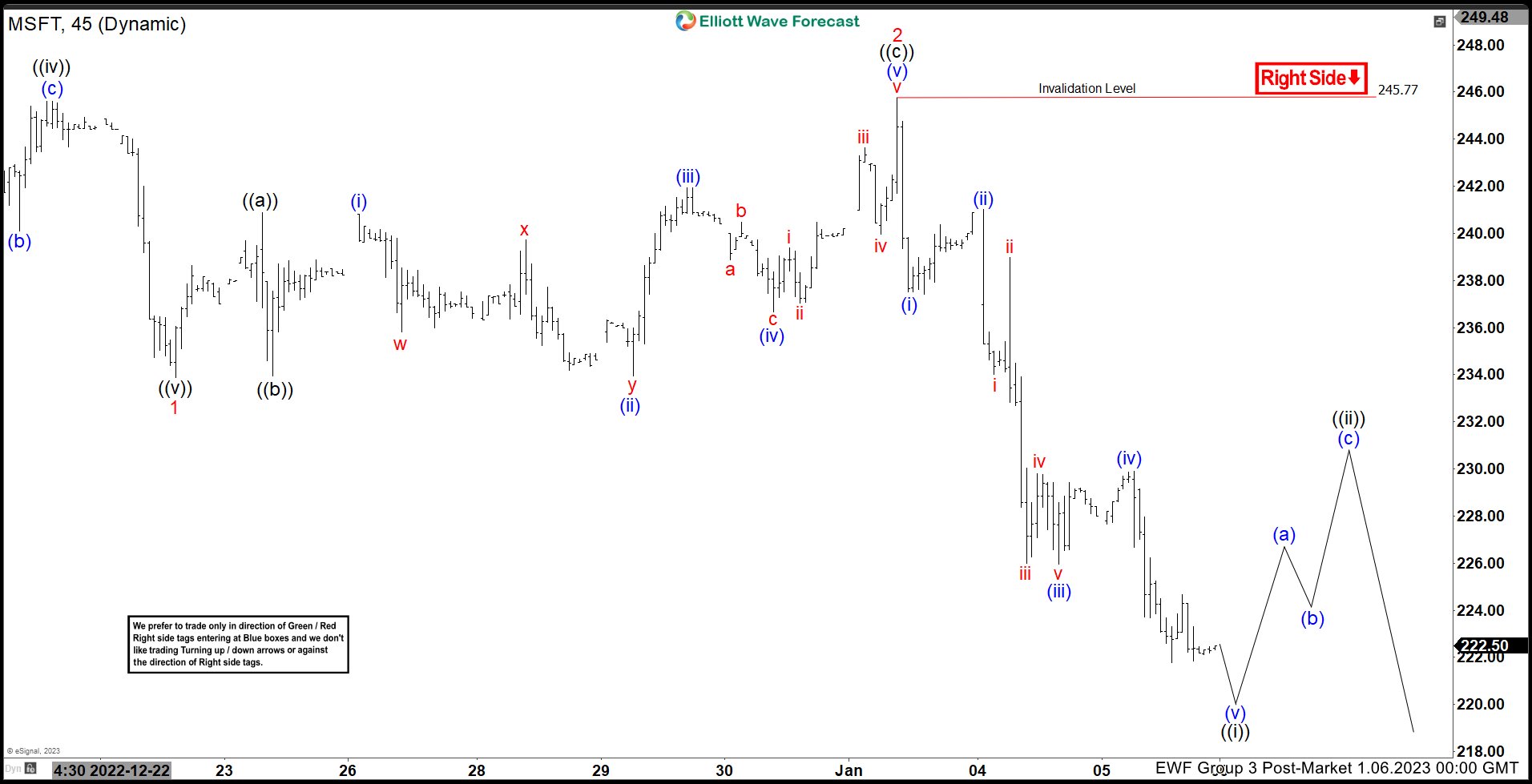

Cycle from 12.13.2022 high is in progress as a 5 waves impulse Elliott Wave structure. Down from 12.13.2022 high, wave 1 ended at 233.87 and rally in wave 2 ended at 245.77. Internal subdivision of wave 2 unfolded as a zigzag structure. Up from wave 1, wave ((a)) ended at 240.87 and pullback in wave ((b)) ended at 233.94. Final leg higher wave ((c)) ended at 245.77 which also completed wave 2. Wave ((c)) unfolded as a 5 waves diagonal where wave (i) ended at 240.8 and wave (ii) ended at 233.94. Wave (iii) higher ended at 241.92, pullback in wave (iv) ended at 236.66 and final leg higher wave (v) ended at 245.77.

The stock has resumed lower in wave 3. Down from wave 2, wave (i) ended at 237.40 and rally in wave (ii) ended at 241. The stock resumed lower in wave (iii) towards 225.96 and rally in wave (iv) ended at 229.89. Wave (v) lower is expected to end soon which should end wave ((i)) in higher degree. Afterwards, expect wave ((ii)) rally to correct cycle from 1.3.2023 high before the decline resumes. Near term, as far as pivot at 245.77 high stays intact, expect rally to fail in 3, 7, or 11 swing for further downside. Potential target lower is 100% – 161.8% Fibonacci extension from 1.3.2023 high which comes at 195.9 – 215.