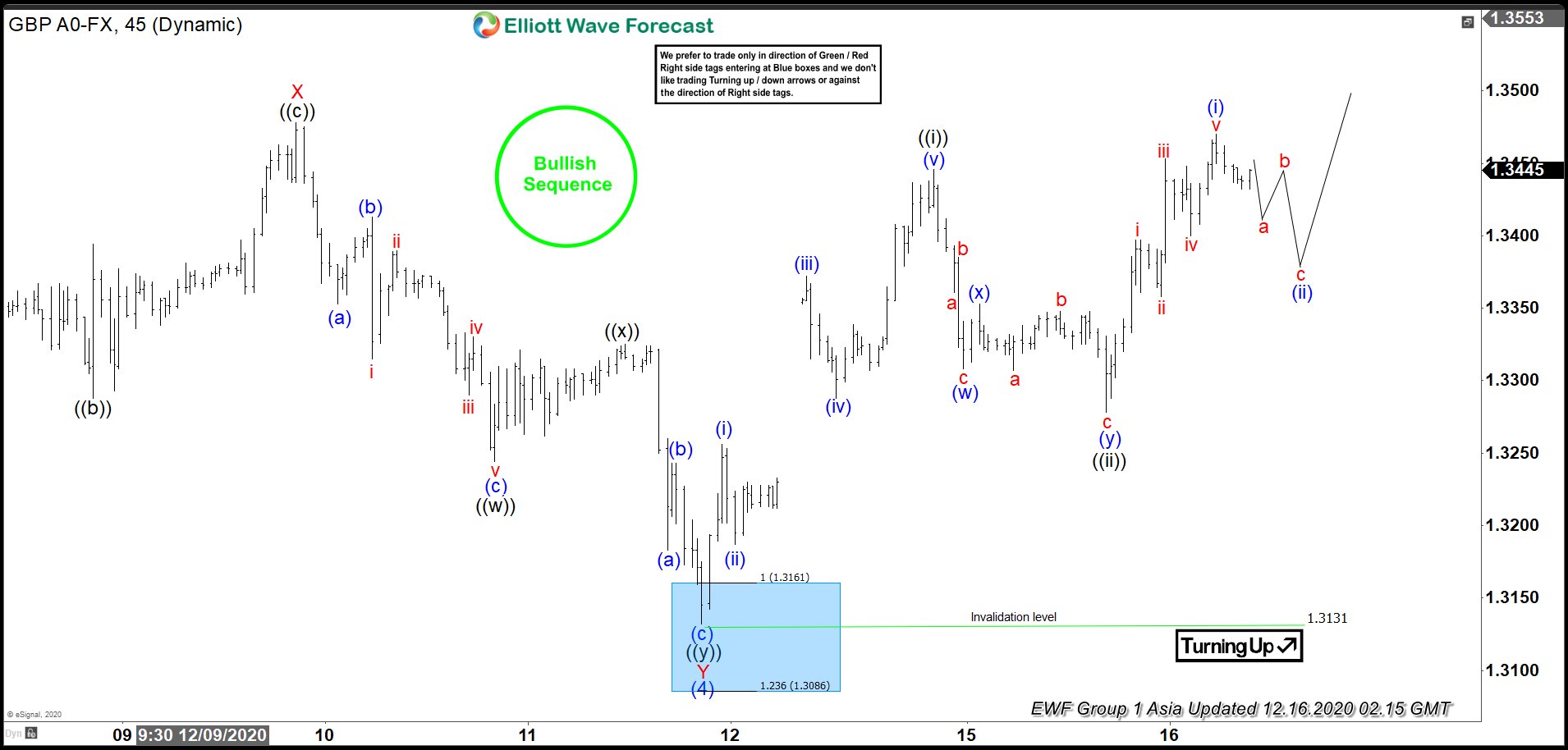

GBPUSD shows an incomplete bullish sequence from March low, favoring more upside. Shorter cycle, the rally from September 23 low is unfolding as a 5 waves impulsive Elliott Wave structure. In the 45 minutes chart below, we can see wave (4) of this impulse ended at 1.3131. Internal subdivision of wave (4) unfolded as a double three structure. Wave W ended at 1.322, bounce in wave X ended at 1.3478, and wave Y of (4) ended at 1.313.

Pair ended wave Y of (4) at the 100% – 123.6% fibonacci extension of wave W at 1.3086 – 1.316 as highlighted in the blue box. Pair has since turned higher from the blue box, allowing traders who bought at the blue box to create a risk free position. Wave (5) higher is now in progress as an impulse structure. Up from wave (4) low at 1.313, wave ((i)) ended at 1.344 and pullback in wave ((ii)) ended at 1.3278. Pair then resumes higher again in wave ((iii)). Up from wave ((ii)), wave (i) ended at 1.347. As far as wave (4) pivot at 1.313 stays intact, dips should continue to find support in 3, 7, or 11 swing for more upside.